Building Nasdaq 23hrX5.5day Swing systems

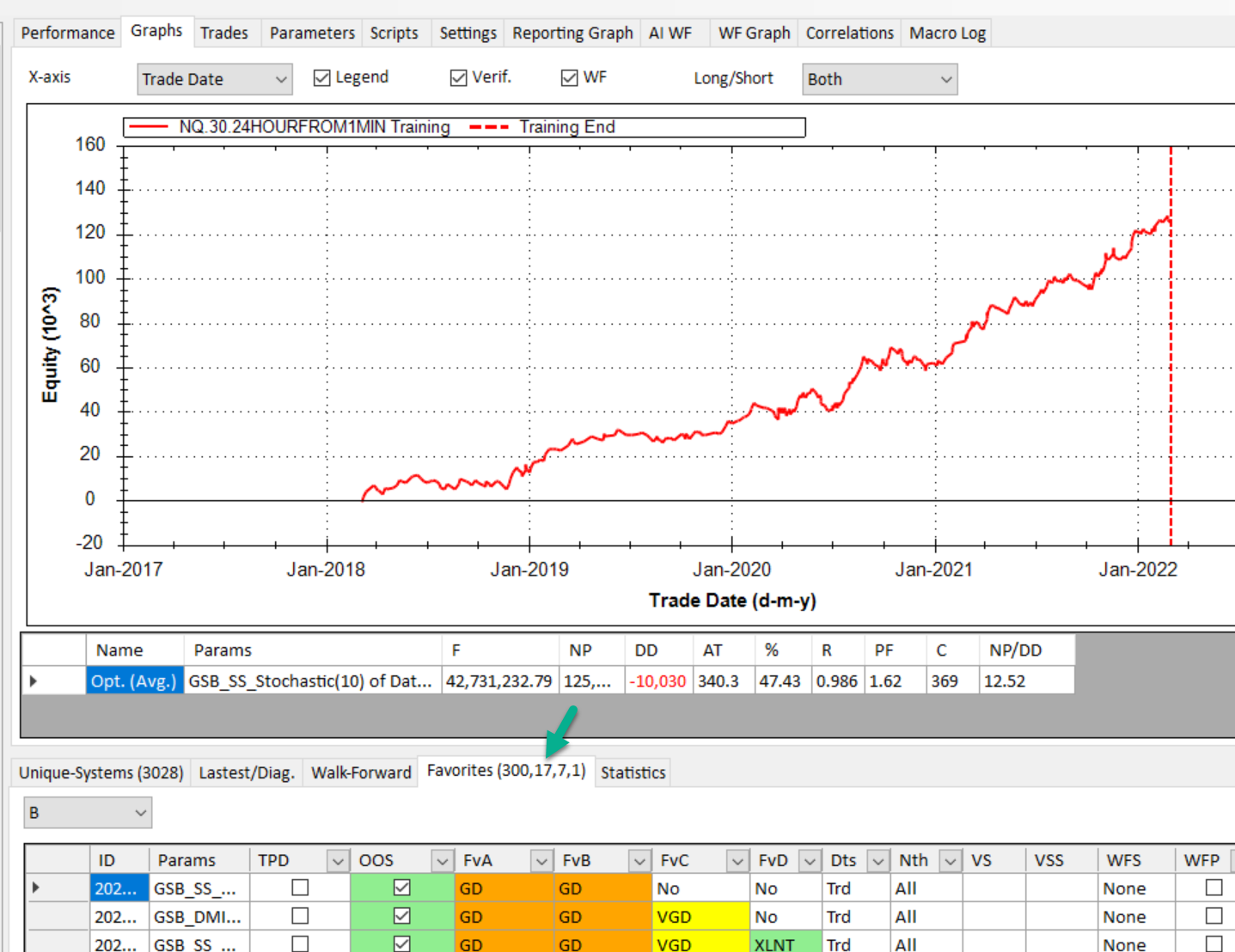

