GSB_GoldSystems

Gold futures is at an amazing time in history, with large moves that often trend well.

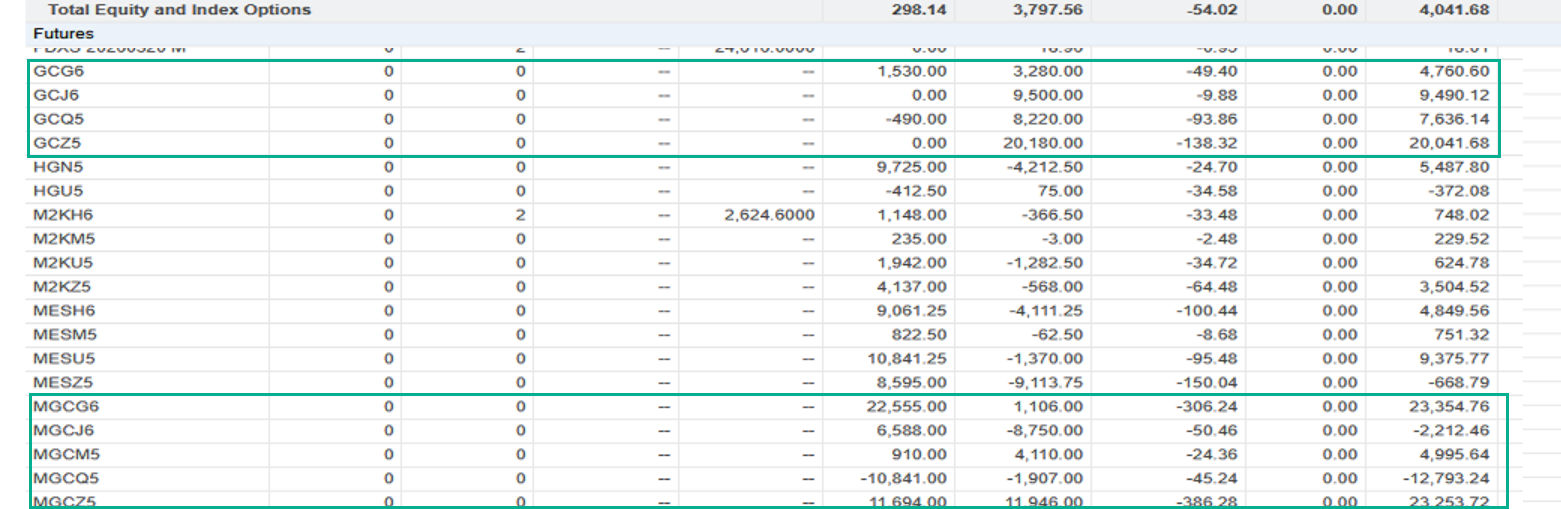

Below is Pl from my Interactivebrokers account May 1 2025 to 30 January 2026.

Disclaimer. Most but not all of these systems are GSB systems.

Grand Total = $78,526.96 Most of the day trading systems were traded on 1 e-mini, longer term systems approx 2 or 3 micros. There was also an execution error where I accidentally had a 10,000 profit target, when I should have had no profit target. The system GSB2GC would have made about $20,000.

GSB2GC was the first Gold system made with new features in GSB with pivots, stop entries new normalization modes.

Purchasers of the system get unlocked code. Max of 4 contracts allowed.

Can be traded E-mini or micro contract. Stop and profit target quoted for e-mini's. Micros are 1/10 the leverage.

