Pivot2NQES

Pivoit2NQES trades Nasdaq & S&P500 futures with zero changes to any parameters.

The system is NOT an upgrade from PivotESNQ and both sets of systems can be traded.

In sample date of system is 2009/01/01 - 2024/01/15.

The system is long only, all trades exit by 3PM Central USA time. The system can be traded on micros or Emini contracts.

Ob the NQ & ES system the stop used is $200 for micros, or $2000 per emini. It is optional to use $160 / $1600 stop for micro / Emini Nasdaq.

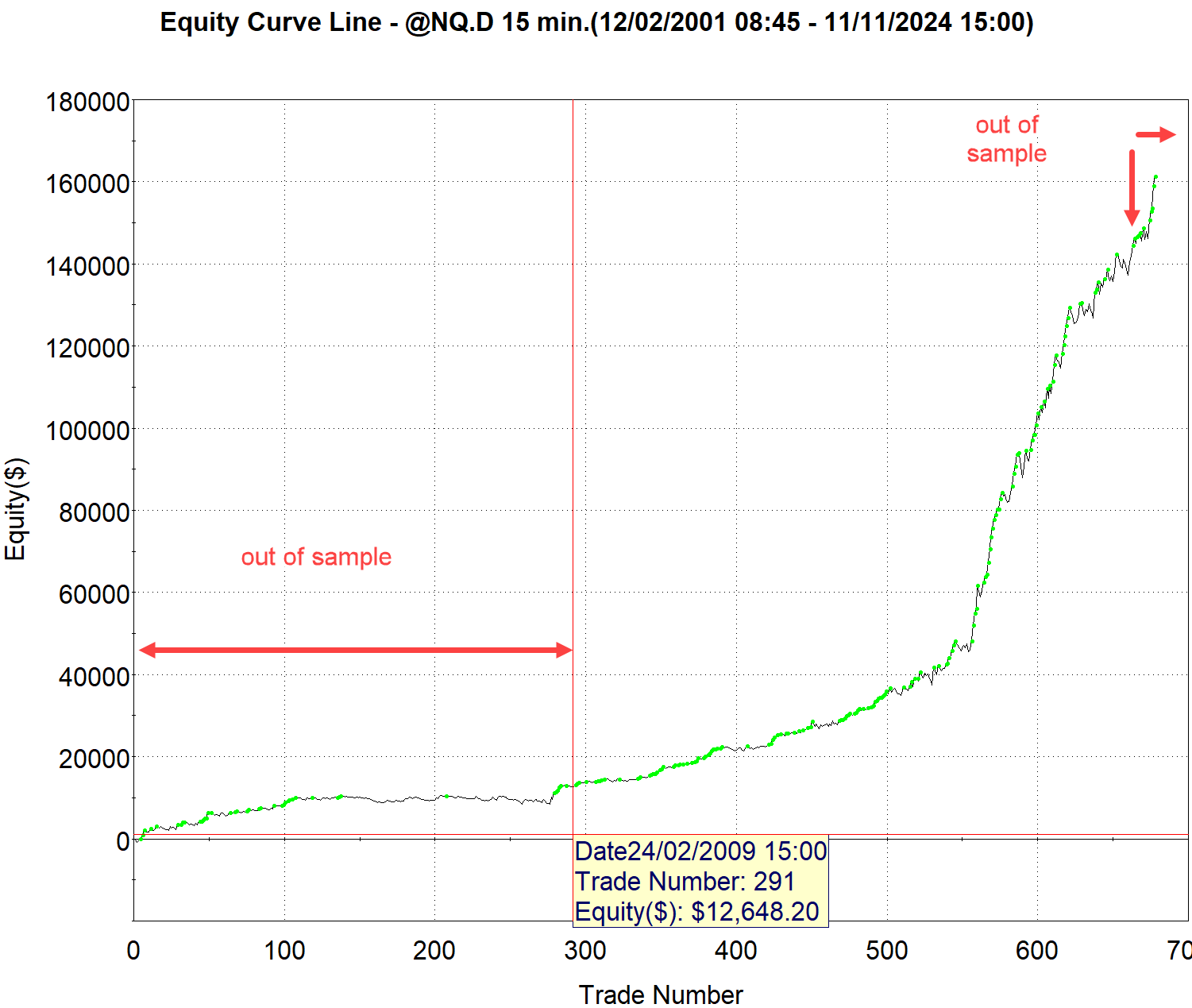

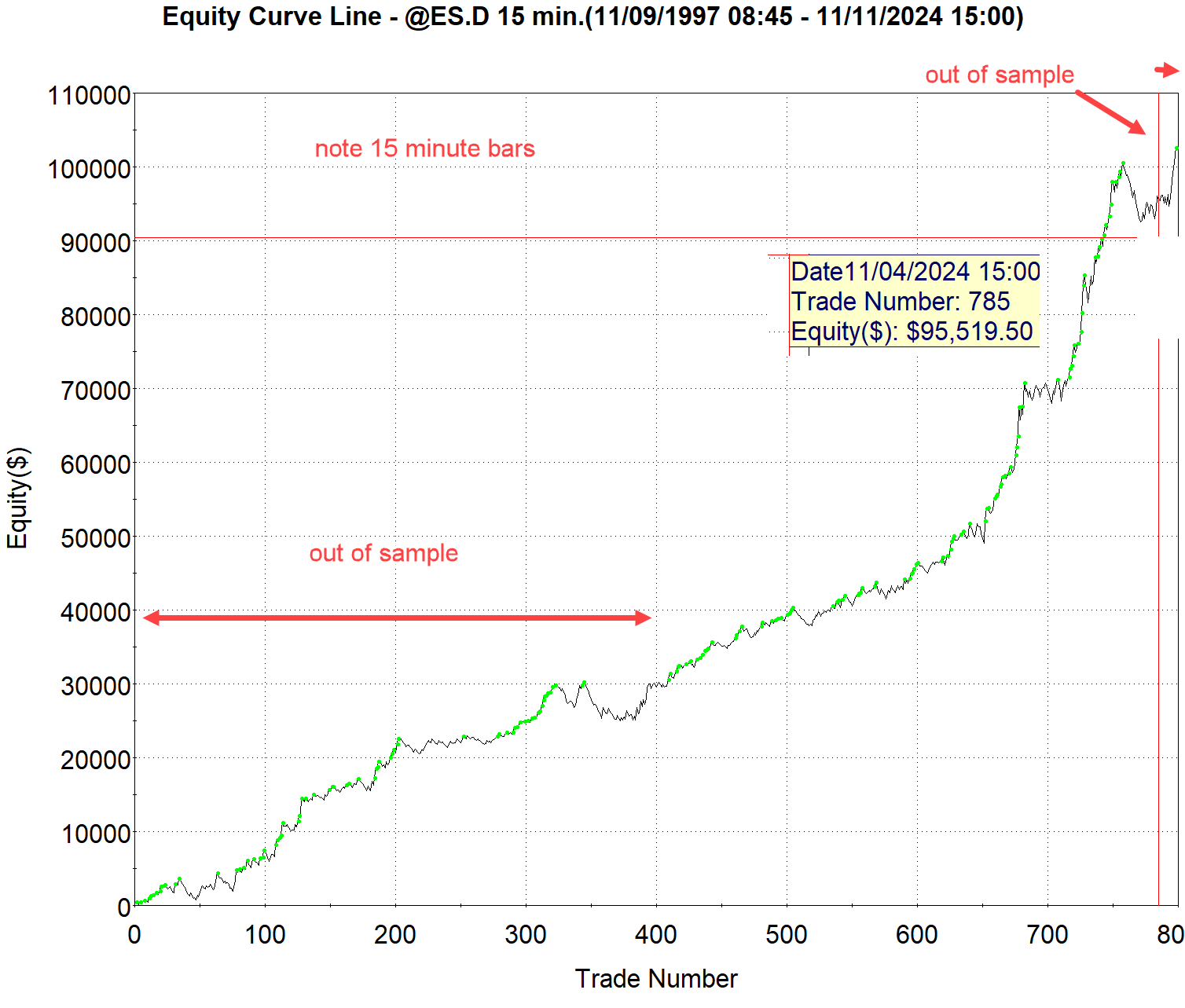

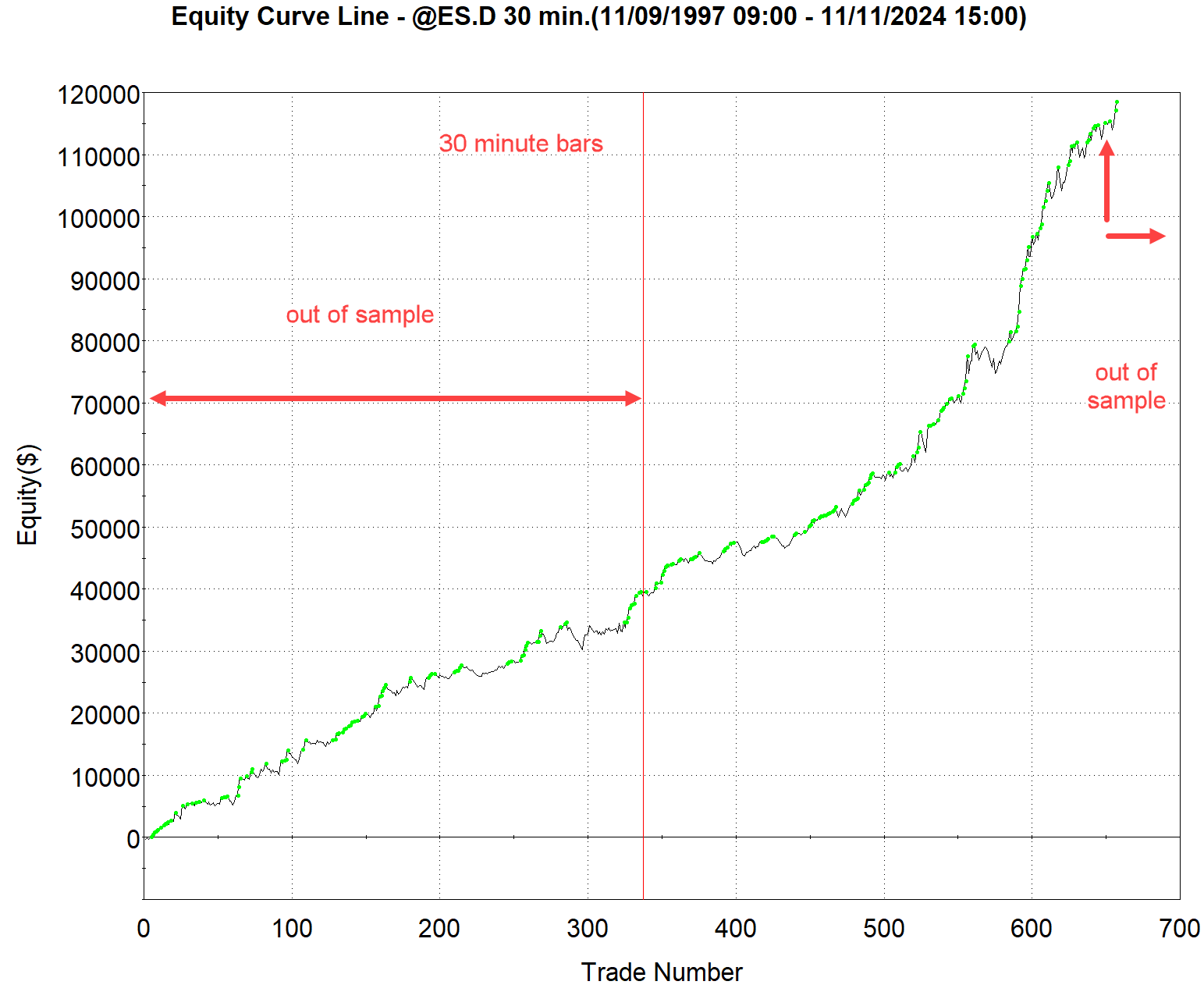

Graph is hypothetical and includes 1 tick slippage and $2.40 each side

below, Now the same code, zero changes in any parameters, also 15 minutes.

Below, the same code, zero changes in any parameters, but 30 minutes.

Pivot2NQES has had a removal of one piece of stop logic and speed improvements to code. (November 2024.)