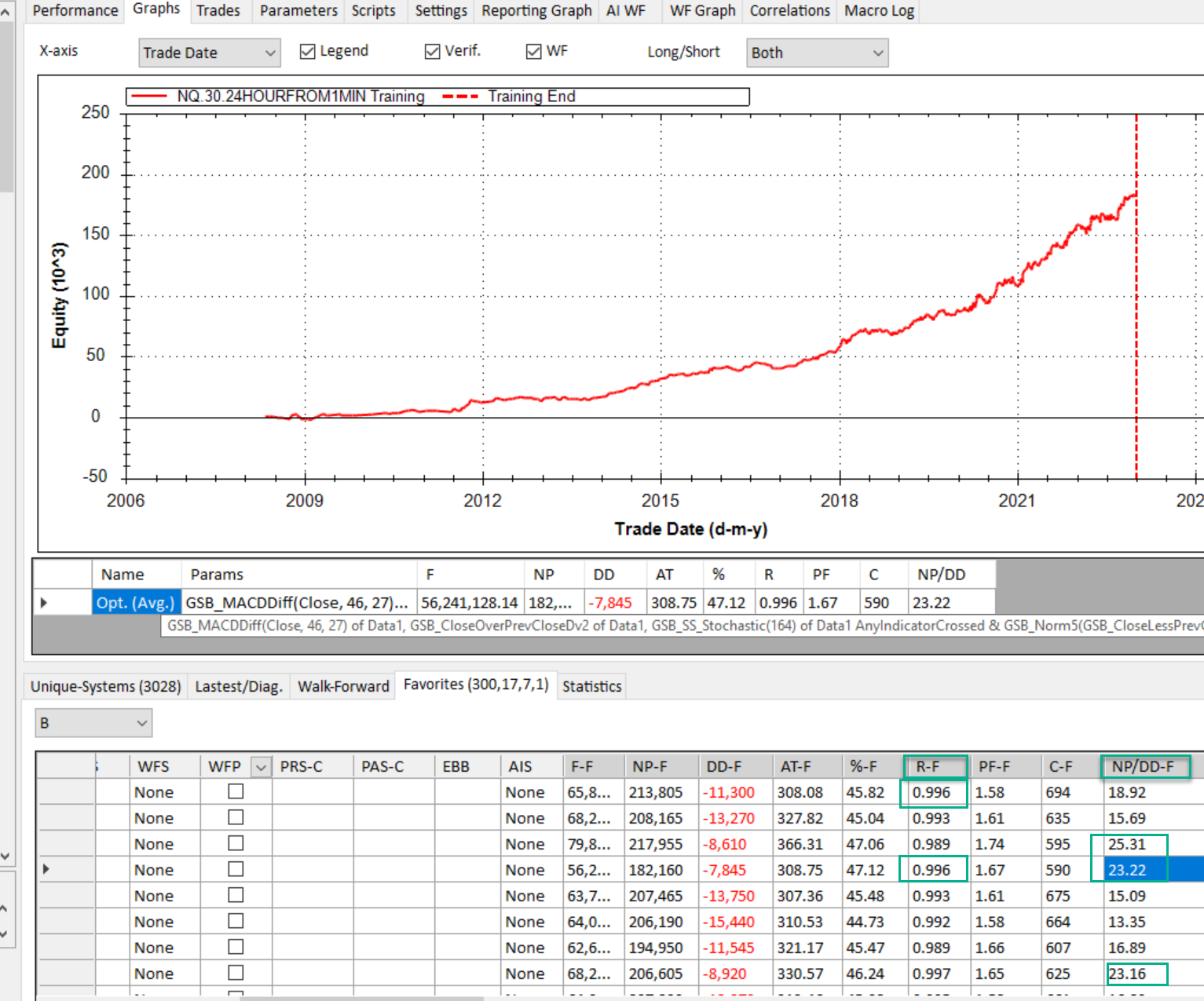

These systems have surprisingly linear equity curve's and are long only.

