GSB Automation

The release build of Automation will allow you automate nearly the entire process of system building.

This allows the GSB methodology - entire 2 pass indicator method, plus doing statistics to be completely done automatically.

For more detail on the 2 pass method, see here.

In late August 2023 there will be an update on the 2 pass method here.

Once you find the best setup for a market, build systems in GSB is extremely fast in human and CPU time. However to find the best setup takes considerable effort.

The good news is GSB users collectively work together and share what works.

Your systems to consider for trading will be the top systems put into favorites B.

Whats important to understand is the methodology can now be fully automated. You basically get a setup in GSB of your data, bar interval, and other basic settings.

Automation can then build 50,000 systems, take the top 250 systems, and put the out of sample stats into a csv file.

You can then change one setting in GSB, and then compare the results to your first benchmark.

The bottom line is this results in spectacular decrease in human time to build trading systems, and reduction in human error.

For example, you can try different session times, secondary & tertiary filters, entry types.

Over time what can be automated will increase, but the above are the critical things you need to explore on a unknown market.

i) Session times.

For markets like S&P500 this is simple. 830 to 1500 exchange time will work best.

For crude oil 900 to 1430 exchange time is likely best, but there might be little room to vary.

For gold & Dax, there are numerous valid session times.

ii) Secondary filters.

These give the direction of the trade. IE long or short.

if you had a signal say if adx>20, this cant normally tell you to go long or short.

If our secondary filter was CloseminusCLoseD then

if Close >Closed(1){Yesterdays close} then we can go long.

if Close <Closed(1){Yesterdays close} then we can go short.

so if close>closeD(d) and adx>20 then ... buy

Now some markets like stock index's work best to secondary filter CloseminusCLoseD{BPV}, however we still need to explore this more.

Most other markets can have many possible secondary filters. Crude oil especially.

So GSBAutomation can try the identical test on any selected secondary filters.

iii) Entry types

GSB has numerous entry types. Typically there is one entry type that works best for a specific market.

But the entry type for each market is not the same.

For example

result=indicator1

if resultsCrossesOver0 then buy;// good for S&P500

result=indicator1

if results>0 and result[1] >0 {prev bar result} then buy;// good for crude oil.

GSBAutomation lets you test all entry types, with a few clicks of the mouse, and a lot of CPU time.

CPU time is spectacular, in that we can use unlimited GSB servers any-ware in the world. You will get a small amount of cloud power free,

but you can buy or subscribe to your own GSB cloud servers.

iv) Indicator selection.

Hugh increases in performance can be made by finding the indicators that work well on a specific market before you try to build trading systems.

This is now fully automated.

More automation tasks will be added over time.

Optional

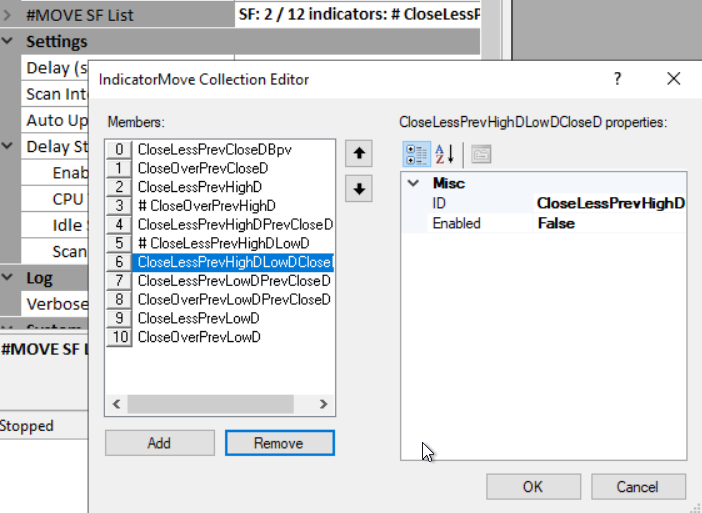

If you want to try various secondary filters, select them here.

Indices work best with ClosedBPV filter. (Not normalized) In this case do not use this option.

Most markets will work best with GA normalized CloseMinusCloseDBPV or CloseOverCloseD

Crude oil is unusual that that CloseD is NOT the best secondary filter, and numerous other things do work better.

See list below

Examples of secondary filters are shown here.

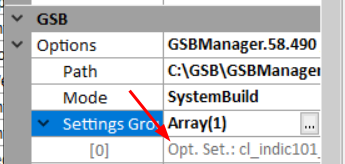

3) run GSB_Automation.

