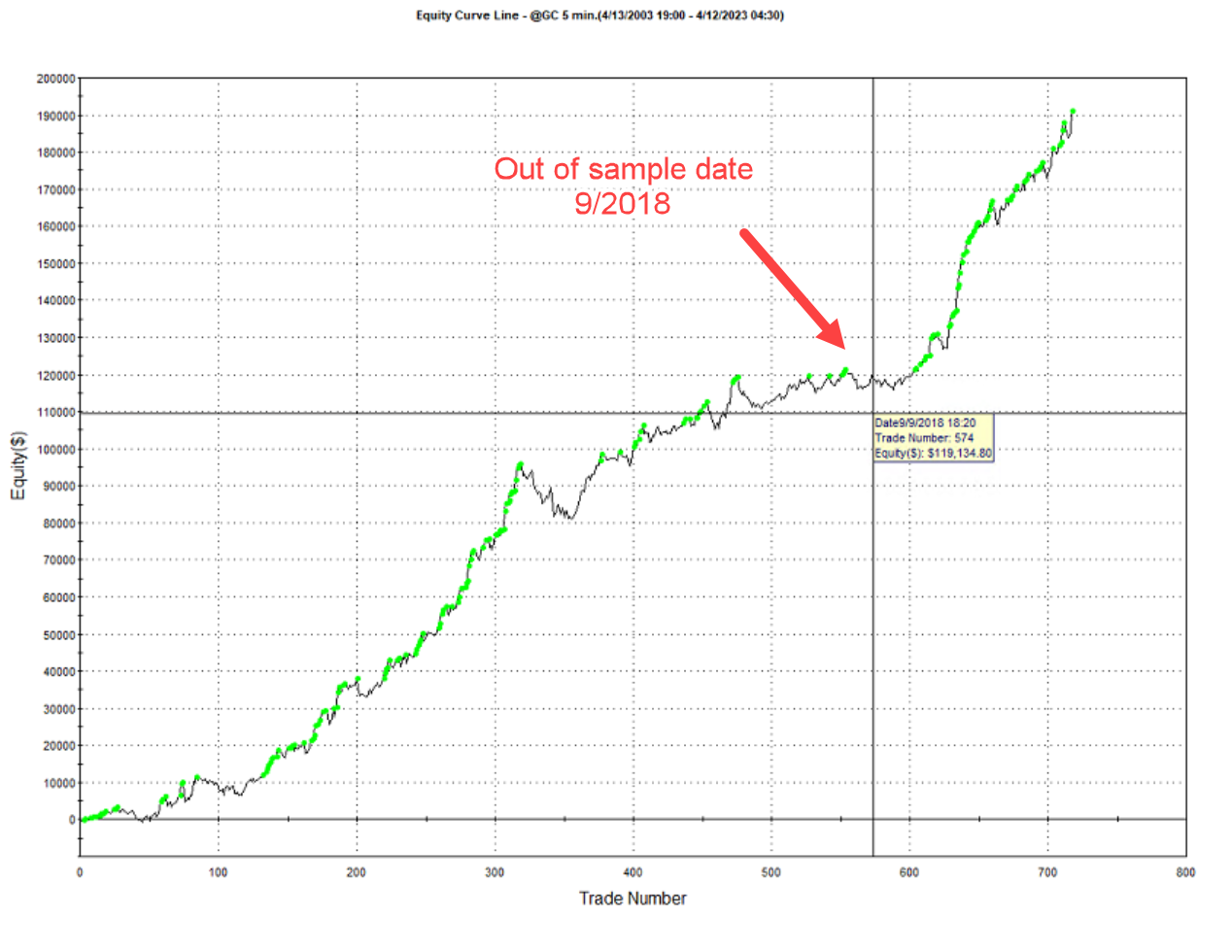

GoldminerSwingGC

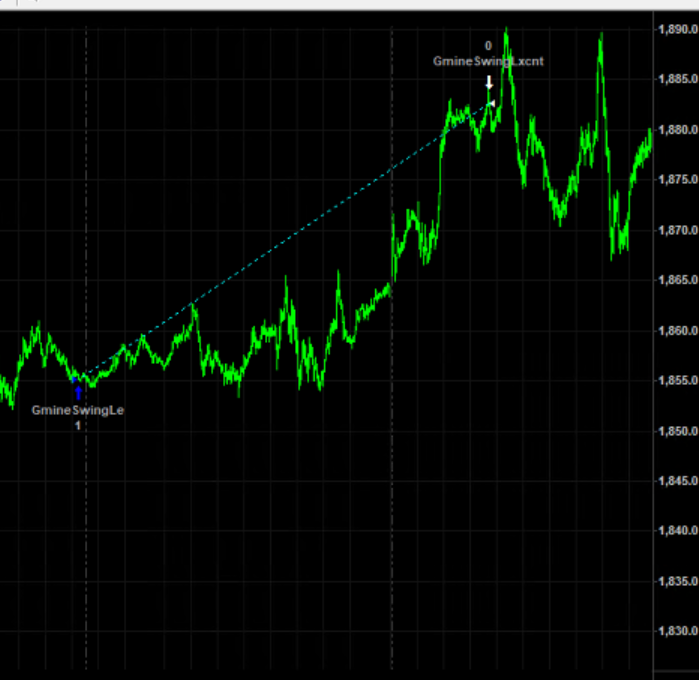

GoldminerSwing & GoldDigger GC trades in 5 minute bars, over a 24 hour session.

It is out of sample since 2018-08,

Trades typically are a few days long and can go long over the weekend.

However being long gold over a weekend means if there is a global adverse event, gold is more likely to go up than down.

The system can be traded on full contract or micro gold. Exit time of day is not critical, so can be adjusted from in the code inputs.

This is NOT a GSB system. Systems for sale deliberately have some 'human' made systems as it gives greater diversity in out of sample results - the goal being lower out of sample draw downs.

The logic of the two systems is similar, but entries are different in time. Exits are similar but can be adjusted as they are not very time sensitive.

This is the original 2018 version.

Results updated Feb 12 2025

GoldMinerSwing V2

(Version 1.0 out of sample 2018-09-01, )

V2 Out of sample 2023-04-12

Note previously by mistake these results were showing GoldMinerSwing V1

GoldDiggerSwing

DISCLAIMER

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.