GSB Setup and Operation

GSB normally defaults to run S&P500 futures data. If you want to use other data, read below.

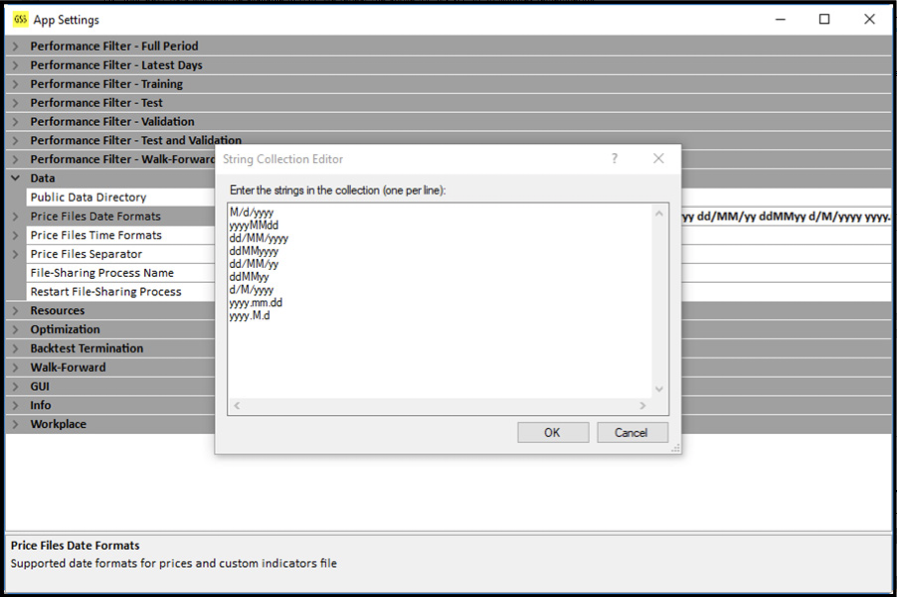

Before proceeding we need to ensure that our data is supported in GSB. Each GSB program, Standalone, Manager may need additional date formats added to make sure the date format used by your data is supported. The list in FIG 1.51 is reasonably comprehensive. GSB will auto detect most formats.

Now paste the formats from FIG 1.51 into this box over the existing formats and click OK. You will now have the date formats you will need.

FIG 1.52 App Settings - Data

FIG 1.53 Window showing Date Formats

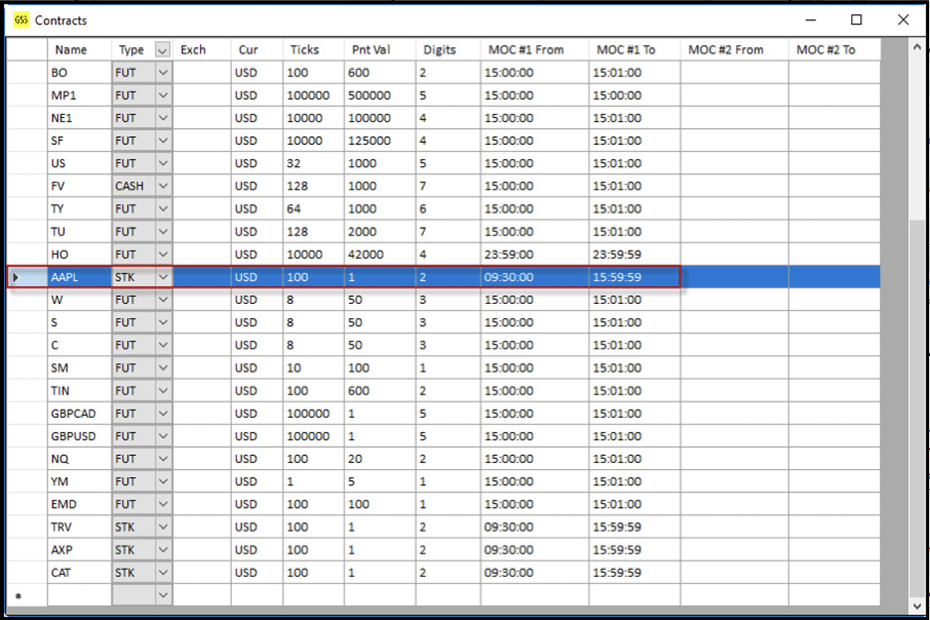

Before loading any new data into GSB, we also need to add both AAPL and SPXXO to the Contracts List in GSB (If they are not already in the list). This is done by clicking on Tools – Contracts List and adding AAPL and SPXXO. We have added AAPL as highlighted in FIG 1.54. The required settings for AAPL are shown.