Overnight risk is reduced in that they are active 23 hours a day, and Sunday 5pm to Sunday midnight.

A few comments.

They are slow to build as there is approx 3 times more bars in a day than a 830 to 1500 system.

Worker memory usage is high approx 10 GB per worker, and more if your workers have large cache settings (not the default)

A $500 to $2750 break even stop should be added, though this is not essential. GSB does not yet have break even stop, but its due out soon. This can be added into Tradestation / Mulitcharts.

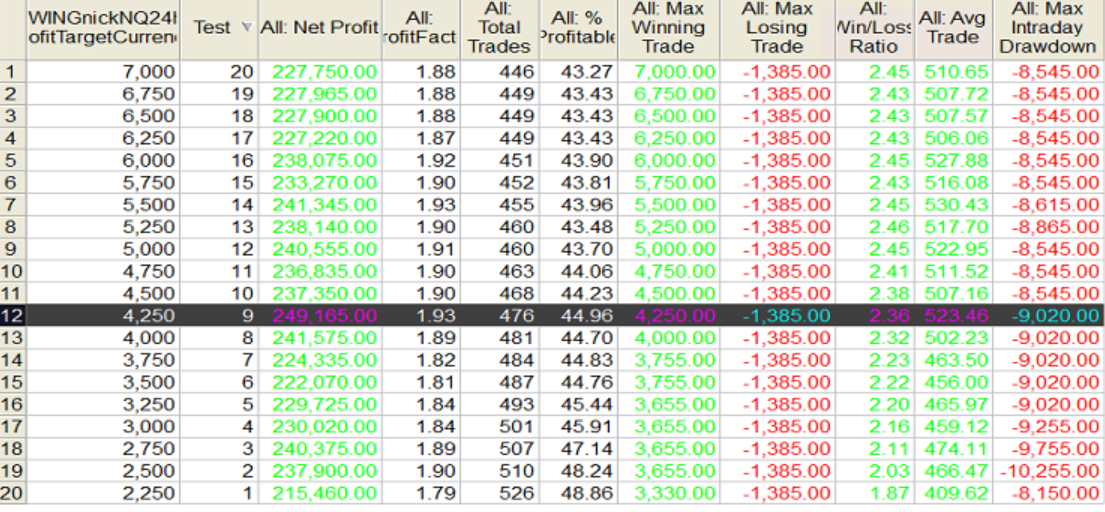

Profit target should be increased up to $6000. The default settings deliberately do not have this done, as it will tend to curve fit GSB to look for a few days that give massive wins.

Exit mode SFR (Secondary filter reverse) (Default in swing24x5 settings) or IFltRvAndSFRv (Indicators reverse and Secondary Filter Reverse should be used.

No exit mode also can be used. There is a little merit in diversifying exits if you have multiple 24x5.5 systems

All files needed should be in default install mid November 2023 for purchased users. Trial users will have to log into the forum and download files from

https://trademaid.info/forum/viewthread.php?tid=117&page=38#pid9502

I have very successfully ported a Nasdaq system to S&P 500, but found the this method on S&p 500 gave very significantly lower results. Its possible some sort of settings change is required. The same Nasdaq system did not go so well on Russell 2000 and Dow futures.

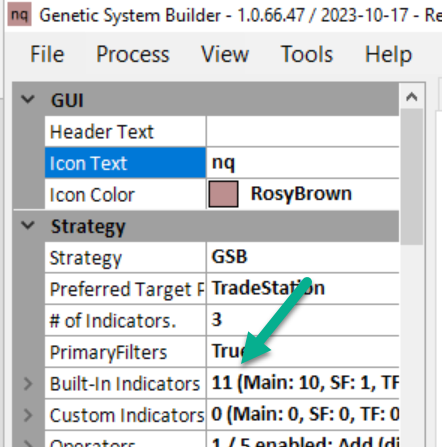

High level of settings (all set in supplied oppsetings file)

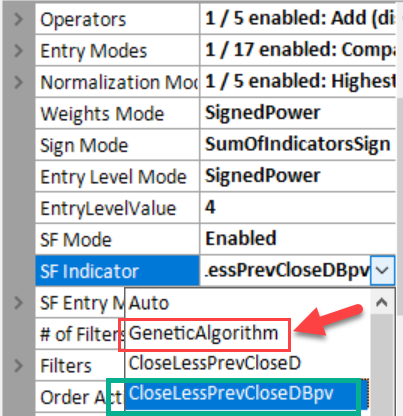

Secondary filter CloselessClosedBPV not normalized. Note SF is often set to genetic, which uses normalized indicators.

