Building Bitcoin systems

Bitcoin is extremely volatile, and GSB friendly. There are however many issues.

The futures is very poor liquidity, and margins at Interactive brokers for the big contract are 225k for long and 275k for shorts.

Twice when I got stopped, slippage was $475 per trade. (not a typo)

For the micro brokerage is $4.75 per side. IB are basically saying, we don't want you to trade Bitcoin, and its 1/50th the leverage of a full bitcoin contract.

This leverage combined with poor liquidity makes the micro BTC almost useless in my opinion.

Tradestation is more friendly, but margins are around $70,000 for the big contract.

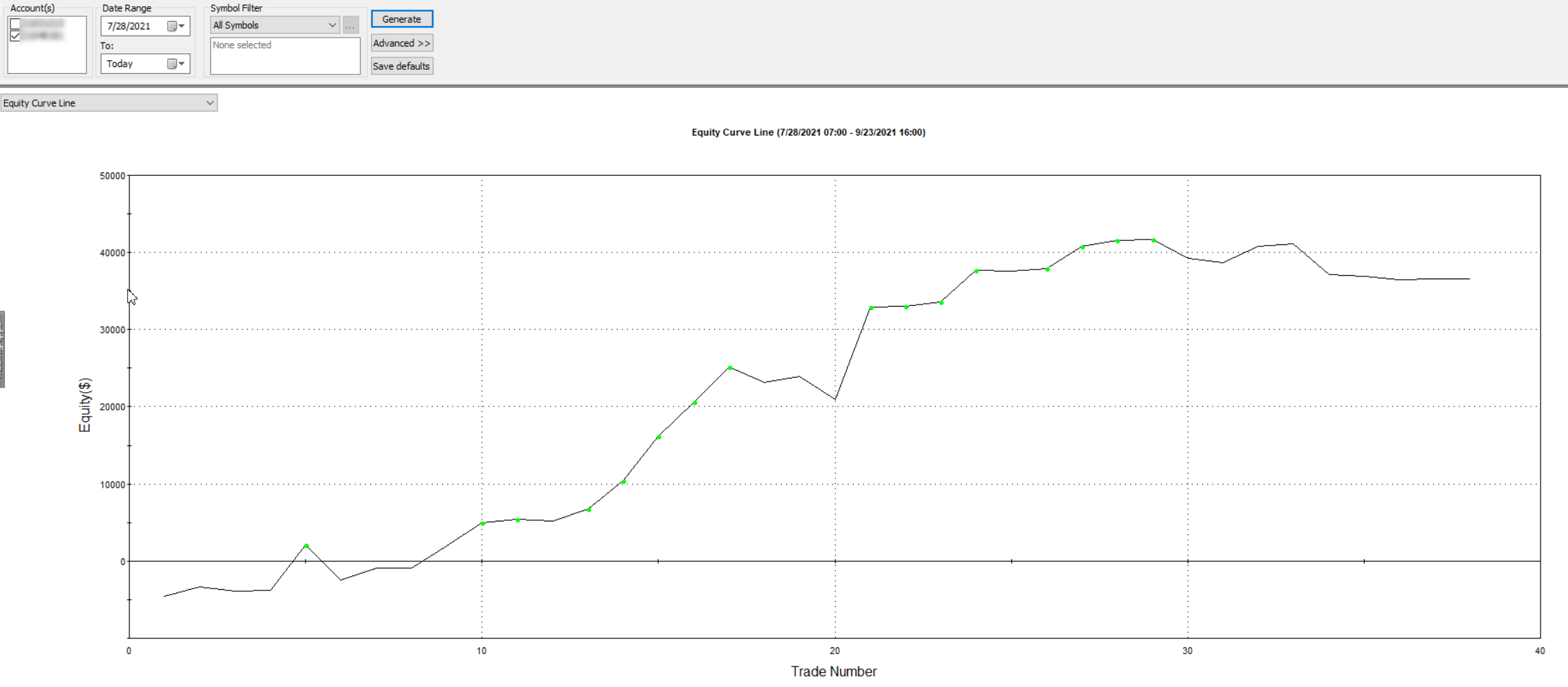

In the short period of time I traded bitcoin, profitability had been good. Below is my fills from live TS account trading a maximum of 1 contract, but with 3 systems.

For this reason is recommend to use Binance. Binance can be traded using Multicharts.

I understand that Bitcoin can now be traded with Tradestation & Interactive Brokers too. At this instant I know nothing about this and if you do know, please let me know.

