SwingDaily-ES-YM-NQ-ER

Systems description

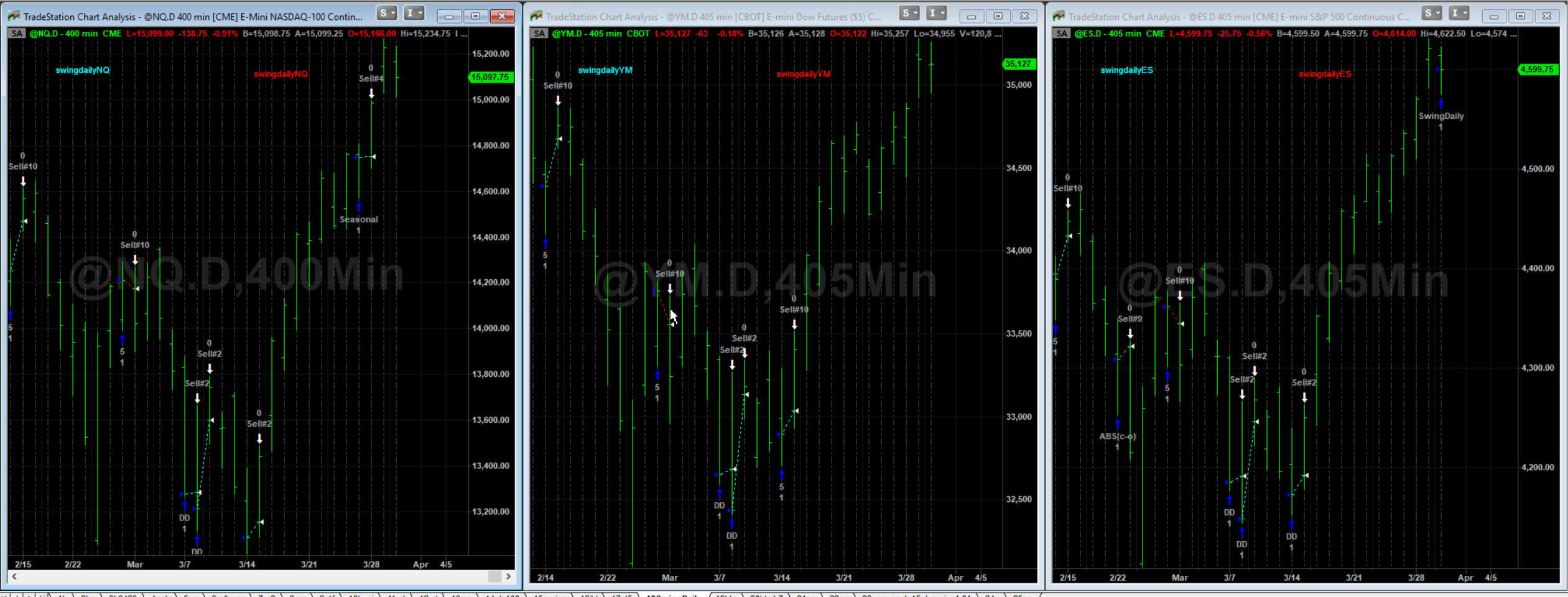

Swing Daily trades S&P500, Dow and Nasdaq, Russell 2000 futures with no changes in parameters.

The system is based on indicators, price patterns and seasonal market characteristics.

Out of sample is 2017-01-01

Either the e mini or micro can be traded.

All trades are < 24 hours long, excluding weekends.

Trades enter long around market close and exit on the open of the next day.

All results are shown for the e mini contracts, but the micros can be used.

Recommended capital is 4 x max historical draw-down per system - not per portfolio. Observation is uses who aggressively use high leverage blow there accounts up over time.

The Russell 2000 and S&P Mid cap 400 can also be traded, but results are not as good.

Contract limits apply of 4 emini or micros per market to preserve market liquidity for all traders.

Updated November 30 2022

I have been trading a modified session time on this system, which happens to have improved in sample and out of sample results

For full transparency, I will show the new and old session times, but will not update old session time results.

Results updated February 26 2025

Swing Daily ALL S&P500 (ES)+Nasdaq+mini Dow (new session time)

Swing Daily mini Russell

In Feb 2024 I noticed that the swing system also works on E mini Russell. Same code with no changes and session time 900 to 1500

Swing Daily S&P500 (ES) (new session time)

Swing Daily Nasdaq (new session time)

Swing Daily mini Dow (new session time)

No longer updated

Swing Daily ALL S&P500 (ES)+Nasdaq+mini Dow (old session time)

Swing Daily S&P500 (ES) (old session time)

Swing Daily Mini Dow (YM) (old session time)

Swing Daily Mini Nasdaq (NQ) (old session time)

Updated February 28 2023

DISCLAIMER

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.