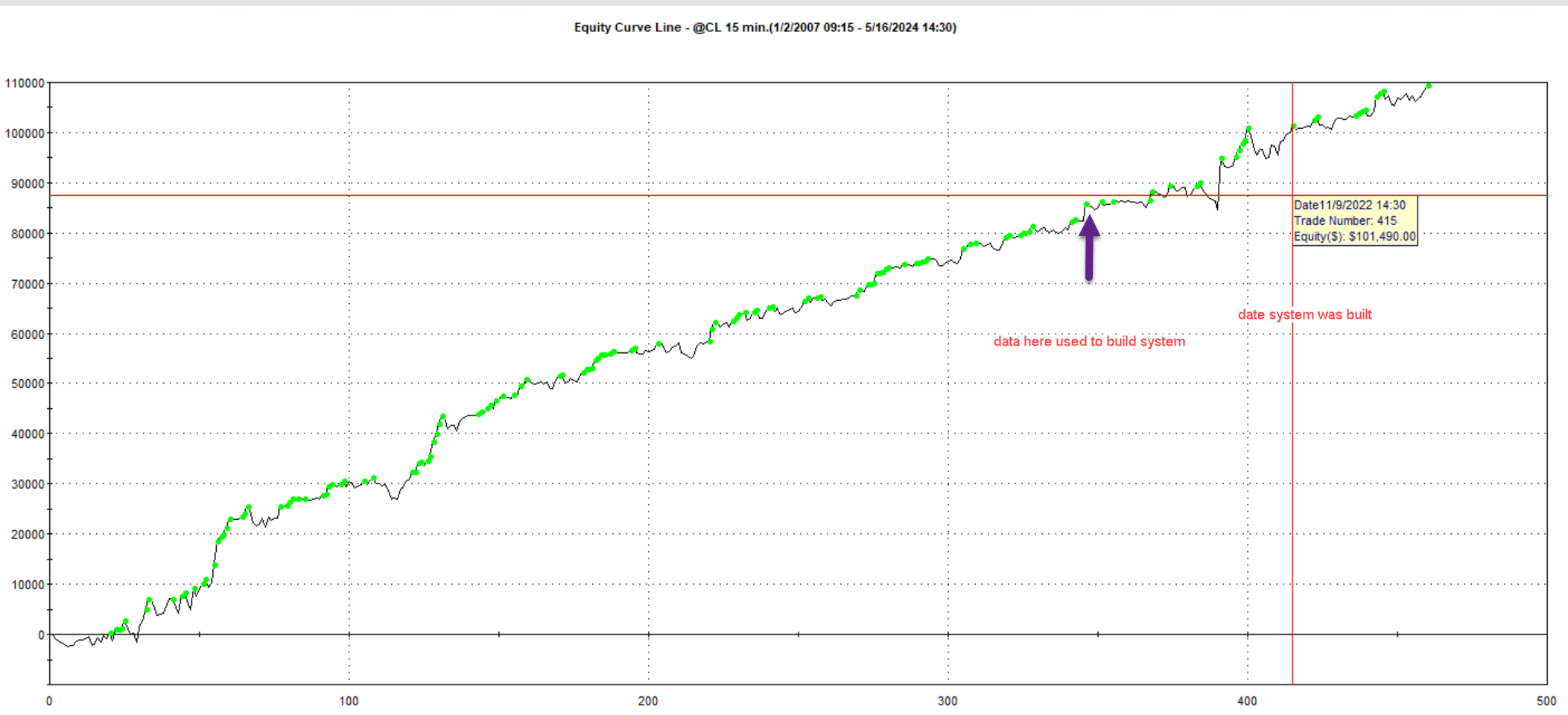

Crude oil 2024 day of week method

This page still under construction, May 21 2024

Background (skip this if your are in a hurry)

Many markets have a strong bias to have trades on a certain day of the week. The reason for this is normally that news announcements of a market are given on a specific day.

This was the first system build using a one day of the week bias. While I believe that excluding a day of the week that consistently goes poorly, is a valid concept - In the past I was not so confident in the concept of trading one day a week only, as the sample size is 20% of a 5 day a week system. We do however have enough trades to give a statistically valid model. My limited tested showed 100 trades its too small a sample, and had very high out of sample degradation. 200 trades was better but still higher out of sample degradation. 300 trades + is the ideal.

The above system was later manually optimized, and every peace of logic in the system checked to confirm it was valid.