Additional paperwork needs to be filed with Tradestation. The form is Crypto-Enhanced-Due-Diligence-AML-Questionnaire.pdf

Binance data must be used. Note that there is a large discrepancy in price between Binance prices, Large CME Bitcoin contract, and small CME Bitcoin contract.

The point I make is build systems on the actual data you will trade.

Small CME Bitcoin data is also much shorter period than the big contract, and the profit loss on Tradestation 9.5 will always show zero. (A critical bug)

Tradestation 10.0 was not tested.

You can also trade using the EFT GBTC.

GBTC however is significantly different to Bitcoin, especially in the fact that the hours are 830 to 1500 Central USA time.

Likely doing long term trades will work better on GBTC, but I have not done anywhere enough work on this.

The setup for GSB on Binance is Secondary Filter RSI and data 630 to 1430, 30 minute bars. (Central USA time)

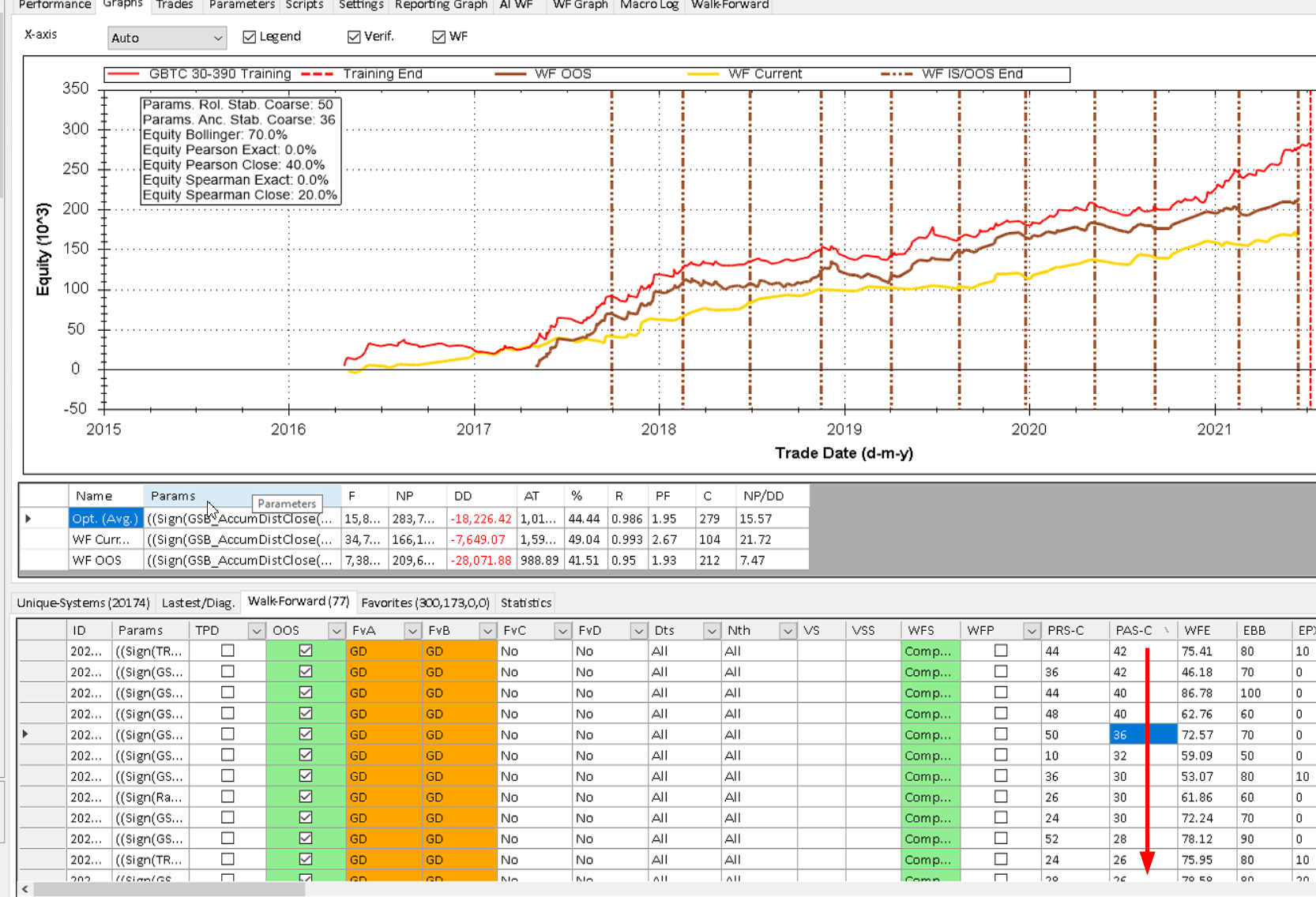

GBTC EFT setup.