FIG 1.54 Contracts List

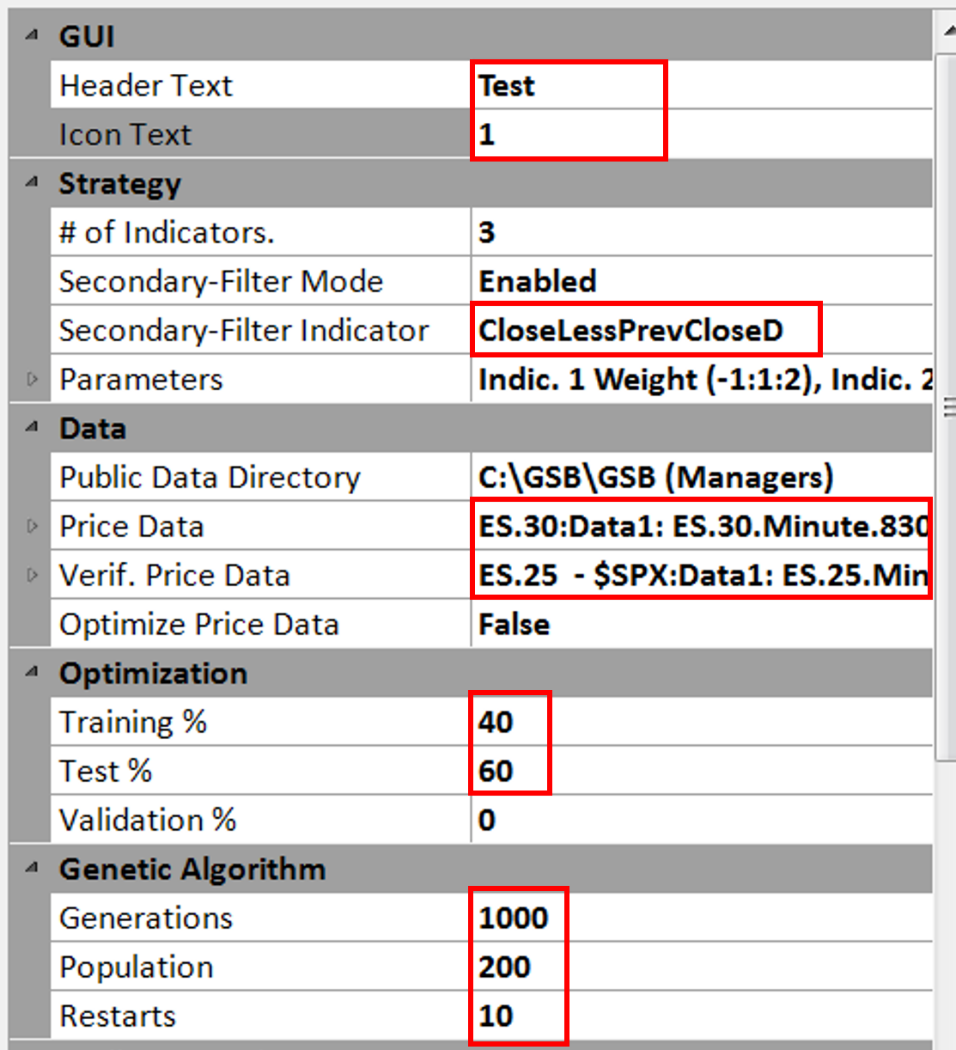

To set up GSB to develop trading systems for our AAPL and SPX 30-minute data we need to change some settings in the left-hand boxes. The following set of FIGURES will highlight the settings that need to be changed to achieve good performance results.

In FIG 1.55 as highlighted in the red boxes we have named our strategy run “Test” & “1” in the Icon and under Strategy we have selected 3 indicators (3-5 is the allowable range). There is some evidence now that 5 may be preferred. We have kept the Secondary-Filter Indicator to CloseLessPrevCloseD, which means today’s closing price being less that the previous days close. The other alternative is GeneticAlgorithm

2022 Dec 28 Update.

Settings below are redundant. Over the years how we use GSB has been enhanced greatly since this was written. Use the default settings that come with GSB.

This section here is the most current documentation.

FIG 1.55 Setups 1

Primary and Secondary Data uploaded as shown in the section 1.4

Under Optimization you can select the percentage of data used for Training (developing the trading system) and for Testing OOS data(out-of-sample data). A Training % between 30% and 50% is recommended. We kept an default 40:60. We have also kept “Restarts” at default 10, you can reduce/increase it to reduce/increase the quantity of trading systems. Normally for serious system development we have been using 10 restarts. Under the settings selected here GSB will test 1000*200*10 = 20 million combinations of indicators and indicator parameters.

