SwingDaily2-ES-YM-NQ-ER-DAX

Systems description

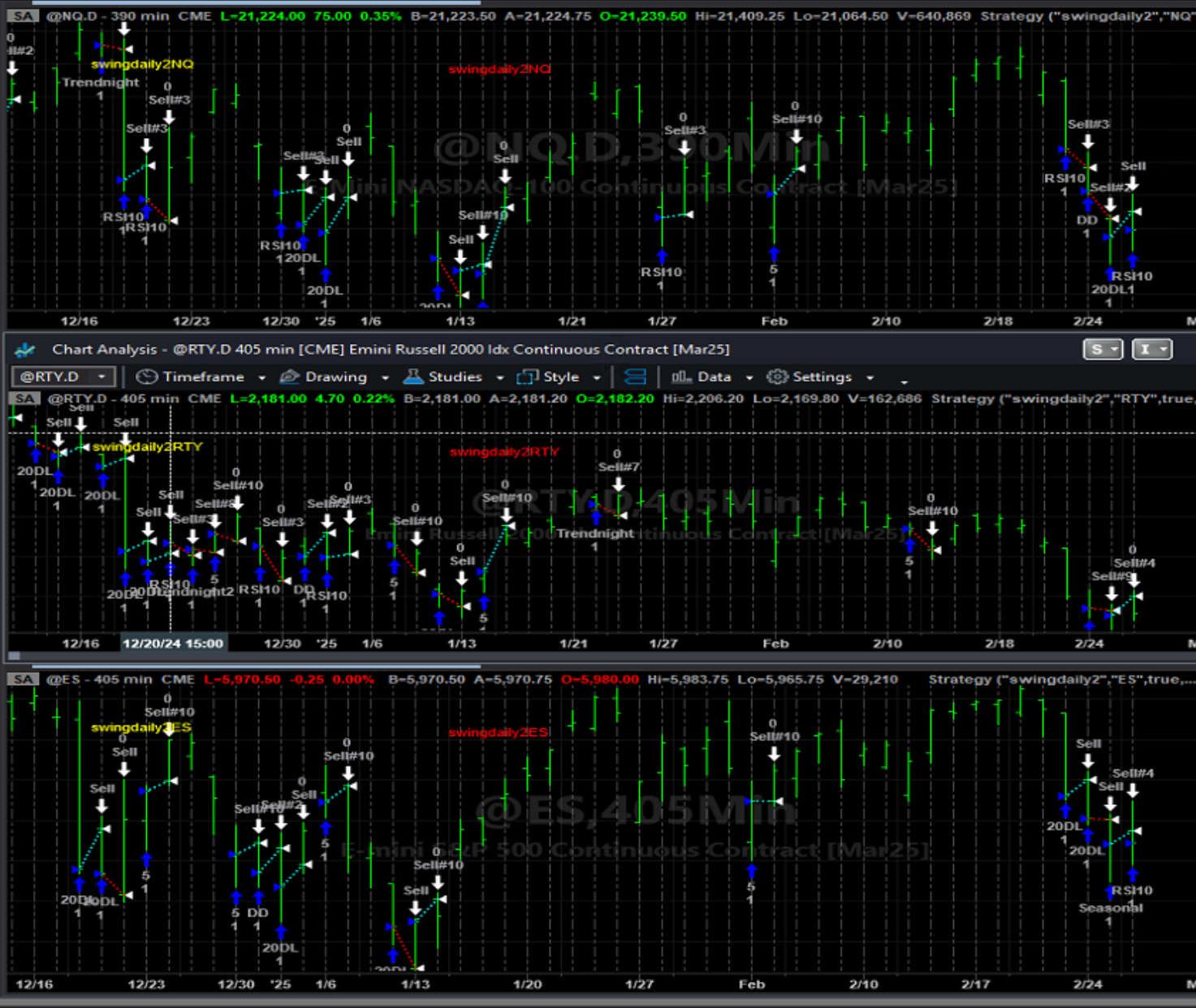

Swing Daily1 trades S&P500, Dow and Nasdaq, Russell 2000 futures with no changes in parameters,

while Swing Daily2 trades S&P500, Dow and Nasdaq, Russell 2000 futures optimized on each market.

The system is based on indicators, price patterns and seasonal market characteristics. There are some minor code changes between series 1 and series2.

The original logic is out of sample is 2006 to 2017-01-01, but optimized form 2006 to 2025-Feb \

out of sample for NQ,ES,YM is January 13 2025, RTY and Dax February 12 2025

Either the e mini or micro can be traded.