For now select the latest version. Must be 58.62 or above

There will be numerous upgrades to GSB to enhance GSB Automation, and GSB likely will fail to run if your not on the newest build.

Now open GSB

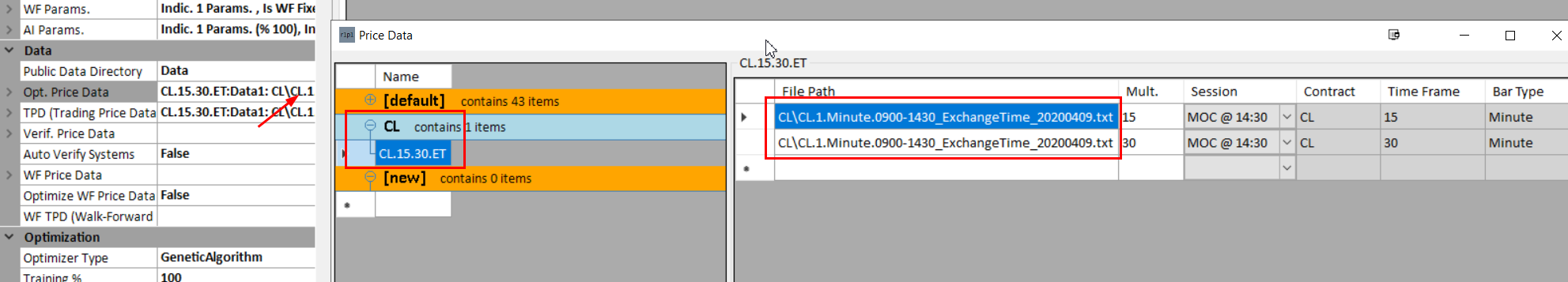

We are going to run the same test as in the CL video.