(For advanced trader who would like to use Nth day for the OOS data, please check advanced mode)

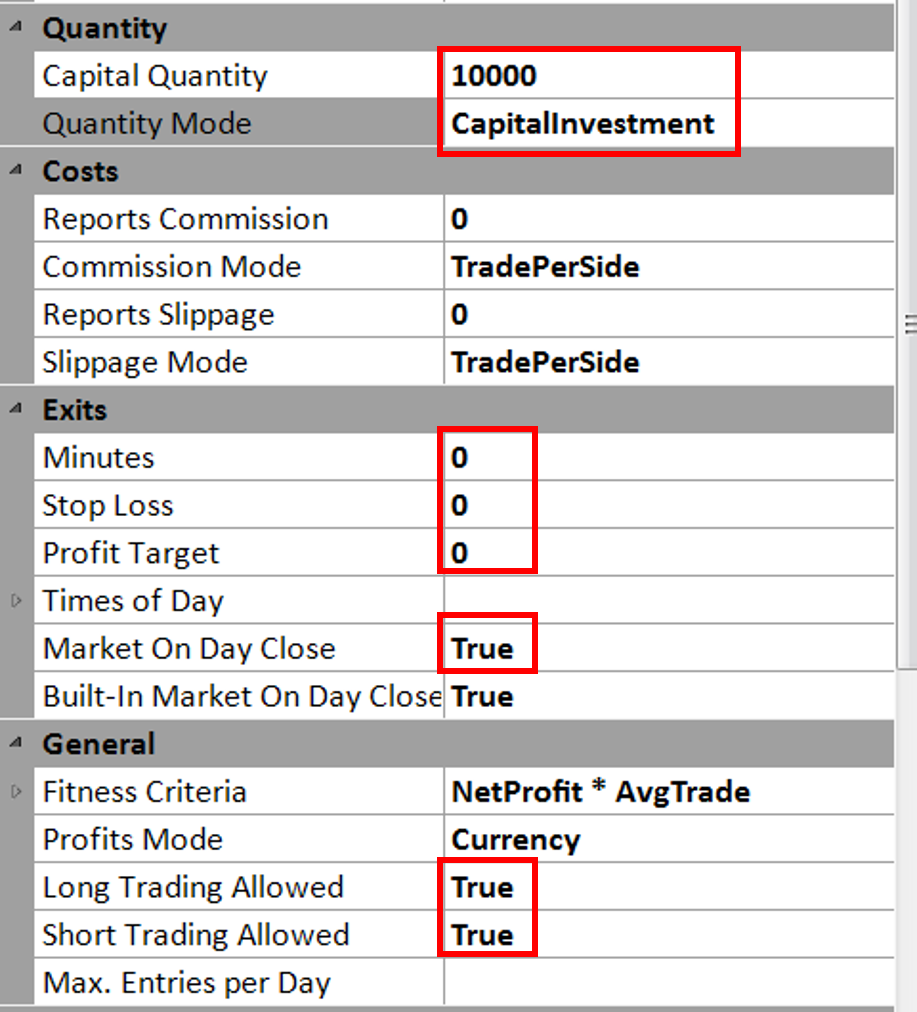

Under Quantity in FIG 1.56 we have selected CapitalInvestment and 10,000 ($) in preference to FixedShareContracts as this is better suited to a stock trading system. Under Costs we can set commission and slippage. We have set a commission at $13.50 per side for this run as this can be significant when trade size is small. For an initial run we have left the other commissions at zero.

We did not set a Stop Loss or Profit Target. We have also set Market On Day Close at True (Default) as would like to exit all trade at the end of day. You would leave this at False if you wanted to develop a Swing Trading system or would like to hold your position over night. We have be Short Trading Allowed & Long Trading Allowed both True (Default) for Both Long and Short trading. However, if you would like to develop a Long/Short only system, you can set Short Trading Allowed/ Long Trading Allowed to False.

FIG 1.56 Setups 2

Please note that in FIG 1.56 under the General section there is a Fitness Criteria which is set to be Net Profit times Average Trade. When doing iterations on various combinations of indicators and of their parameters GSB will select the best systems based on having the highest Net Profit times Average Trade. Please also note that alternative criteria may be set.