The system, and the re-optimized system results are both here. https://trademaid.info/gsbhelp/GSB_CL7.html

Basic setup.

In exchange time we are using 15 minutes bars, 9:00 am to 2:30 pm session.

Secondary filter is CloseLessPrevLowDPrevCloseD (normalized), Filter is CloseLessPrevCloseD,, and entry mode is compare2. 68 trial users indicators are used.

The settings file (provided with GSB 69.31) is CL15-900-1430-Wed.gsbopt

The standard macro to get the top 10 green indicators and macro nct3-300_build_gc_p0.90_pf1.6+stats_is2018.2_oos2022.12-Fast300e are used.

This E version of the macro, also puts the period of March 1 2022 on-wards into period E.

An observation is that the performance metrics in period E are better than period F. I put that down to good market conditions.

Systems are built using the 2 pass methodology described here using the enclosed files nct3-300_build_gc_p0.90_pf1.6+stats_is2018.2_oos2022.12-Fast300e.macro & CL15-900-1430-Wed.gsbopt

Looking at day of week bias

(skip this if your are in a hurry)

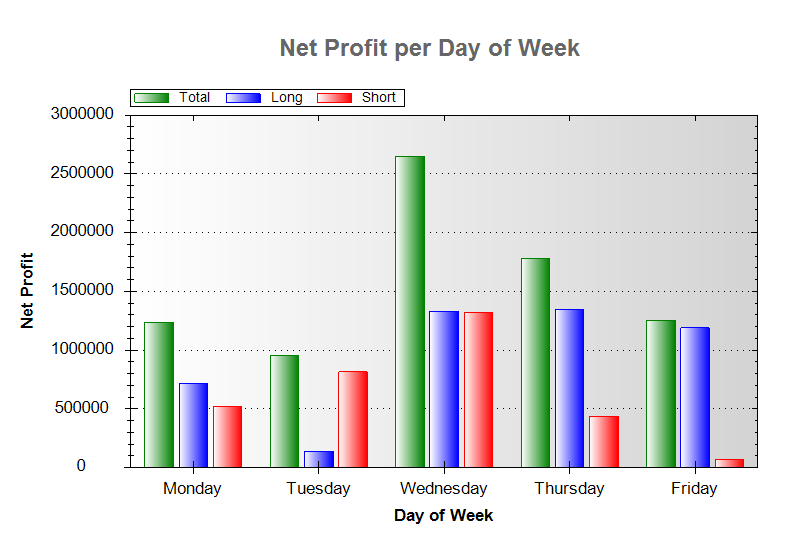

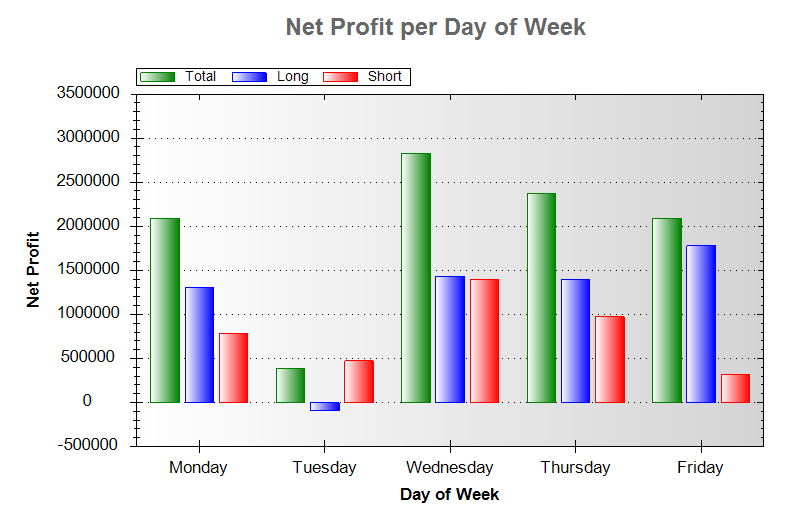

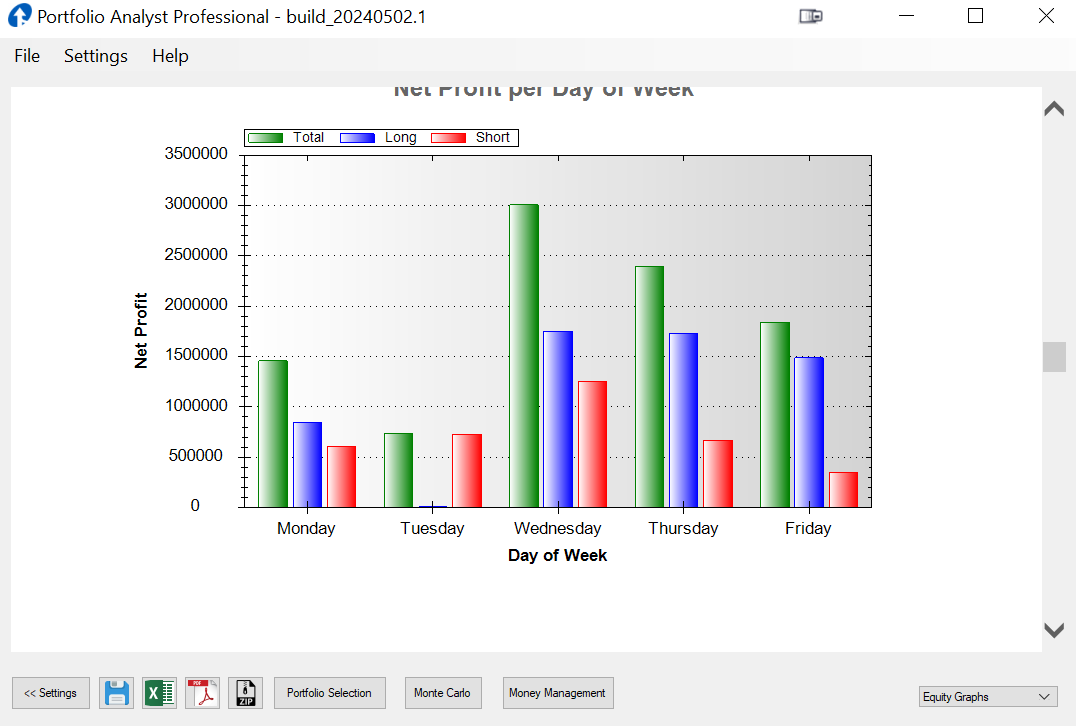

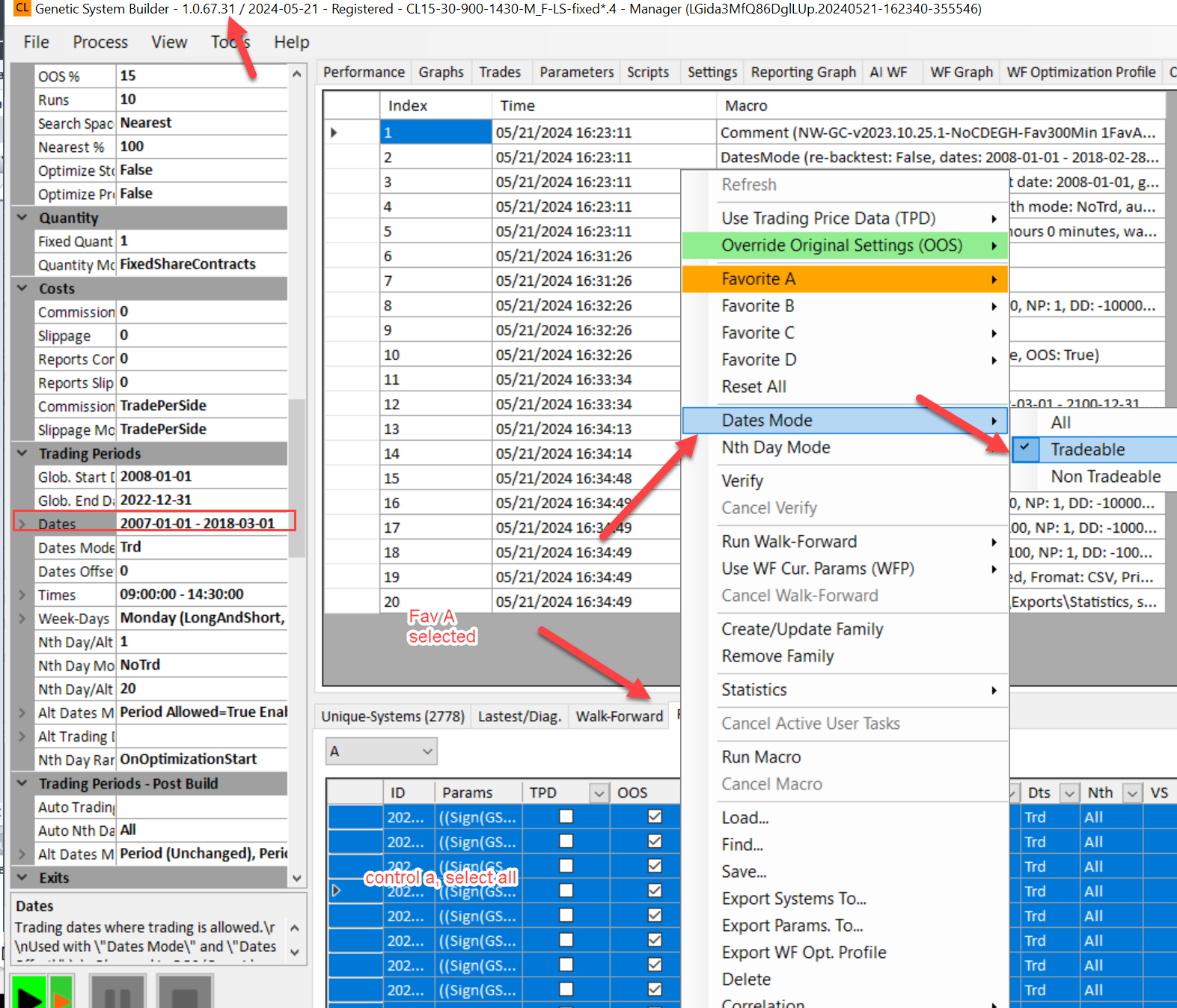

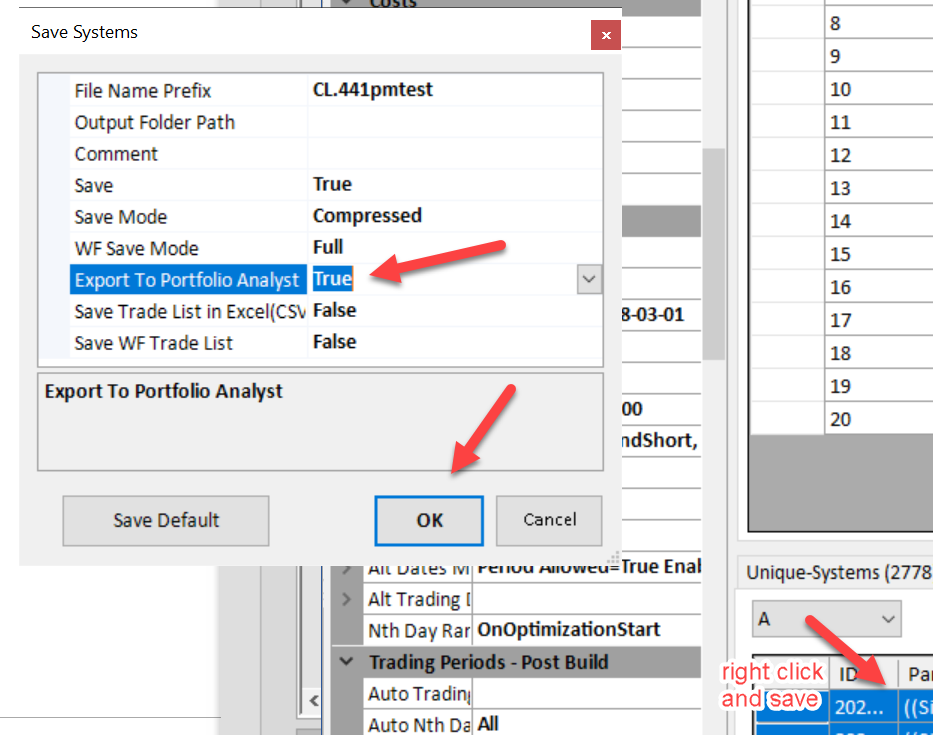

The same setup is used as above, but Monday to Friday is allowed, both long and short. All systems in FavouritesA are exported to Portfolio Analyst Pro.

Typically this was only about 168 systems, as the system quality over all was poor as we are trading some days of the week that work poorly.

Do not do this test in GSB build prior to 67.31. There is a critical bug that's now fixed.

Below another test. Note Wednesday is strongest, Friday is very poor, but other days vary significantly.

Below another test. Note Wednesday is strongest, Friday is very poor, but other days vary significantly.

Important to note, we did not corrupt out of sample by exporting day of week bias after our out of sample periods. (Feb 28 2018)

These saved systems are imported into PA pro to look for daily bias.