No filter or tertiary filter.

Entry type any indicator stop.

$1250 stop.

$2500 profit target.

Exit mode SFR. (Secondary filter reverse)

The usual 2 pass method. 1 pass to get indicators, second pass to get systems.

Time of day entry 900 to 1500, but exit any time the market is open.

nth 20

Future settings to be added to future release of GSB.

Bullish filter.

Break even stop.

STEPS TO MAKE SYSTEMS

1) Open nq-23Hours_SF.bpvNotNorm_Default

If you don't have the nq-23Hours_SF.bpvNotNorm_Default file , download the file nq-23Hours_SF.bpvNotNorm_Default_version1.03.zip

and unzip to any folder.

Run the file Click-on-this-to-install.bat

2) If you are not using GSB automation, open your GSB manager and open the file nq-23Hours_SF.bpvNotNorm_Default

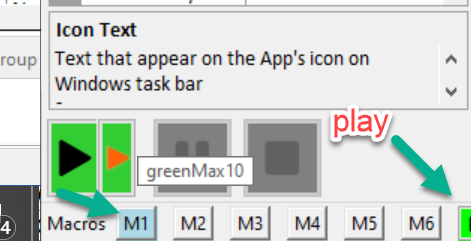

Macro1 should have the greenmax10 macro on it.

3) Run M1.

After significant time, 2500 systems (more is OK but likely not needed) should be built.

4) Open a second manager.

This should have the top 10 indicators from step 3.