All trades are < 24 hours long, excluding weekends.

Trades enter long around market close and exit on the open of the next day.

All results are shown for the e mini contracts, but the micros can be used.

Recommended capital is 4 x max historical draw-down per system - not per portfolio. Observation is uses who aggressively use high leverage blow there accounts up over time.

Contract limits apply of 4 emini or micros per market to preserve market liquidity for all traders.

Results updated September 30 2025

Swing Daily2 ALL S&P500 (ES)+Nasdaq+mini Dow + Dax(full contract)

Systems can be traded on micros, but Emini shown for ES NQ TM RTY

Nasdaq Emini Futures

S&P 500 Emini Futures

Russell 2000 Emini Futures

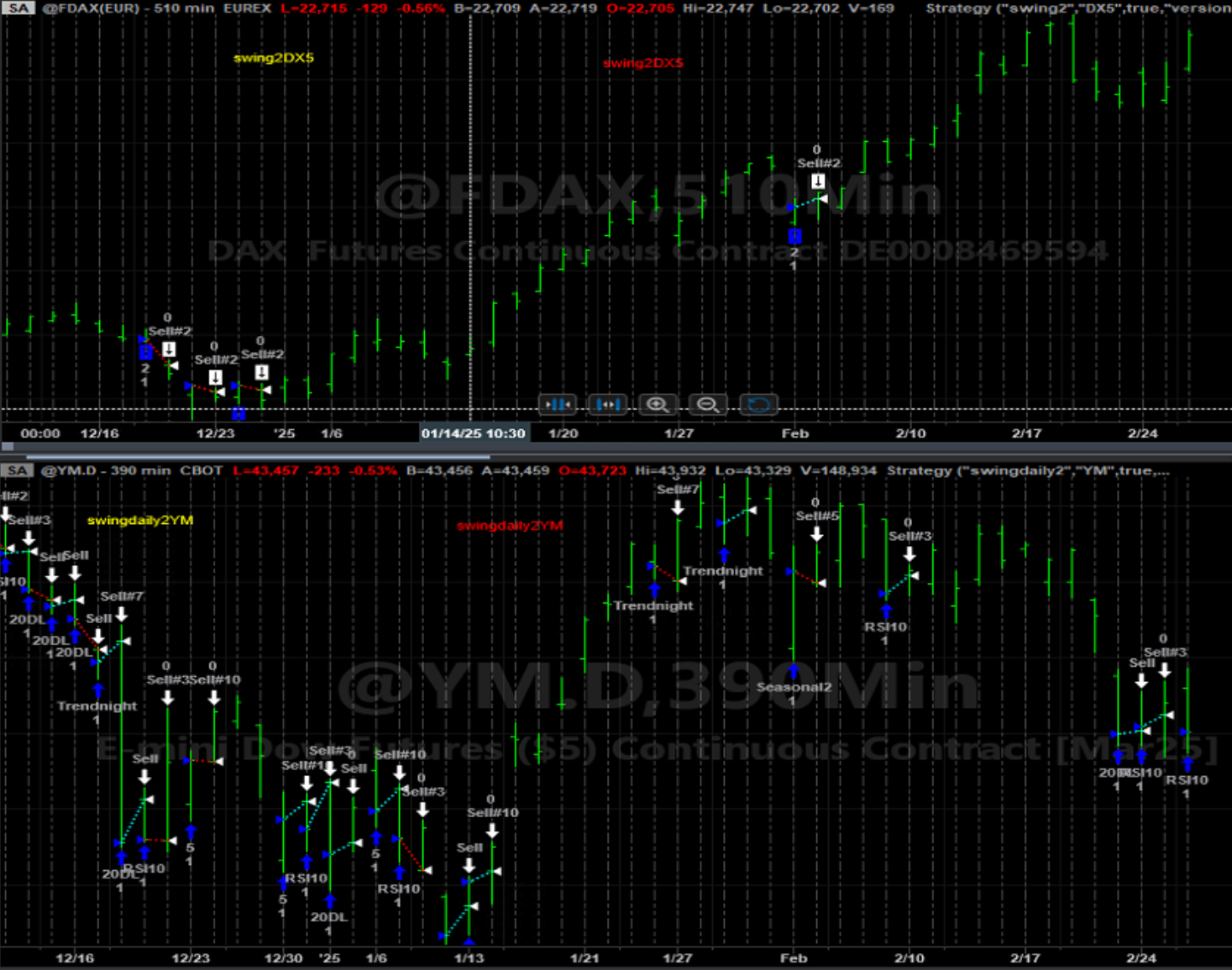

Dow Emini Futures

FDAX Full contract.