Setup CL data as show

run 1) m6-CL-INIDCATORtest_20180228

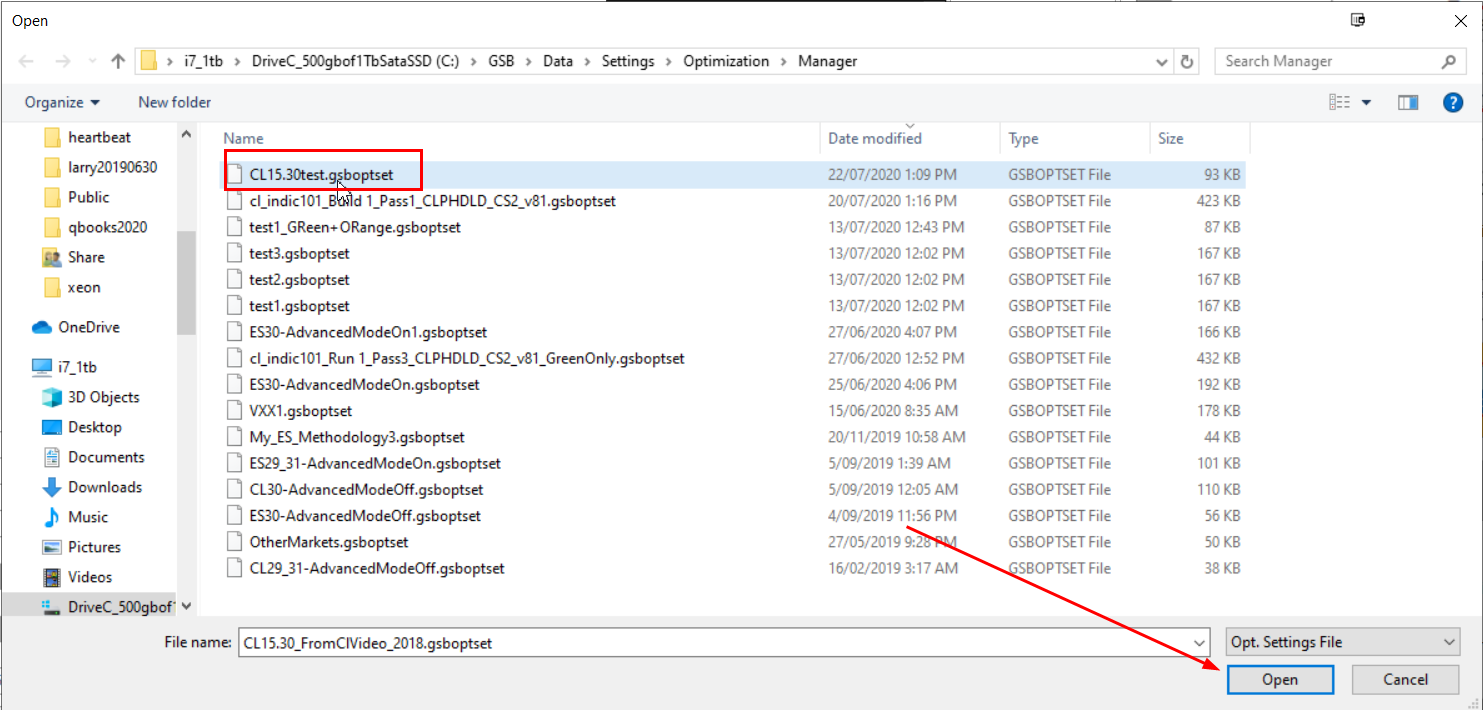

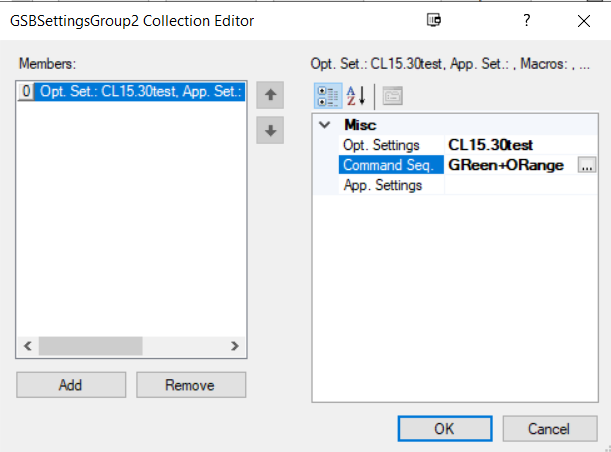

The save GSB opt settings as CL15.30test

This is the starting point of every run performed in GSB Automation.

Advanced option for beta testers only option.

Turn on all indicators from 44 on-wards, except those the use over. ie CloseMinusHighD but not CLoseOVERHighD. (The reason is they are so similar in function they are not worth doing)

save as CL15.30test_101i (101 indicators)

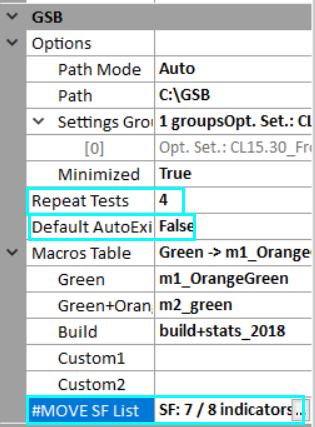

Note the settings below

Populate the list of MOVE SF List. For markets other the CL, normally just CloseBBPv is used.

In time entry types and other options will be added into the MOVE criteria.

Repeat tests. There is often great variation even with an identical test. This is due to the random seed choosing different systems

which leads to different indicators. Running a test 4 times gives greater precision.

Use 1 for quick test, or 4 of through tests.

DEFAULT AUTOEXIT.

If you want managers to close by default when done, set this to true. When testing this for the first time best use true.

If doing many tests, its annoying to have many managers open.

