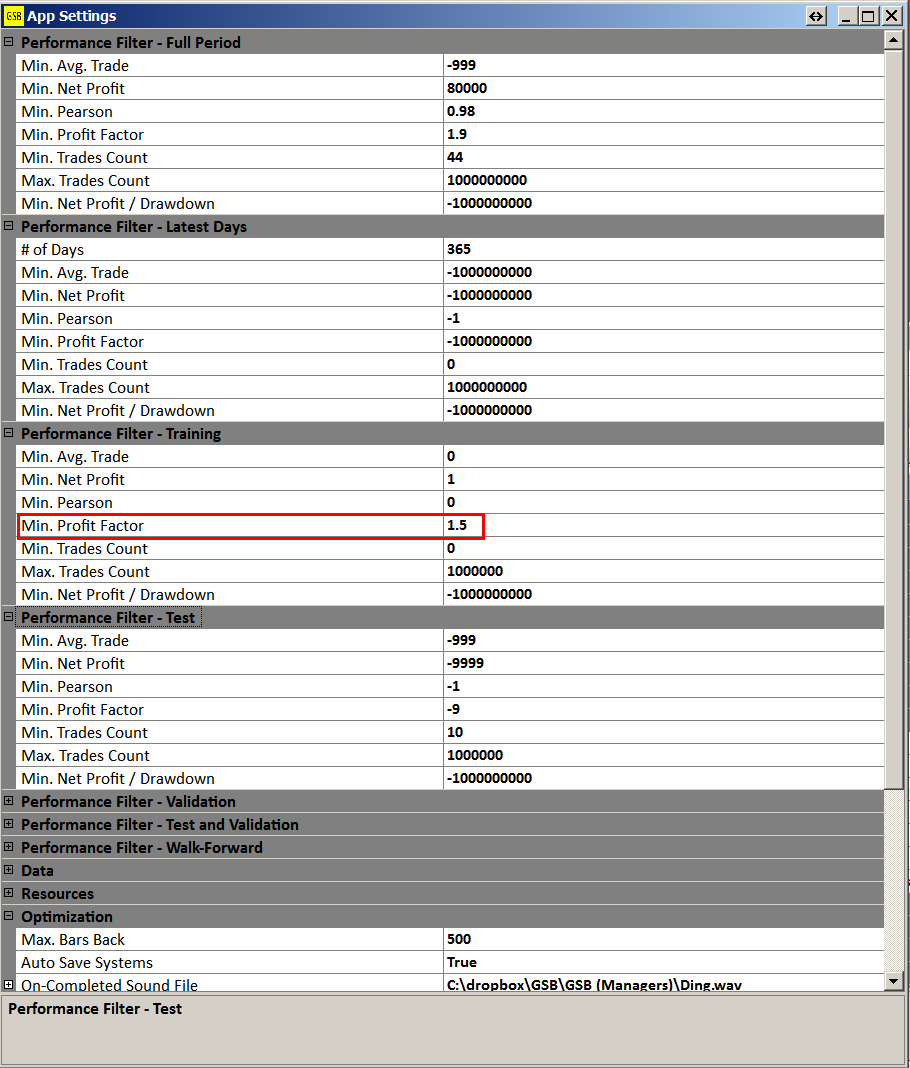

App Performance Filters

The most important setting here is Training.

It is recommend to start using GSB with profit factor 1.2 in the training period, and allow all other systems (good and bad) to pass. This will mean you get a real picture of what works out of sample, and the ratio of good and bad systems out of sample. For markets that GSB finds it easy to make systems on, IE S&P 500, increasing this to a higher value of 1.5 to 1.8 is good to do. If the PF value is too high, no systems might be produced.

Warning, searching for high PF leads to lower amount of trades in sample, and out of sample.

Lowering the amount of trades is very likely to decrease the out of sample results.

Latest days has been added so you could filter out any systems that make less than $x in the last year (or other period)

The feature is psychologically appealing, but in my limited tested actually will gave decreased out of sample results.

The various metrics are to filter out any systems that don't meet your chosen metrics.