Results updated Sept 10 2025

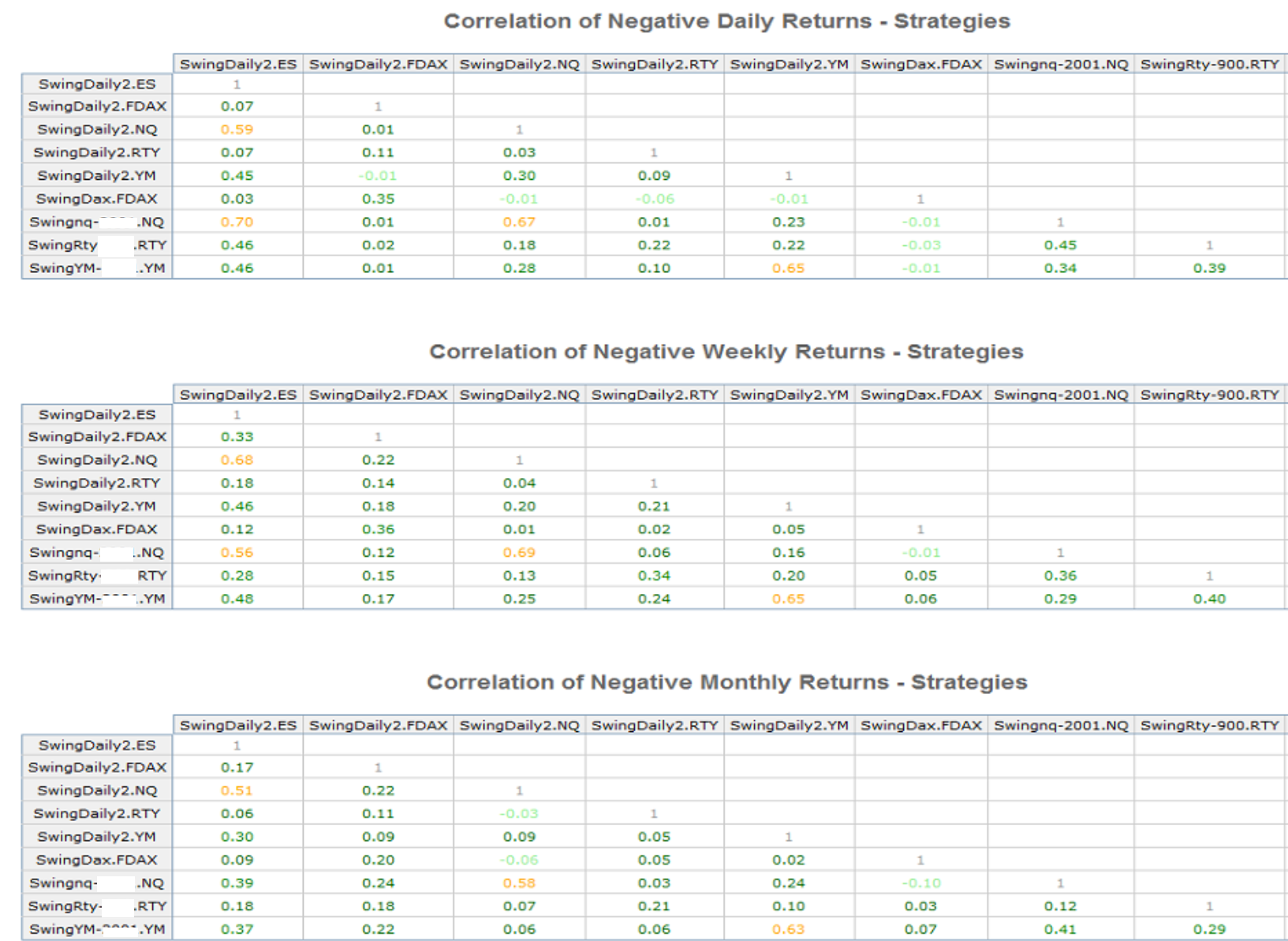

Correlation tables, data since 2006.1.1 onward.

As you can see, results over SwingDaily1 and SwingDaily2 systems vary greatly. If you have SwingDaily1 systems its recommend to trade series 1 and series2

Market performance since 2006.1.1 onward.

DISCLAIMER

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.