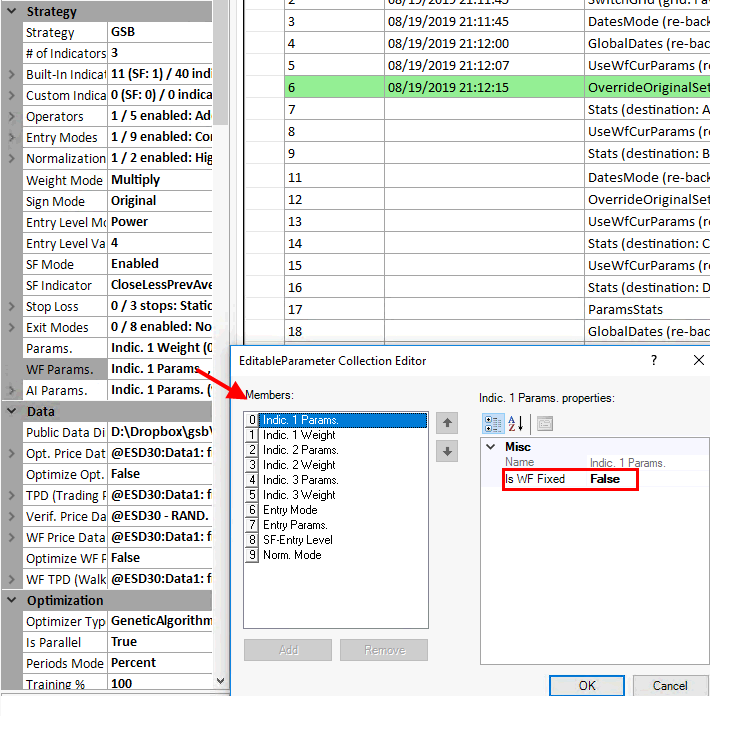

WF paramaters

New in version 54.81 is the ability to NOT walk forward any input.

This could be useful for example when you want to keep the secondary filter level at a fixed value.

For example the secondary filter value on S&P500 will typically be about 16 ($800 if BPV (Big point value) is used

This should be considered advanced material. It is not essential to know, but very good if you understand this.

The bottom line is newer users are just going to know, what works best on specific markets.

It will take time for the GSB community to test.

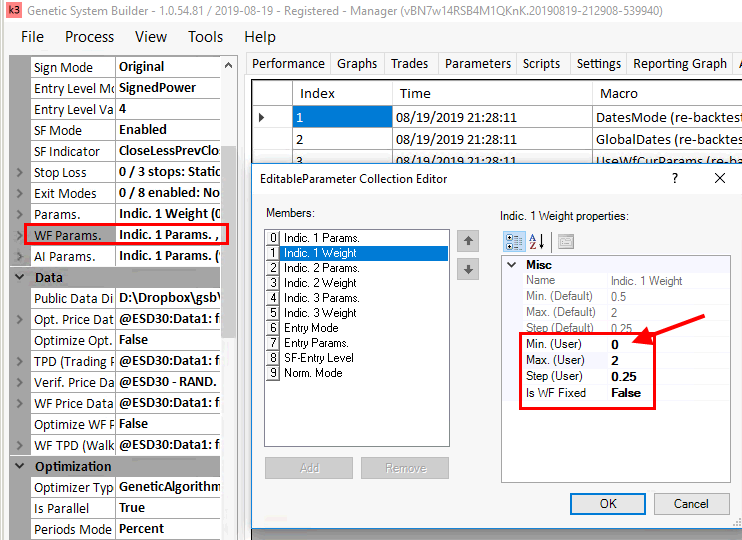

Note below how the min value of Indic. 1 Weight is 0.

This has significant implications.

Lets say we used result=indic1*weight1+indic2*weight2...

If a walk forward chose weight1 being zero, it tells us that we are better of without indicator1.

Indicator1 should be removed from your trading code as its redundant.

Here is another example

i1=signp(indicator1)^weight1.

i2=signp(indicator2)^weight2.

i3=signp(indicator3)^weight3.

Lets say we used result=i1*i2*i3

The signp(x) returns 1 for any value above 0, 0 for 0 and -1 for any value under 0

So if weight=0 is chosen, this simplifies to

result=signp(indic1)*indic2...

This is totally value and its even fine to build systems using signp with weight 0.

Here is another example

we use "+" operand and signp0

This simplifies to

i1=signp(indicator1)

i2=signp(indicator2)

i3=signp(indicator3)

result=i1+i1+i2+i3

If result >entrylevel then buy....

so we can now have a total of how many indicators are above or below zero.

(Zero happens but is rare)

So in this case result will be between -3 and 3

So you could optimize entrylevel from -3 to 2

This means we go long according to how many indicators are above zero.

Using signp of zero, also means we dont have to optimize weight values (though you could)

and that means use can use smaller walk forward generations / populations.