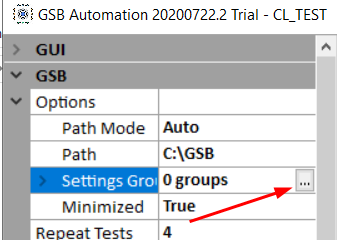

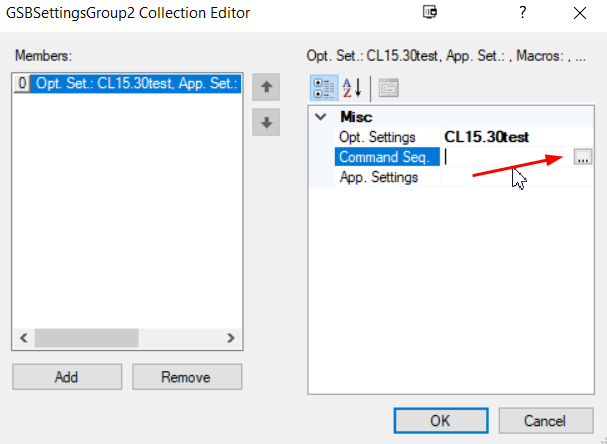

Click on settings group

Click on the file we saved in GSB. CL15.30test

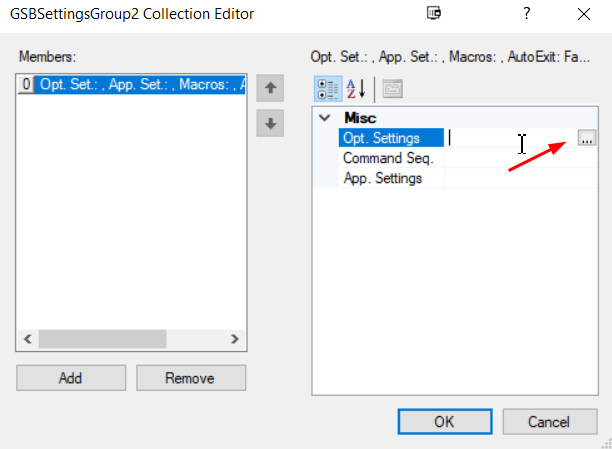

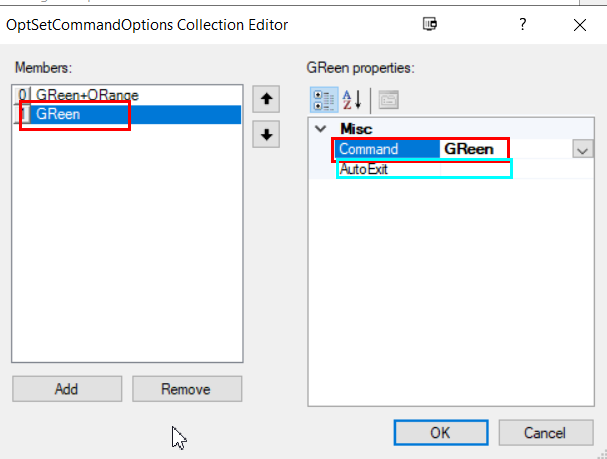

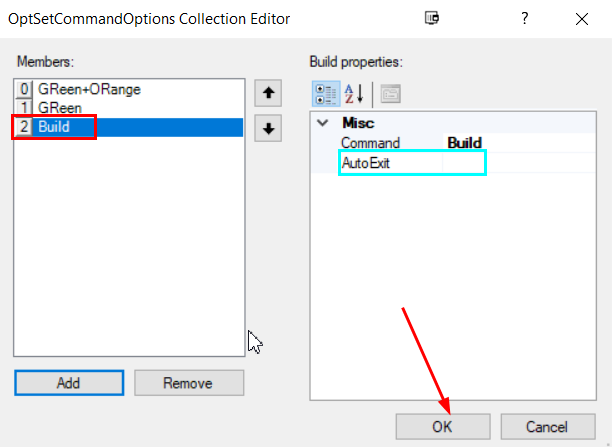

Click on command Seq.

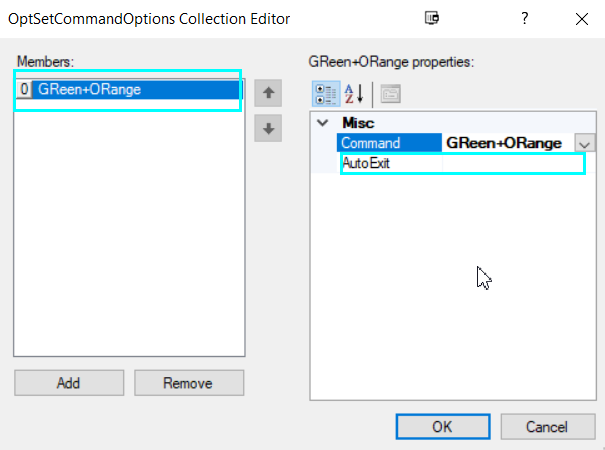

Select green+orange for two pass using Green+Orange or just Green

Optional select autoexit true / false to over ride default autoexit

Select green for second pass. (a third pass could be added, though I have never done this)