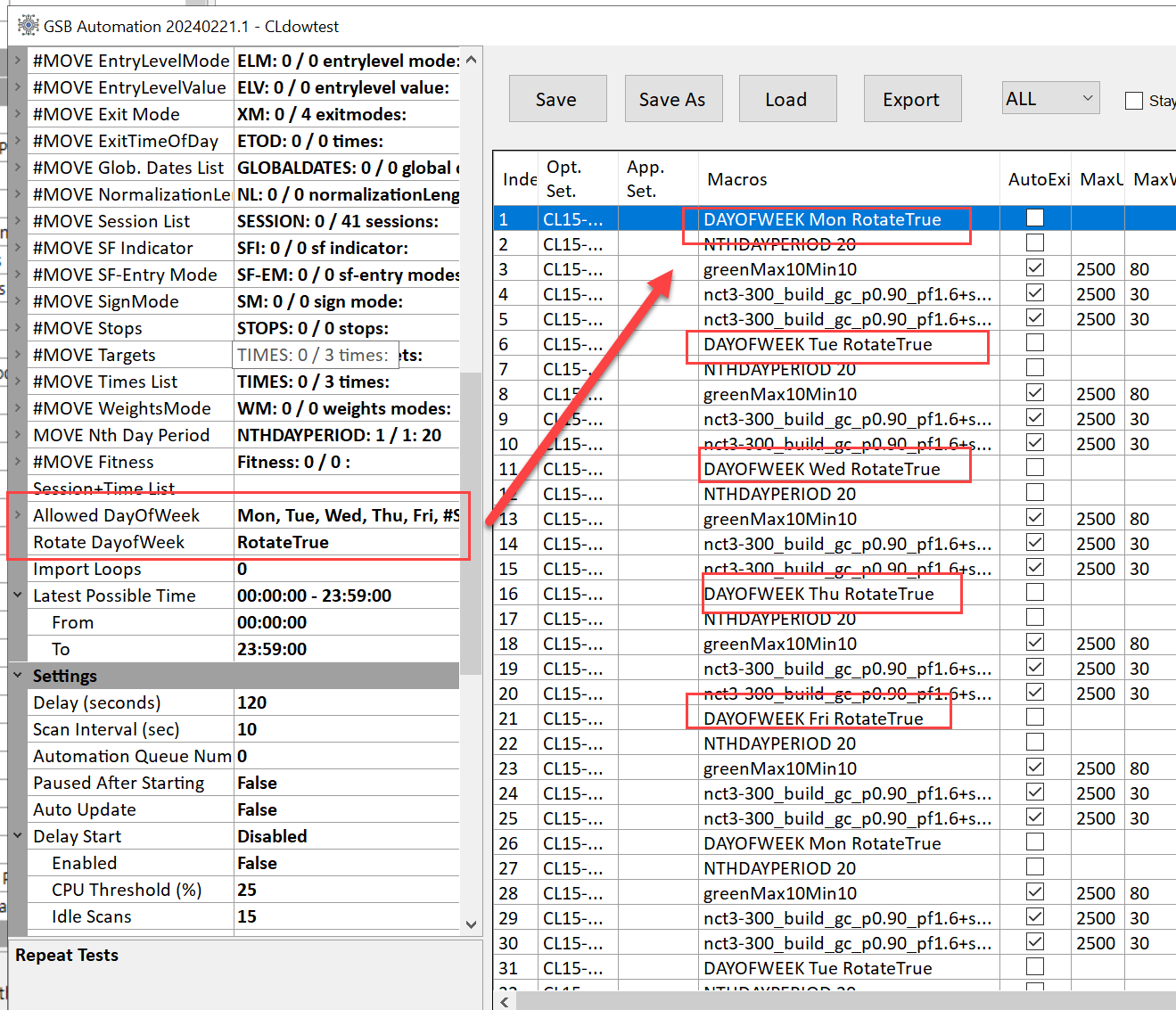

As the above results were too erratic, I'm going to perform a much more through test using GSB automation, rotate day of week function.

A summary of work on Crude Oil can be found here.

A later release of GSB automation (after this current work was published), can do the same test with Wednesday force True, and then combined with each of the other 4 days of the week.

Next time I revisit CL, I want to try Wednesday Long short, with each day of the week long, then each day of the week short.

This will also be faster to computer, as I observe Monday is very slow to build systems on as the results are poor.