SwingDaily2-ES-YM-NQ-ER

Systems description

Swing Daily1 trades S&P500, Dow and Nasdaq, Russell 2000 futures with no changes in parameters,

while Swing Daily2 trades S&P500, Dow and Nasdaq, Russell 2000 futures optimized on each market.

The system is based on indicators, price patterns and seasonal market characteristics. There are some minor code changes between series 1 and series2.

The original logic is out of sample is 2006 to 2017-01-01, but optimized form 2006 to 2025-Feb \

out of sample for NQ,ES,YM is January 13 2025, RTY and Dax February 12 2025

Either the e mini or micro can be traded.

All trades are < 24 hours long, excluding weekends.

Trades enter long around market close and exit on the open of the next day.

All results are shown for the e mini contracts, but the micros can be used.

Recommended capital is 4 x max historical draw-down per system - not per portfolio. Observation is uses who aggressively use high leverage blow there accounts up over time.

Contract limits apply of 4 emini or micros per market to preserve market liquidity for all traders.

Swing Daily2 ALL S&P500 (ES)+Nasdaq+mini Dow + Dax(full contract)

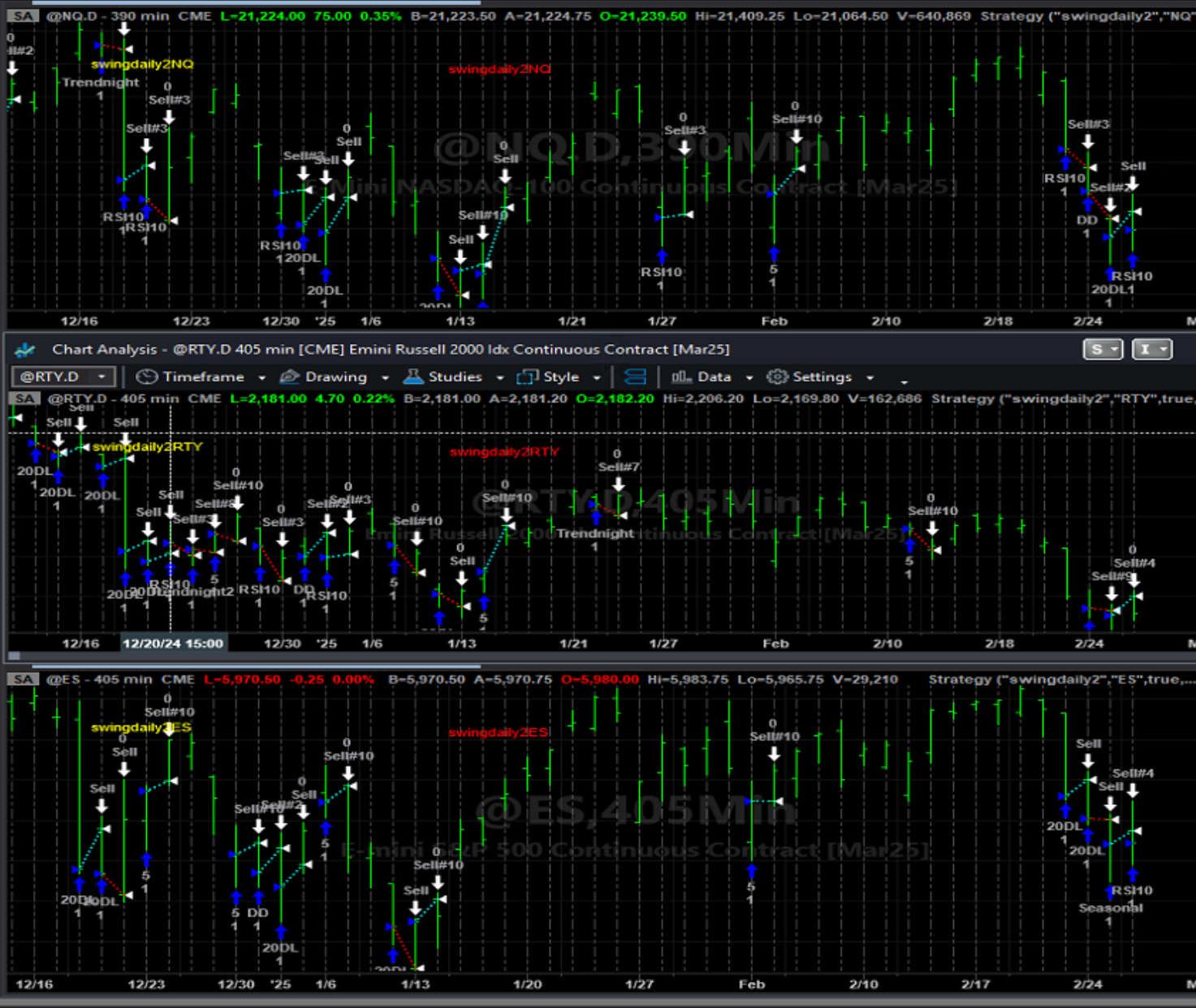

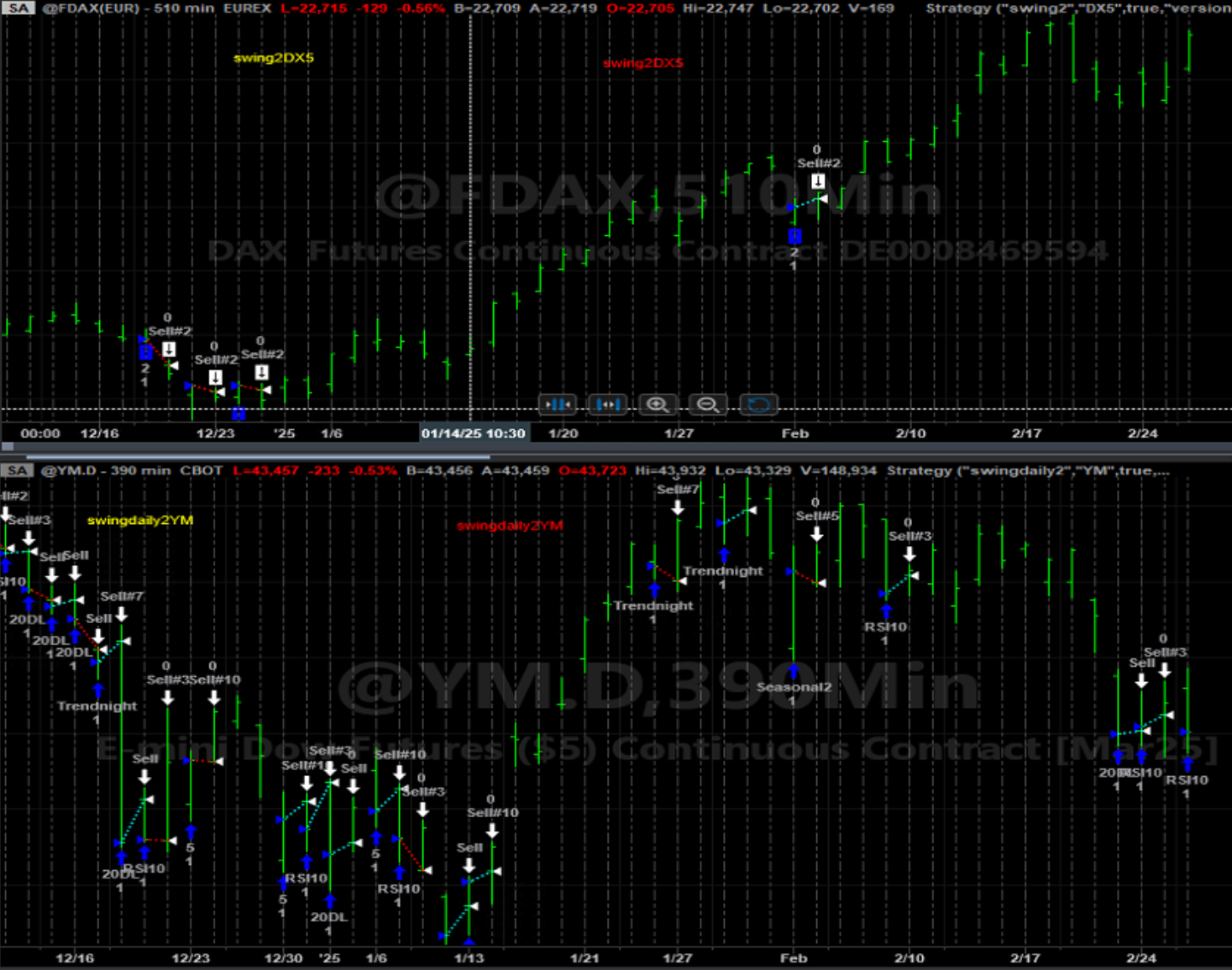

NQ

ES

RTY

YM

FDAX

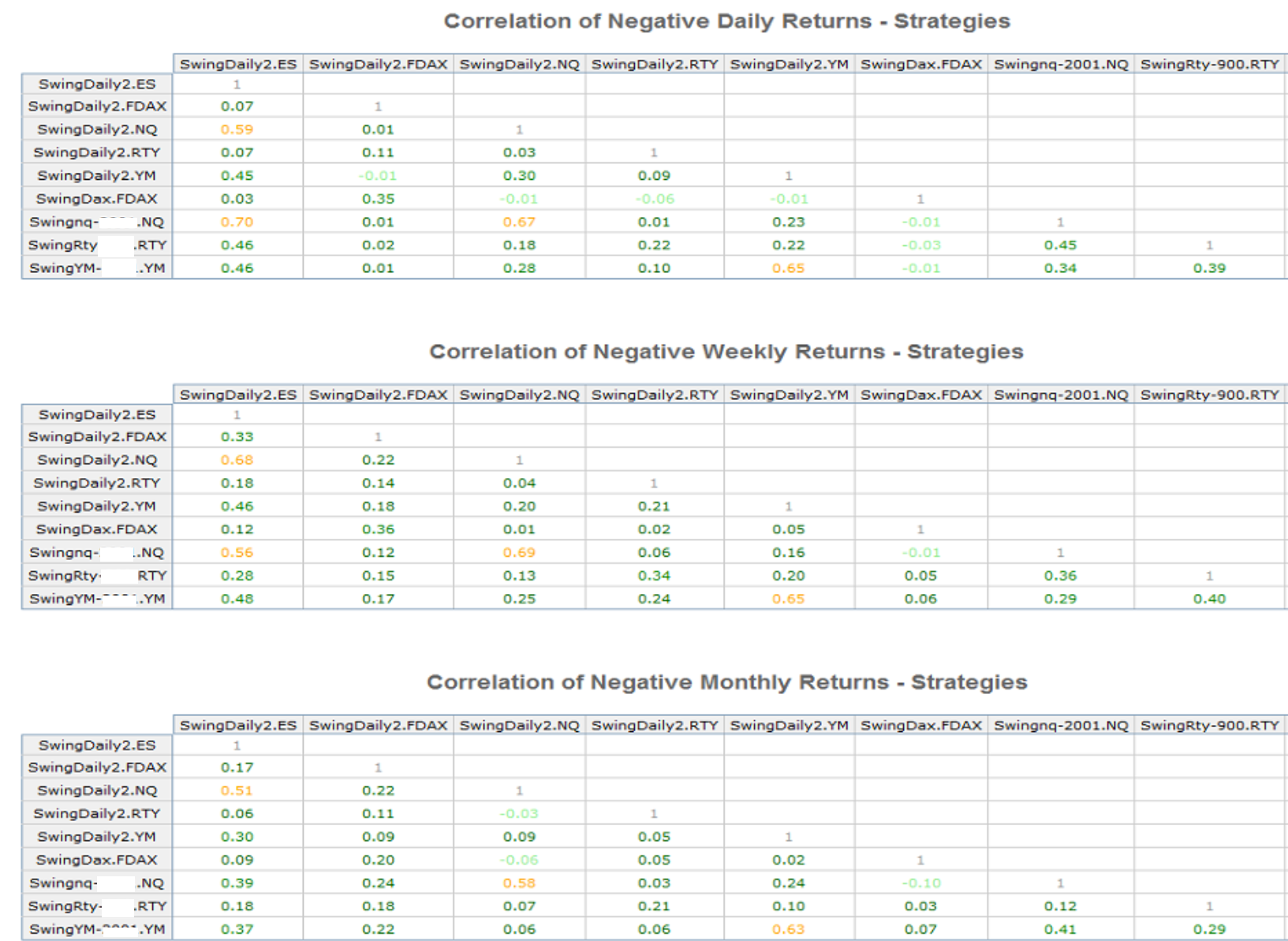

Correlation tables, data since 2006.1.1 onward.

As you can see, results over SwingDaily1 and SwingDaily2 systems vary greatly. If you have SwingDaily1 systems its recommend to trade series 1 and series2

Market performance since 2006.1.1 onward.