Select build

Select ok

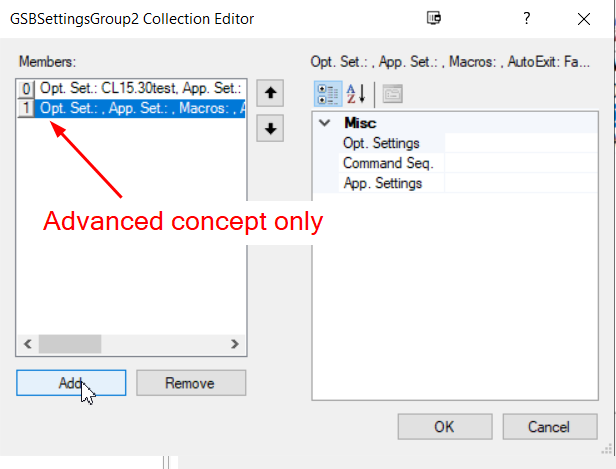

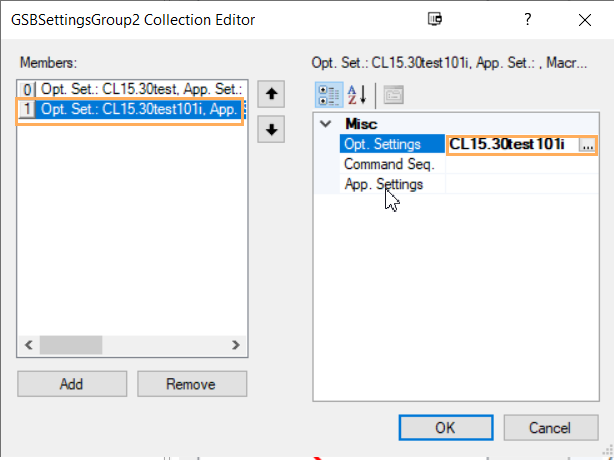

Next as an advanced option. We could select the CL15.30test_101i (101 indicators) or any other file you made previously.

This would be executed by Automation after the first file has been completed.

Selected CL15.30TEST101I

Not shown, fill the macro fields to do two pass and build.

END OF ADVANCED ADDITION.

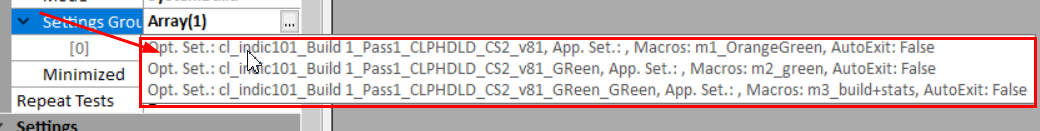

Review your settings my holding the mouse over the mouse over field.

The move features are not shown in the mouse over

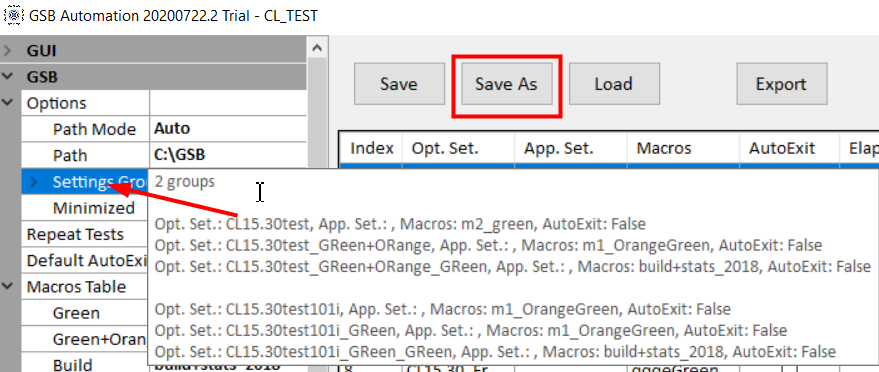

Save your settings.