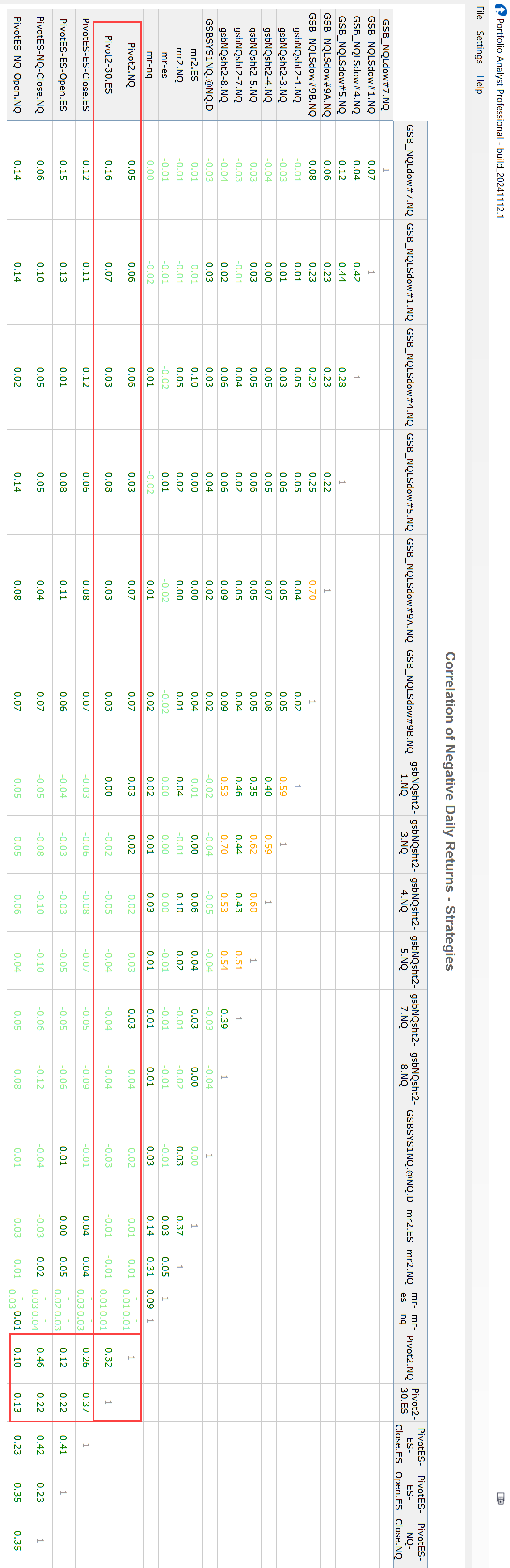

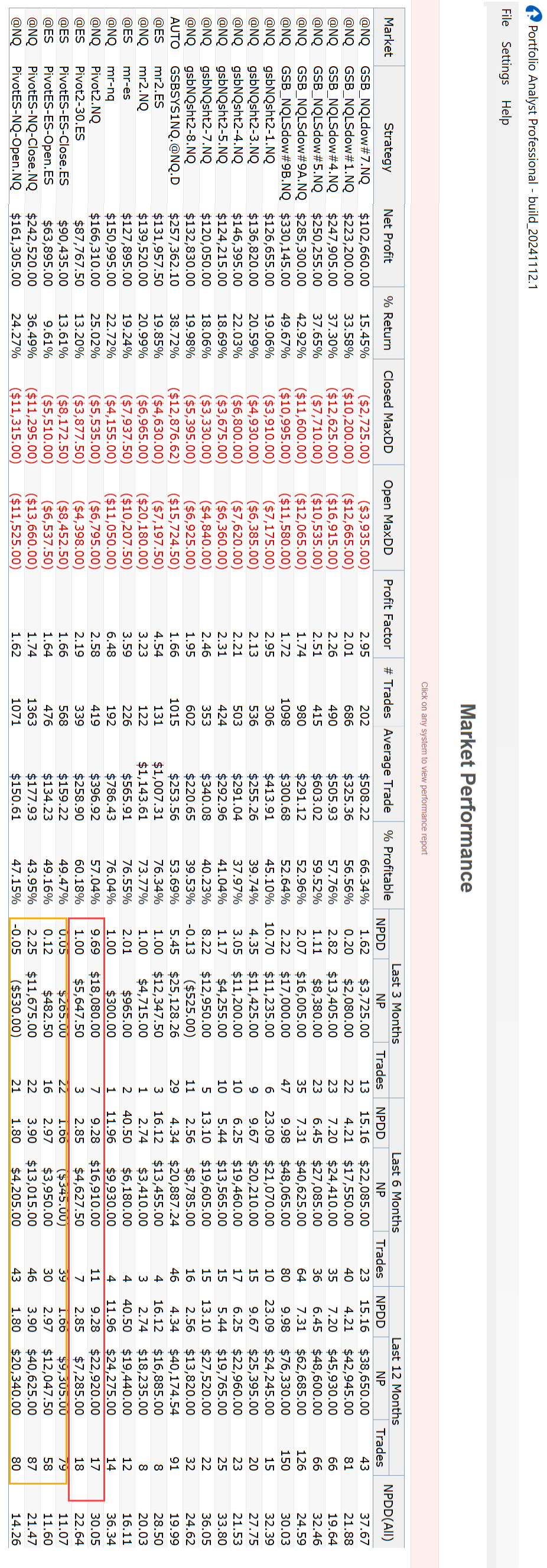

Comparison between the systems is as follows

TM_Pivot NQ1.01 15 np:190871 tum:752 ave: 253.82 pf: 2.22 dd:5193

TM_Pivot NQ1.00 15 np:173744 tum:742 ave: 234.16 pf: 2.10 dd:5659

TM_Pivot ES1.01 30 np:141925 tum:672 ave: 211.20 pf: 2.23 dd:5200

TM_Pivot ES1.00 30 np:128400 tum:657 ave: 195.43 pf: 2.15 dd:4238

Too make a valid comparison of Nasdaq to S&P500, 2008 start dates are used on all reports.

Pivot2NQ (report since 2008 not 2001)

Pivot2ES (report since 2008 not 1997)

Pivot2NQ&ES (report since 2008 not 2001)

Note how performance differs from pivot 1

DISCLAIMER

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.