GSBSwing30ES-NQ

Results shown for trading one Emini contract. Most users will want to trade micro's which has 1/10 of the leverage.

Results updated August 27 2024 version 1.4x

System description

Version 1.4x has change in indicators used, small change to HMA filter, minor parameter changes. This build is a significant and free upgrade for all purchased users. The new eld can be downloaded in the same pcloud url that was received when you bought the system.

The system was chosen to have robust and lower risk parameters. It would be optional to trade 1/2 your NQ contracts at a 200 point profit target, instead of 150 point.

The systems trade 22 or 23 hours per day, 5.5 days per week. Exit is profit target, stop, signal reversal or break even profit lock.

They are long only and hold overnight. Risk is lower than many overnight systems as exits can often occur outside the day session market.

These systems are good in that overnight moves can often be captured. The historical equity curves show good linearity over many years.

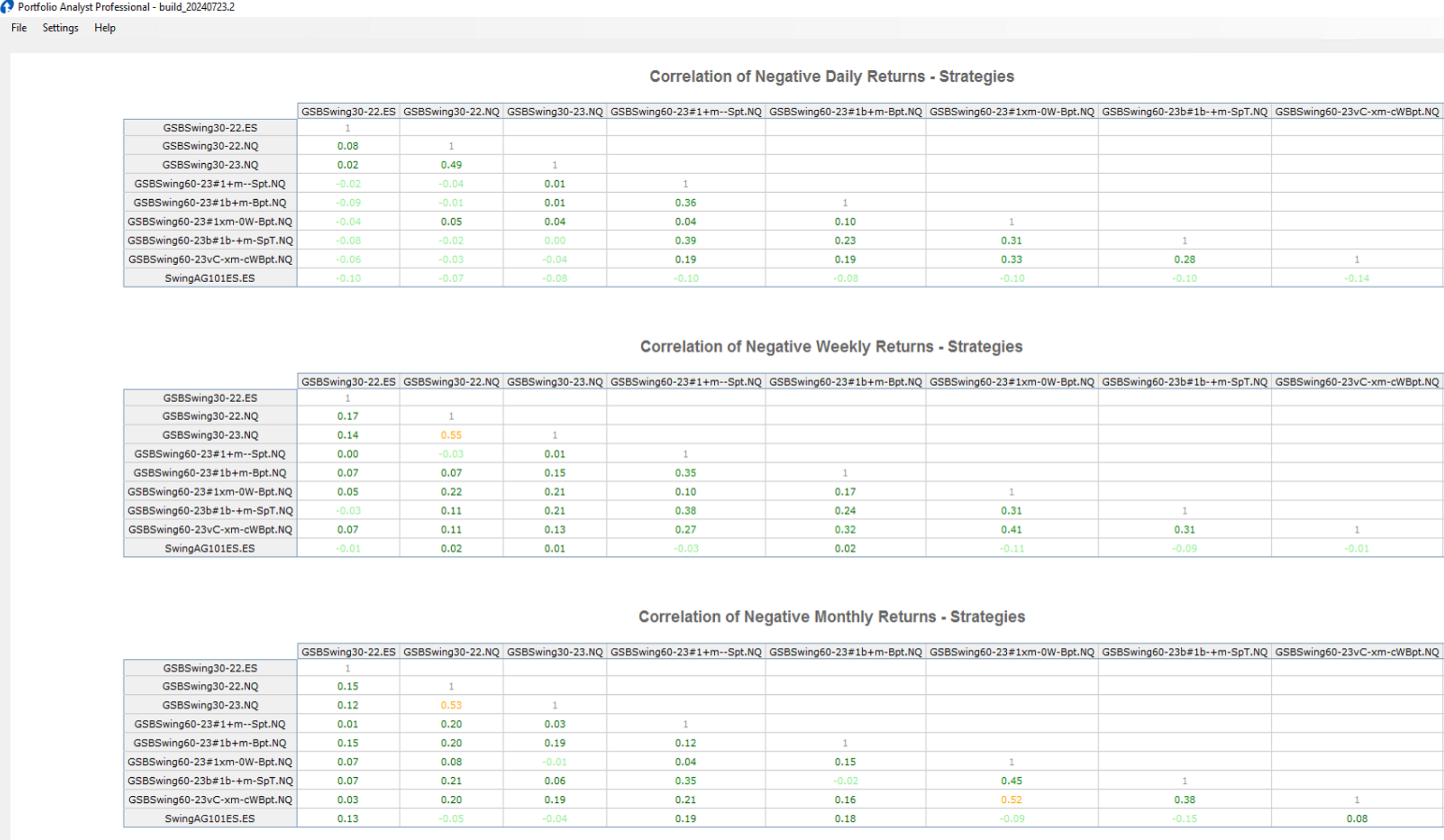

There are two NASDAQ variants with slightly different parameters and session time, and a S&P500 variants. The NASDAQ compared to S&P500 have loosing trade correlation of less than zero. (very good)

Markets trades

Capital $3600 per micro contract.