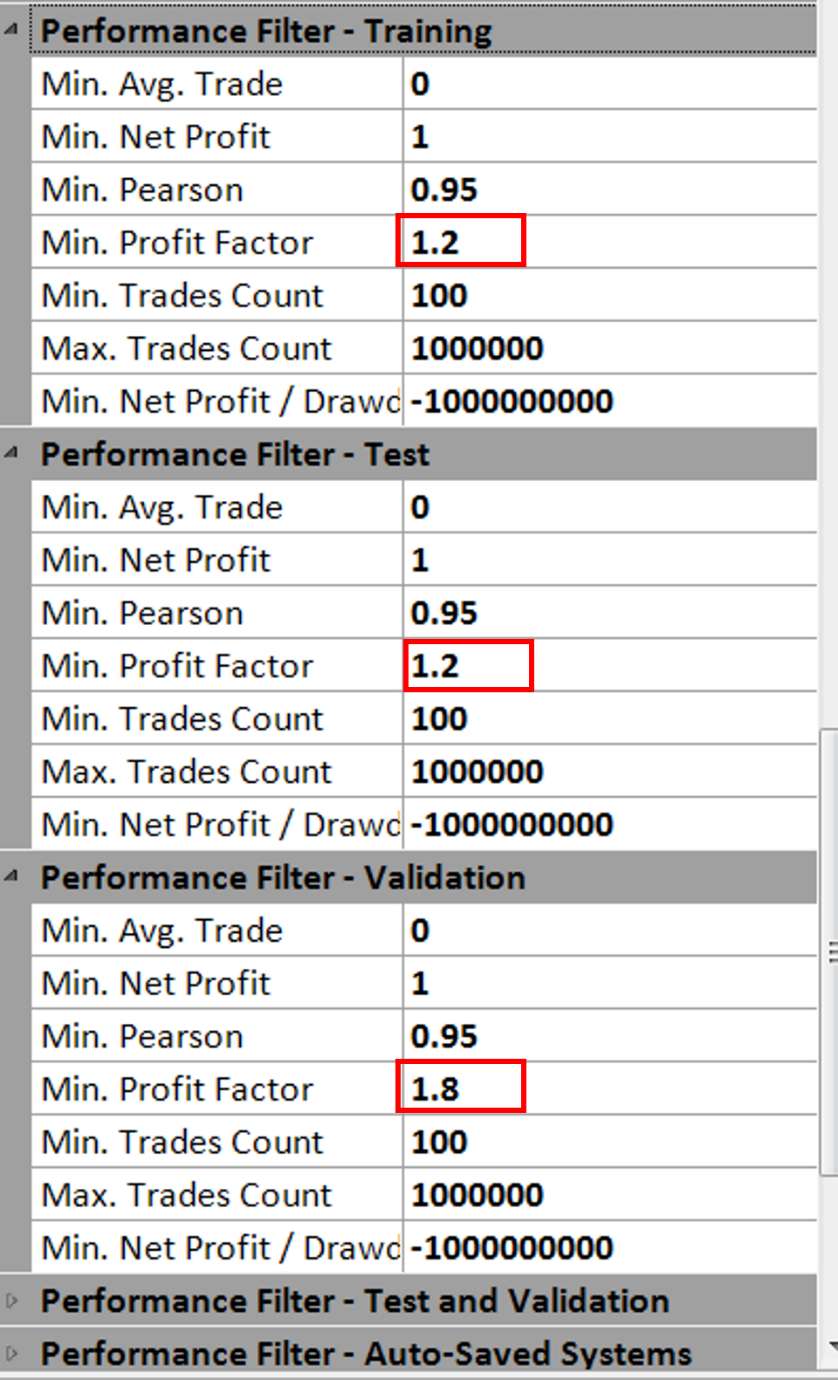

You can set up performance limits for your system testing. There are quite a few things we can change however, Person coefficient and the Profit factor is the key here. We would like our System equity curve as close to straight line or other word no major Draw-downs. We set a Person coefficient of 0.95 (Highest is 1). For the training and Test we kept everything same, except for Validation we would like our profit Factor to be little higher, so we have it at 1.8 (compare to 1.2 in Training and Test). You can set limits for minimum average trade size, minimum net profit, minimum Pearson Coefficient, minimum Profit Factor etc (see FIG 1.57).

FIG 1.57 App Settings

We are now ready to start the GSB trading system development run on AAPL. Just click the green button with the arrow at the bottom of the GSB screen and shown in Fig 1.38 below.

FIG 1.58 Start GSB

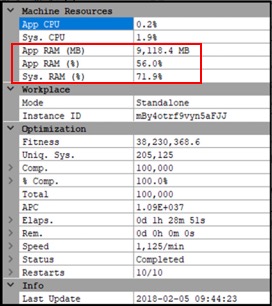

While a run is in progress it is worth checking on the Machine Resources being used and especially the System RAM (%) highlighted by the red box in FIG 1.39. From experience it seems that you will need at least 16 GB of RAM to run GSB without problems.

FIG 1.59 Machine Resources