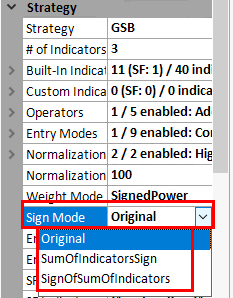

Sign Mode

Consider these examples.

All examples are valid to use. In time the GSB community likely will have preferences for what works best on specific markets.

This was introduced because there is a small architecture issue with sign mode original and multiply operand.

lets say we have 3 indicators, and two are below zero.

WHen they are multiplied together, we will get a positive number. This is interpreted by GSB as bullish, when its actually bearish.

Because of the secondary filter seeing the overall trend, this is not a terribly significant issue. My tests however showed that we may be missing out on short trades.

Thats not bad but means things can be improved. Hence the sign modes below.

Sign mode original

i1=indicator1

i2=indicator2

i3=indicator3

result=i1*i2*i3

Signmode SumofindicatorsSign

i1=indicator1

i2=indicator2

i3=indicator3

direction=sign(sign(i1)+sign(i2)+sign(i3))

result=absvalue(i1*i2*i3)*direction

Signmode Sumofindicators

i1=indicator1

i2=indicator2

i3=indicator3

direction=sign(i1+i2+i3)

result=absvalue(i1*i2*i3)*direction