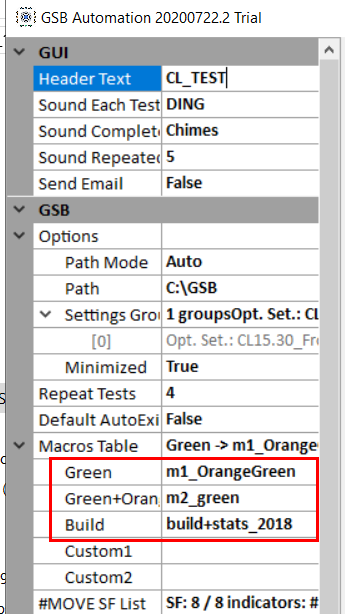

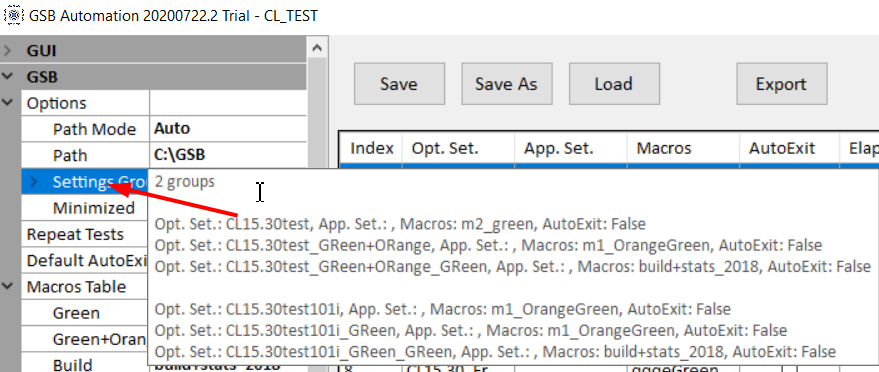

Next we are going to build 3 runs for the 2 pass indicator method.

Run 1, Choose green and orange indicators. (note you might want to choose green only) Macro m1_OrangeGreen or m1_Green

Run 2. Choose green indicators. Macro m2_green

Run 3. Change number of indicators used from 2 to 3, and put nth to all. Macro m3_build+stats

The mouse over on settings group shows this. See in red below.

To do these 3 steps above, this is how we would do it.

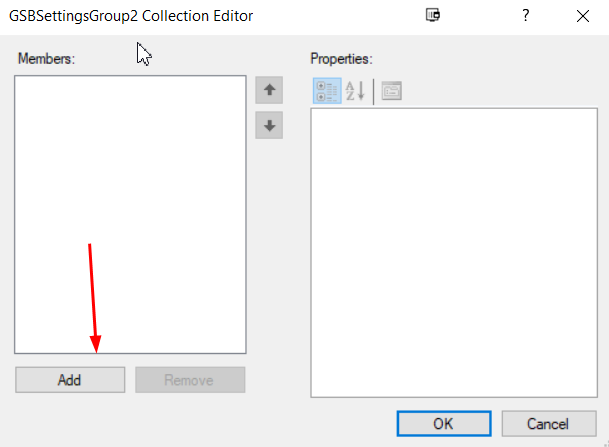

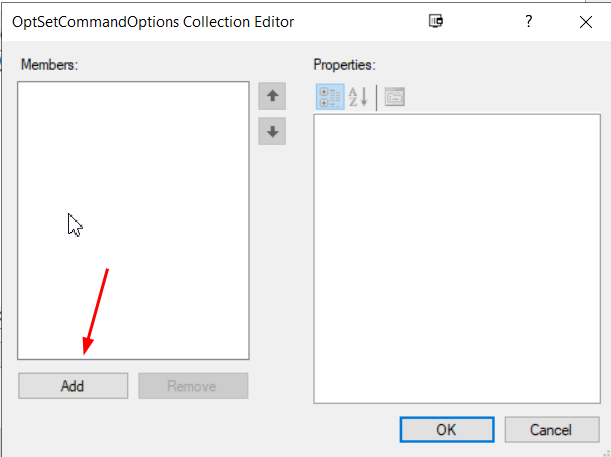

Click on settings

Click add

Note the autoexit option below. Do you want all the managers to stay open after you have run these tests.

Click Opt settings

Below we have now done step 1 of 3

Below is step 2 done

Below add the m3 build + stats

Check your settings by the mouse over

Other options

How many times do you want the loops to run? Do you want the managers minimized?