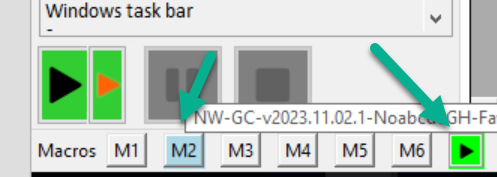

5) Click m2, and then hit play

6) You should have some systems in Favorites B, and perhaps Fav C, D

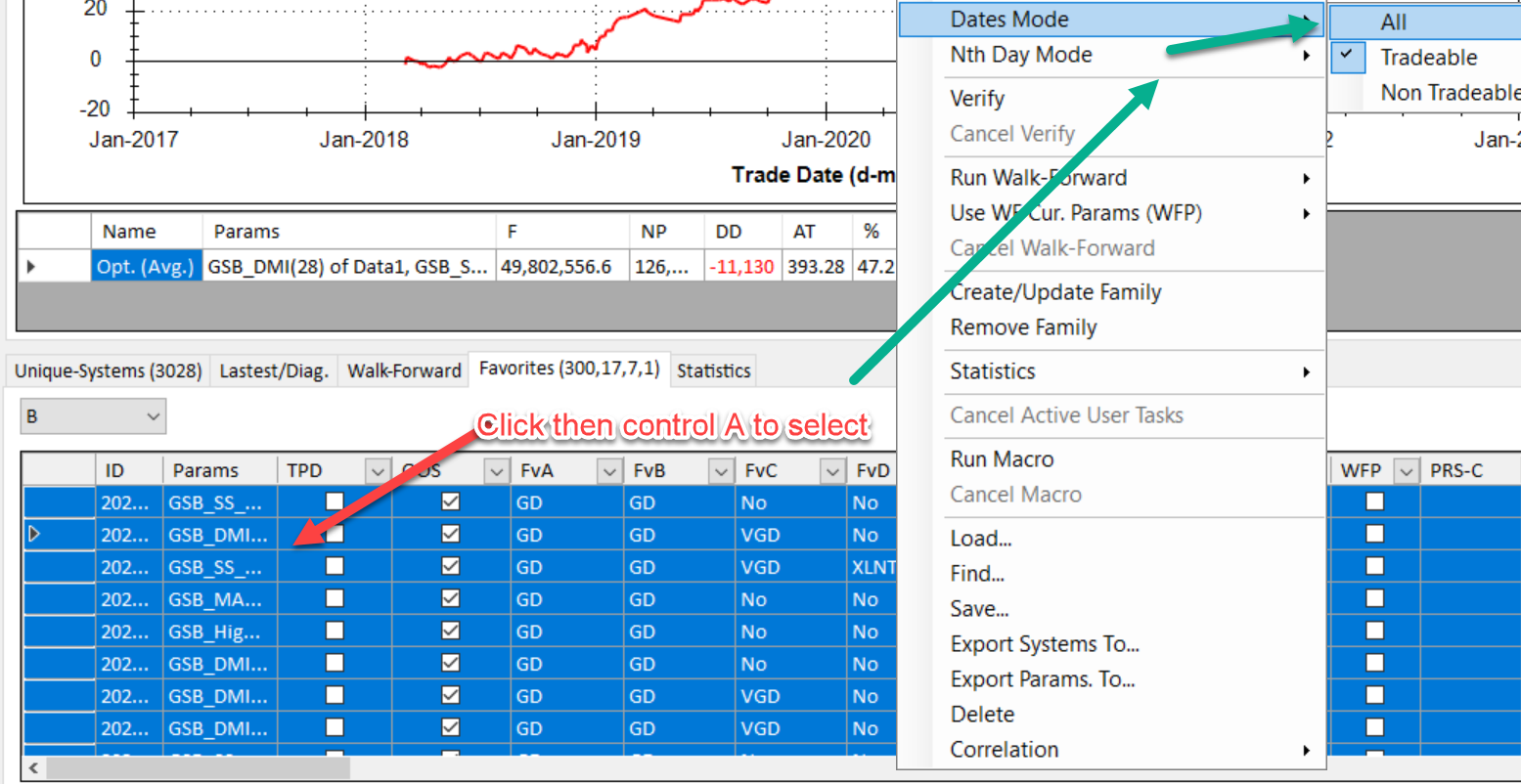

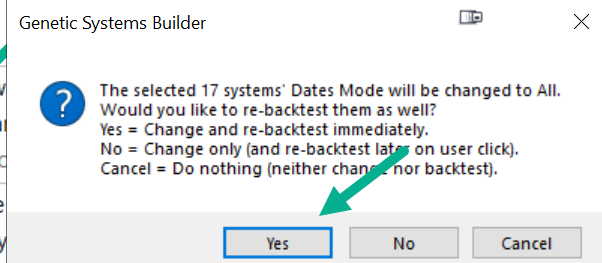

7) Change dates to ALL.

Look for any systems you like the metrics and curves off.

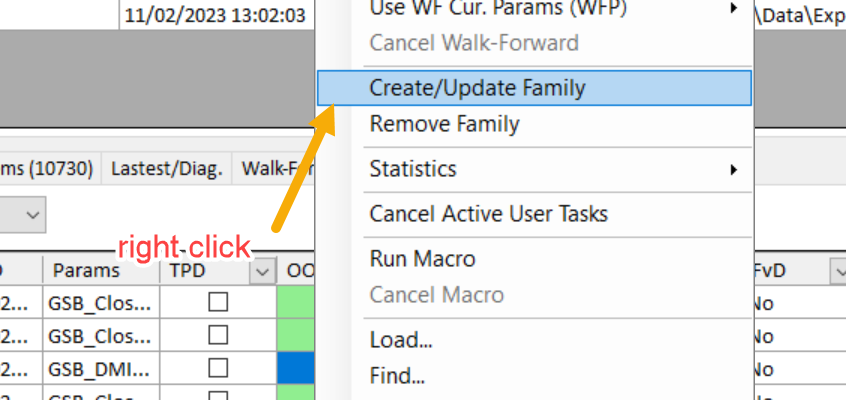

Right click and walk forward these systems to your workers.