First release Oct 18 2023. Last change Aug 27 2024

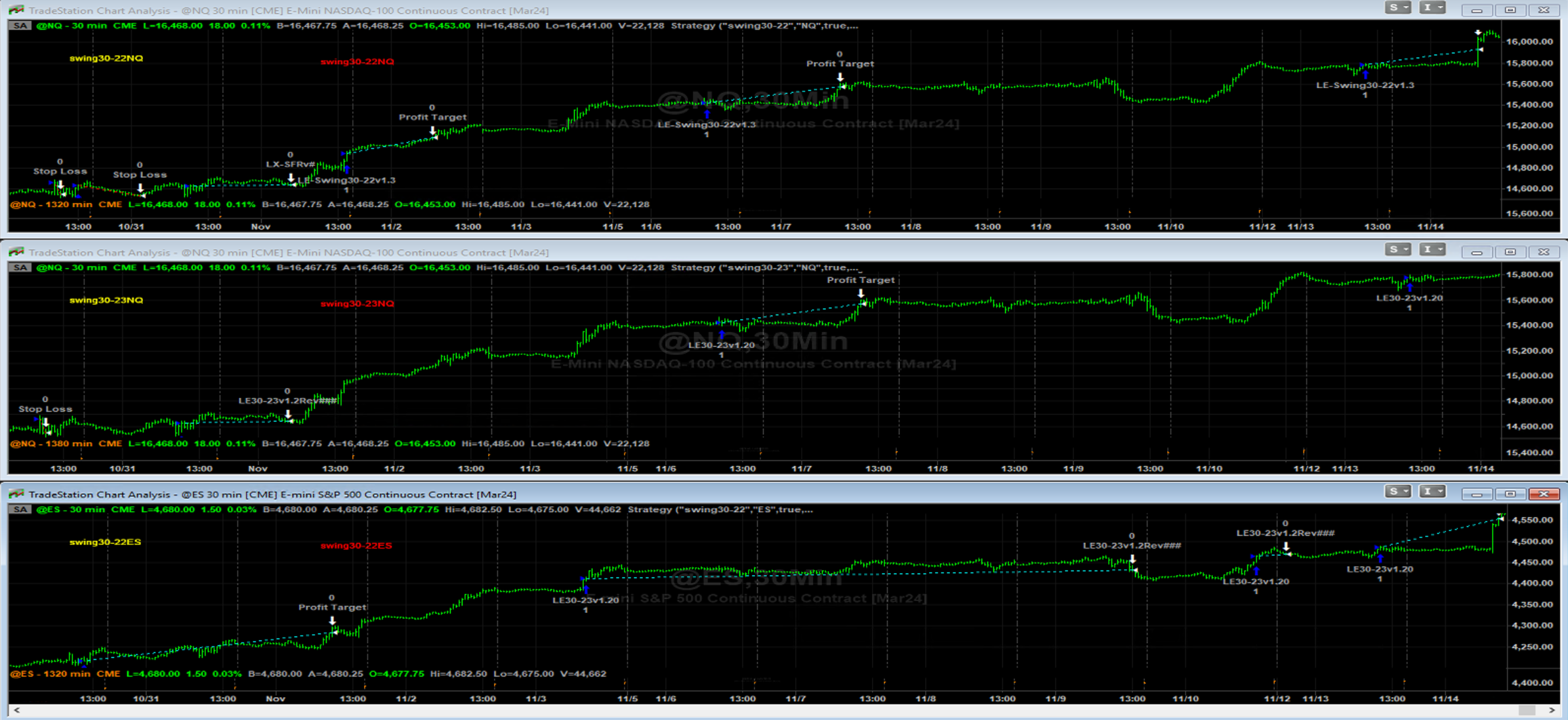

The chart below shows the differences and similarities trading over the same period.

The differences in results between the 3 systems are due to mild parameter / code changes, and 23 hour vs 22 hour a day session, and 2 Nasdaq systems compared to1 S&P 500 system.

System price is $500 for one system or $800 for all 3 systems.

These systems may also be traded at approved brokers.

GSBSwing30-22NQ

Swing30-22ES

GSBSwing30-23NQ

All 3 systems combined

GSBSwing30all.xml

DISCLAIMER

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.