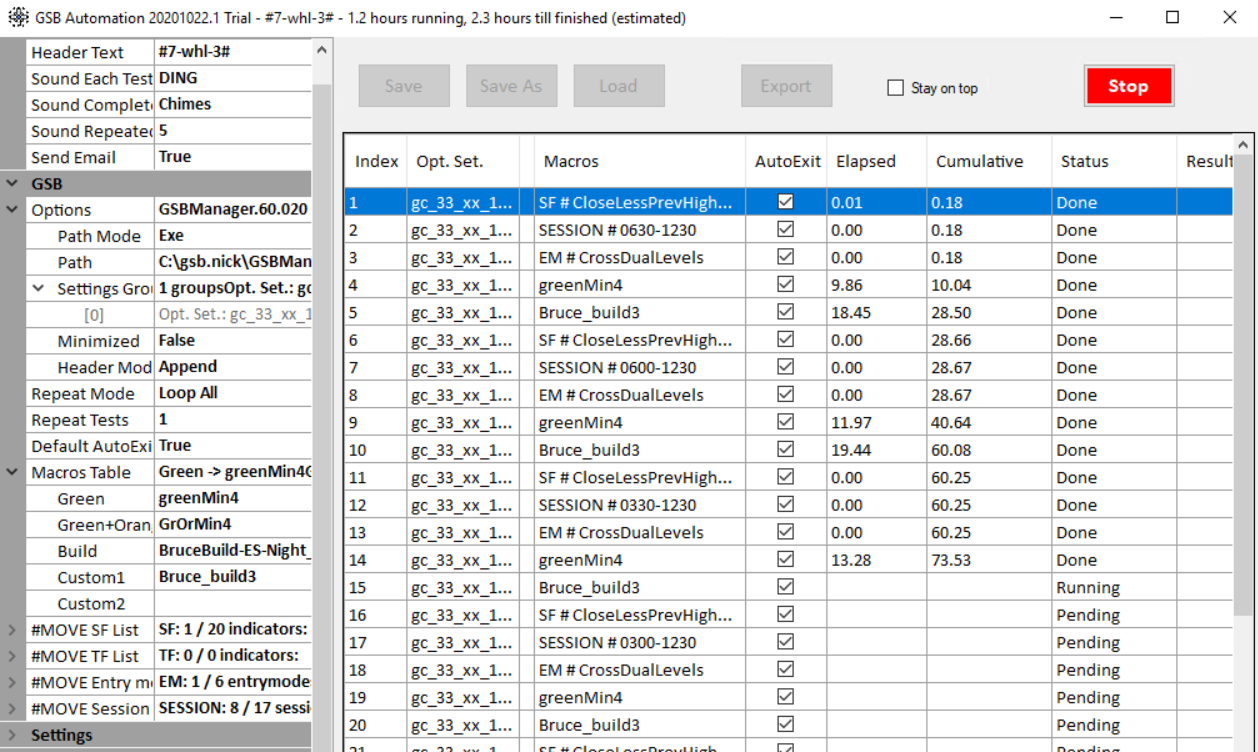

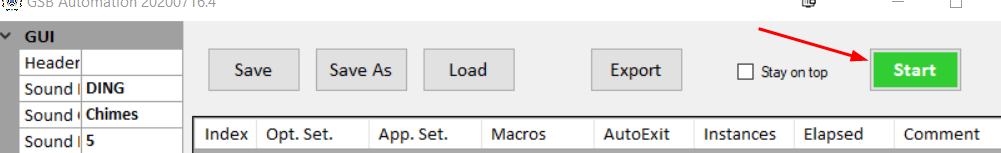

Hit start to run.