8) Recommend step. Reduce the systems to ones that are unique.

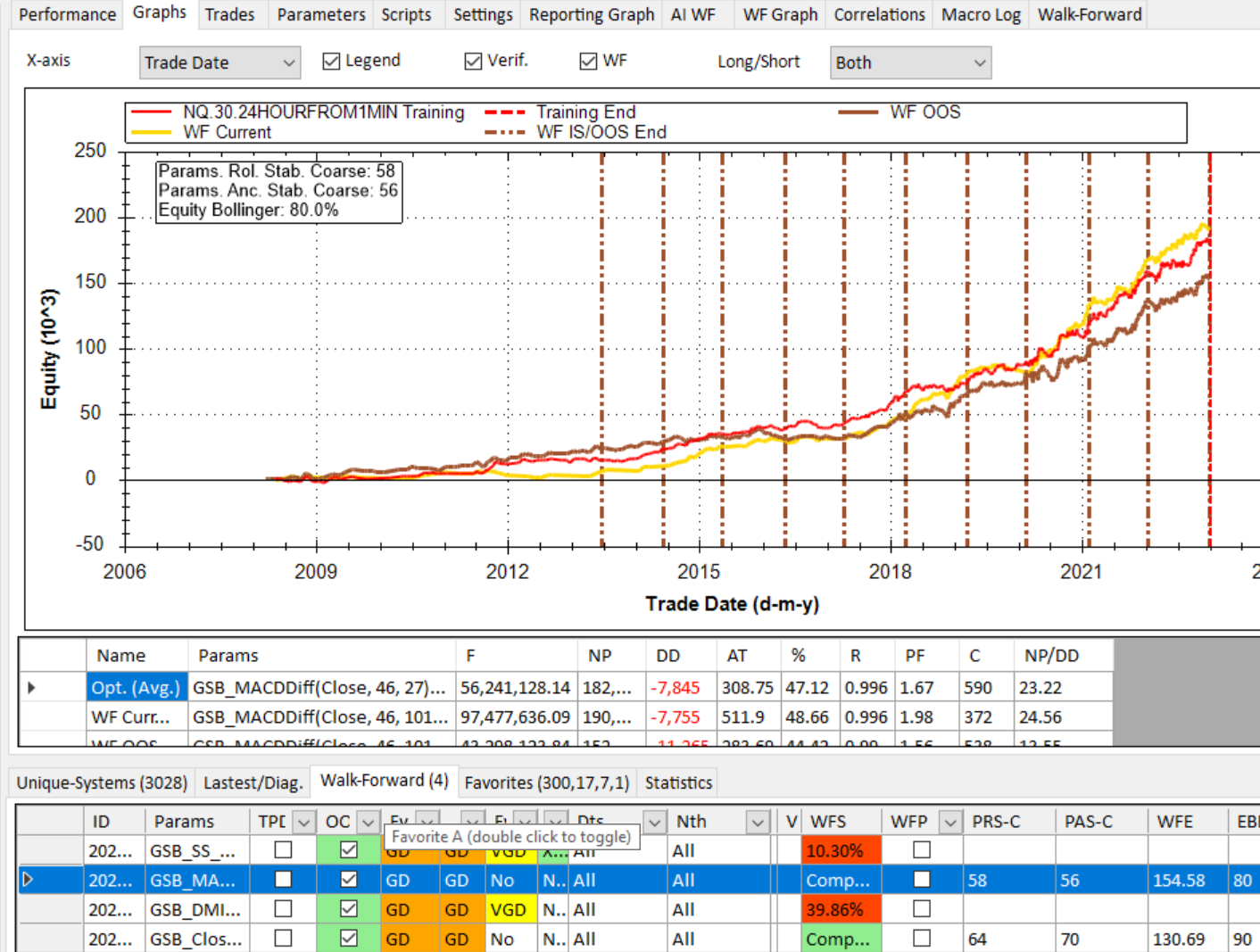

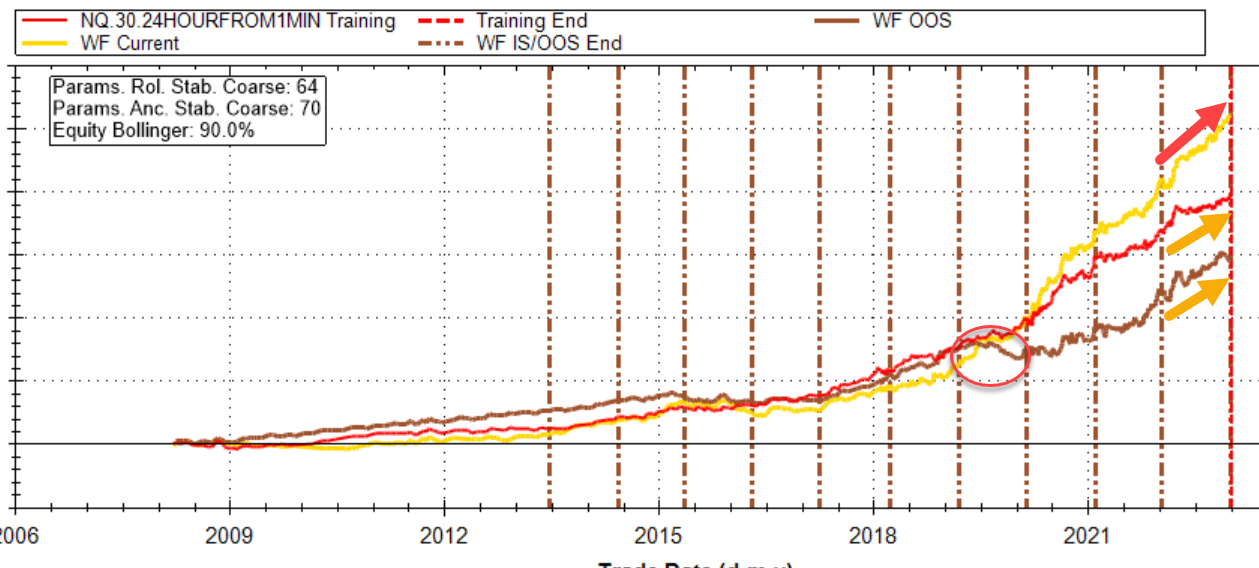

9) Choose systems you like the WF curves of, and that have high anchored and rolling stability score.

Example of good WF curves. Very parallel. Good out of sample curve too. (brown)

Example of poorer WF curve. Large difference between WF curves, and the distance gets large over time.

