General

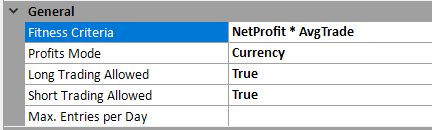

Fitness Criteria

This is what GSB looks to maximize in its training period. Default is netprofit * average trade.

If you are looking for other metrics - Netprofit * profitfactor, netprofit with slippage figure is also ok. If your are on the S&P500 and have SF (Secondary filters on) a reasonable commission figure in fitness is fine to use. For other markets I would leave it at zero, build a system using GSB to find an entry technique. Then add other filters (Truisms) to increase average profit per trade and Profit factor.

Profit Mode

Calculates profit-based metrics (i.e. net profit, avg trade, etc) in currency (more common for futures), Percent (More common for Stocks), Points, or Ticks/Pips (Common for FOREX)

Long/Short Trading

By default, both “Long Trading allowed” and “Short Trading Allowed” are both “True” means both active and system will be built on both LONG & SHORT trade. However, if you would to have a system based on only LONG you can change “Short trading allowed” to “False” and it will only look for LONG opportunity. Same way you can do set it for SHORT only.

Time of Day

With this you can Exit at certain time of the day.