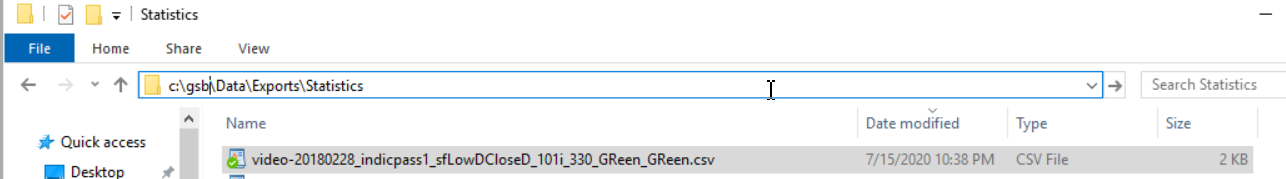

Output will be here

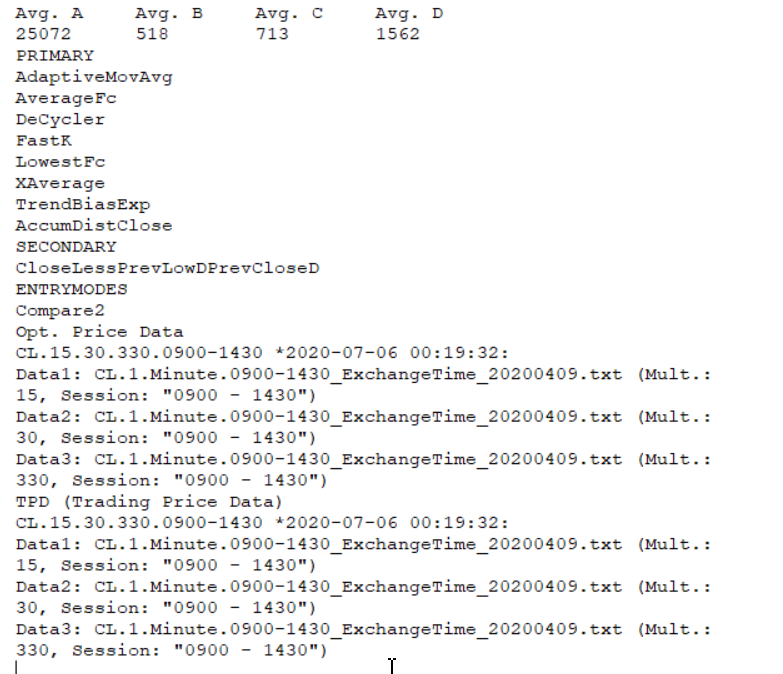

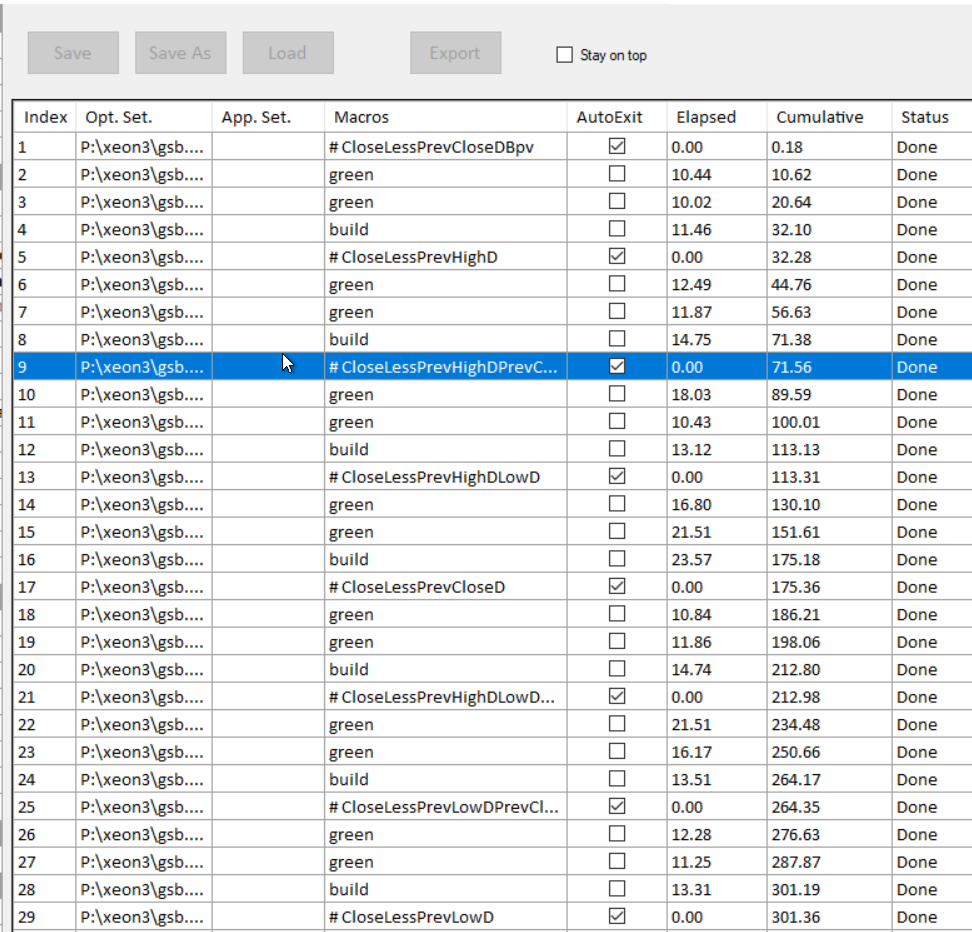

Output will be as follows as an example

Example of output.

Note the times to complete these tests were done with about 150 workers. This is the equivalent of about 10 high end PC's / servers. So your times will be considerably longer.

GSB Automation and the excel spread sheet $700

You will have use of this forever and updates for 1 year.

After 1 year you will need to pay a upgrade price to get the newer version but can use your current version of Automation forever.

Video 1 of 3. Videos 2,3 not done yet