Stops and profit targets can be exceeded due to after hours gaps

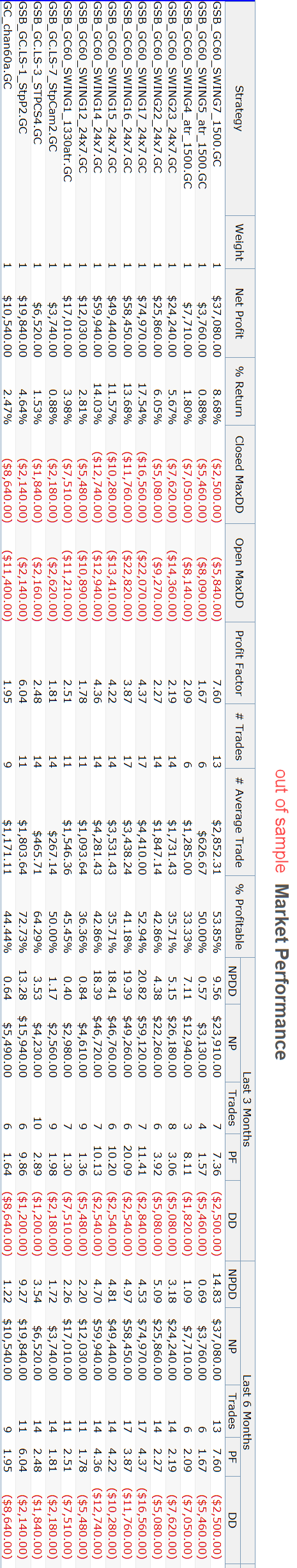

Nearly all systems are out of sample from May 1 2025. A few are May 15 2025

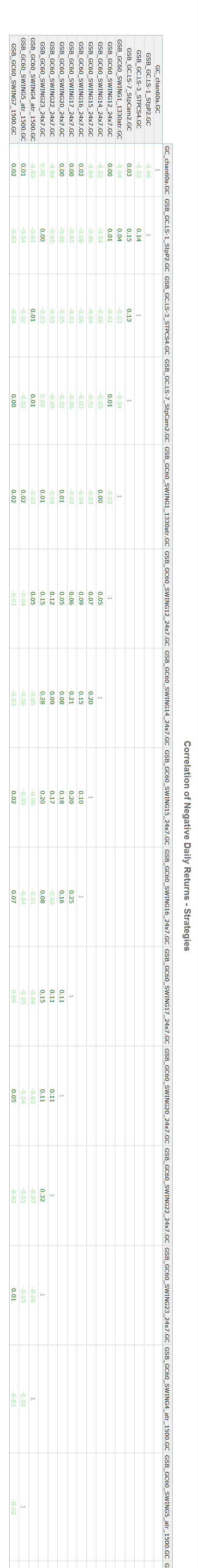

In my 25 years of trading, I have never seen systems with so low negative correlation to each other.

October 2025 was the most volatile month in gold futures history. Results for systems varied from no trades for the month, to in one day just under 13,000 win for a day trade system and 2 * 13,000 wins for a swing trade.

All reports updated January 30 2026

Click on the fields you wish to look at on the system report. You may need to hit f5 on your browser to refresh to most current content. (monthly will show last month)

GSB_GC1

Day trading system. Exit is market on close or $2500 stop for emini or $250 for micro gold. $2500 stop for emini or $250 for micro gold. 6 AM to 1230 PM session time.

GSB_GC.LS-3_STPCS4

Day trading system. Exit is market on close or 2 hours time duration . $2500 stop for emini or $250 for micro gold. 6 AM to 1230 PM session time.

GSB_GC.LS-7_STPCAM2

Day trading system. Exit is market on close or 2 hours time duration $2500 stop for emini or $250 for micro gold. 6 AM to 1230 PM session time.

GSB_GC60_SWING1_1330atr

Swing trading system. $10,000 profit target and approx $2800 stop. Session 0000 am to 1330 pm.

Most recent trades shown.

GSB_GC60_SWING4_atr_1500

Swing trading system. $10,000 profit target and approx $2500 stop. Session 0000 am to 1500 pm.

GSB_GC60_SWING6_1330

Swing trading system. $10,000 profit target and approx $2500 stop. Session 0000 am to 1330 pm.

GSB_GC60_SWING7_1500

Swing trading system. $10,000 profit target and approx $2500 stop. Session 0000 am to 1500 pm.

GSB_GC60_SWING12_24x7

Swing trading system. $10,000 profit target and approx $2500 stop. Full session Monday to Sunday.

GSB_GC60_SWING14_24x7

Swing trading system. $13,000 profit target and approx $2500 stop. Full session Monday to Sunday.

GSB_GC60_SWING15_24x7

Swing trading system. $13,000 profit target and approx $2500 stop. Full session Monday to Sunday.

GSB_GC60_SWING16_24x7

Swing trading system. $13,000 profit target and approx $2500 stop. Full session Monday to Sunday.

GSB_GC60_SWING17_24x7

Swing trading system. $13,000 profit target and approx $2800 stop. Full session Monday to Sunday.

GSB_GC60_SWING22_24x7

Swing trading system. $10,000 profit target and approx $2500 stop. Full session Monday to Sunday.

GSB_GC60_SWING23_24x7

Swing trading system. $13,000 profit target and approx $2800 stop. Full session Monday to Sunday.

GSB_GC_all systems combined.

To purchase, fill in the NDA here & email it back. Not needed if this NDA has been filled in before.

click here to buy

More gold systems to be added to paypal purchase options approx Tue 28 October. Email me if you want to buy sooner

|

Pricing GBSsys1 to GSBswing23 Number of systems |

Total |

|

1 |

500 |

|

2 |

980 |

|

3 |

1420 |

|

4 |

1820 |

|

5 |

2180 |

|

6 |

2500 |

|

7 |

2780 |

|

8 |

3020 |

|

9 |

3220 |

|

10 |

3380 |

|

11 |

3500 |

|

12 |

3580 |

|

13 |

3620 |

|

14 |

3620 |

|

15 |

3580 |

|

16 |

3500 |

For example if you want 4 systems, total cost is $1820

16 systems total cost is $3500

DISCLAIMER

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.