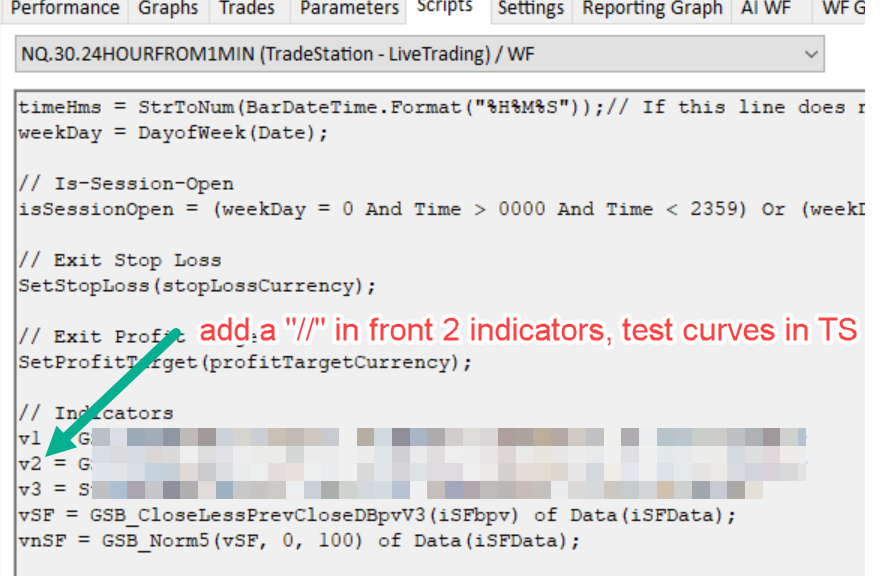

10) for advanced users - but highly recommend

Check there is no indicator that gives poor results.

We want to try one indicator at a time

so change the code from

v1=...

v2=...

v3=...

to

v1=...

//v2=...

//v3=...

and look at performance metrics. If any one the metrics is poor, leave the line commented out.

then repeat

//v1=...

v2=...

//v3=...

then repeat

//v1=...

//v2=...

v3=...

Check the results after March 1 2022 as these have not been seen by GSB.

Confirm they are profitable.

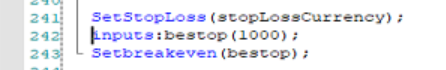

11) Optional and recommended.

add break even stop

change vars:profitTargetCurrency(2500);

to

inputs: profitTargetCurrency(2500);

Optimize the profit target (do this first) and later the break even stop.

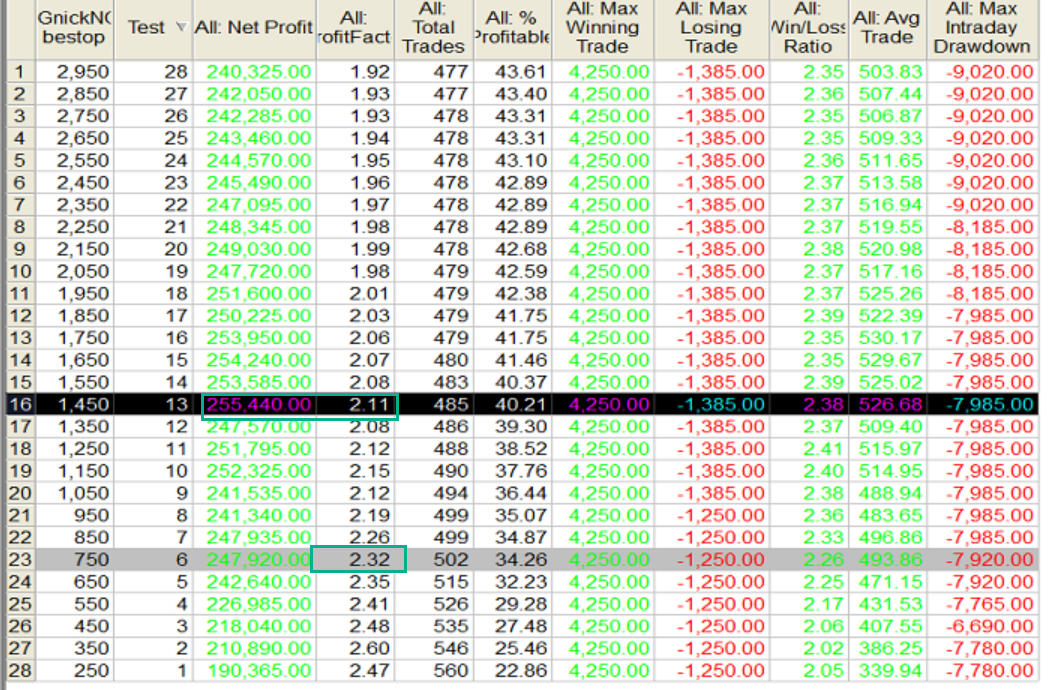

Note the results shown do not include slippage, are up to October 2023 and have one extra non GSB filter added.

settings are not critical.

Tighter break even stop reduces draw down, profit and increases profit factor.