These are long term systems (over night), and they are long and short.

Entry type is Compare2.

I am no longer using exit type "Decision Exit (I/SF)"

For GBTC eft, capital used is in these examples is $50,000 with zero slippage and commission in the build process.

Just a fixed stop of $2000 and profit target $3000 for system building. Likely for live trading at $2500 stop and $4500 profit target is better.

I liked lower stop & PT values as it gives more trades, which is better as BTC data is shorter in years compared to most other markets we trade.

Too few trades in system building in it self will increase how much a system will degrade out of sample.

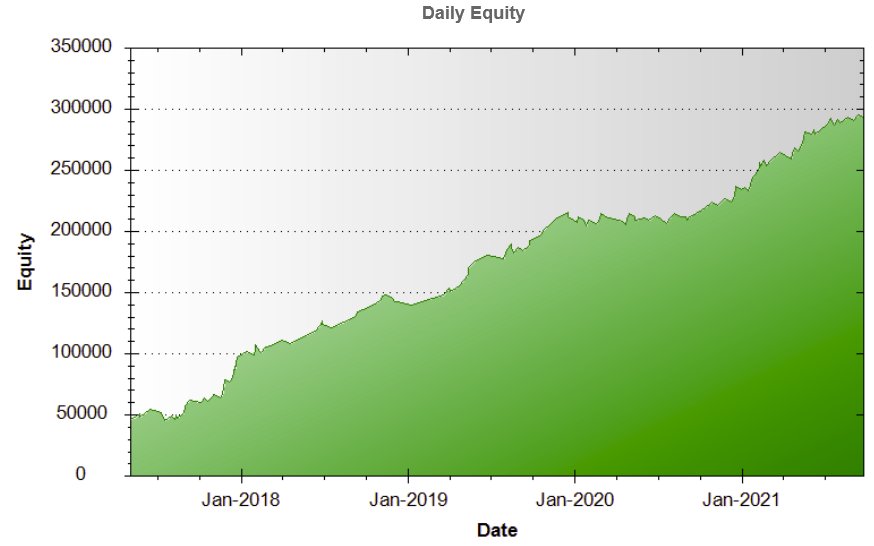

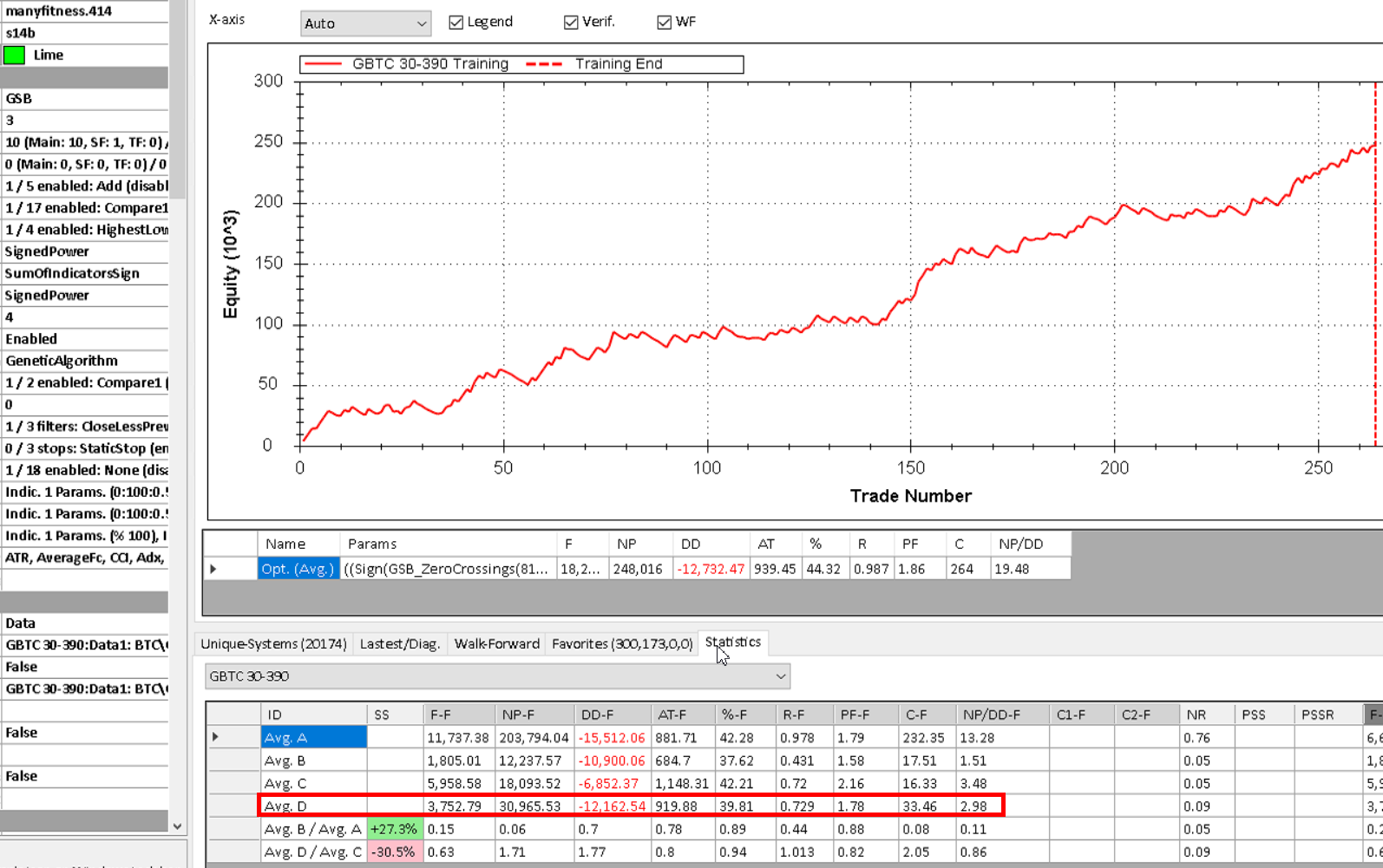

Here is results of a final GBTC system.

There is no out of sample period, but the system was manually optimized one parameter at a time, then walk forward in EWFO

Slippage & commission is used in this report. There was 2 months out of sample when this system was made, but the final WF was done with no out of sample data left.

I'm live trading this system now with a small amount of $ allocated to it.

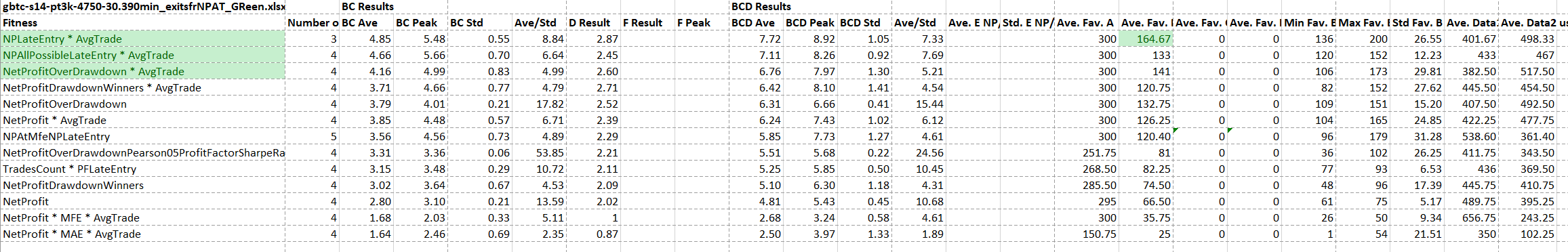

Fitness used is NetProfitOverDrawdown * AvgTrade

Fitness NetProfitOverDrawdown * AvgTrade or fitness NPAllPossibleLateEntry * AvgTrade can also be tried.

What you need to check using these latter 2 fitness's is that walk forward results are okay. Its possible that WF may not work well with these.

Results via GSB automation for a variety of fitness are shown.

Note the top test was tried 3 times (It should have been 4 times)

This is stats from one build

Note the Ave D is the stats for the entire out of sample reply.

All files used for this build are in GSB 1.0.63.06 on-wards obtained for GSB purchasers via GSB resource manager. The files will make there way into the trial build late 2021

High level of how to build GBTC systems

In the manager, open up gbtc-pt3k-4750.gsboptset

Run M1. This will build 20,000 systems and choose the best indicators. (50,000 is better but slower)

After this is complete, save the opt settings as gbtc-pt3k-4750_green.gsboptset.

Close GSB

open GSB using gbtc-pt3k-4750_green.gsboptset

run M2. This will build 20,000 systems (faster than M1) and choose system(s) from Favorites B

This is all covered in Building Nasdaq, S&P500 or Dow systems in greater detail.

Shown here is a system that looks nice. I sorted on Anchored stability score from high to low and choose a system I liked.