GSB_NQLS-dowseries

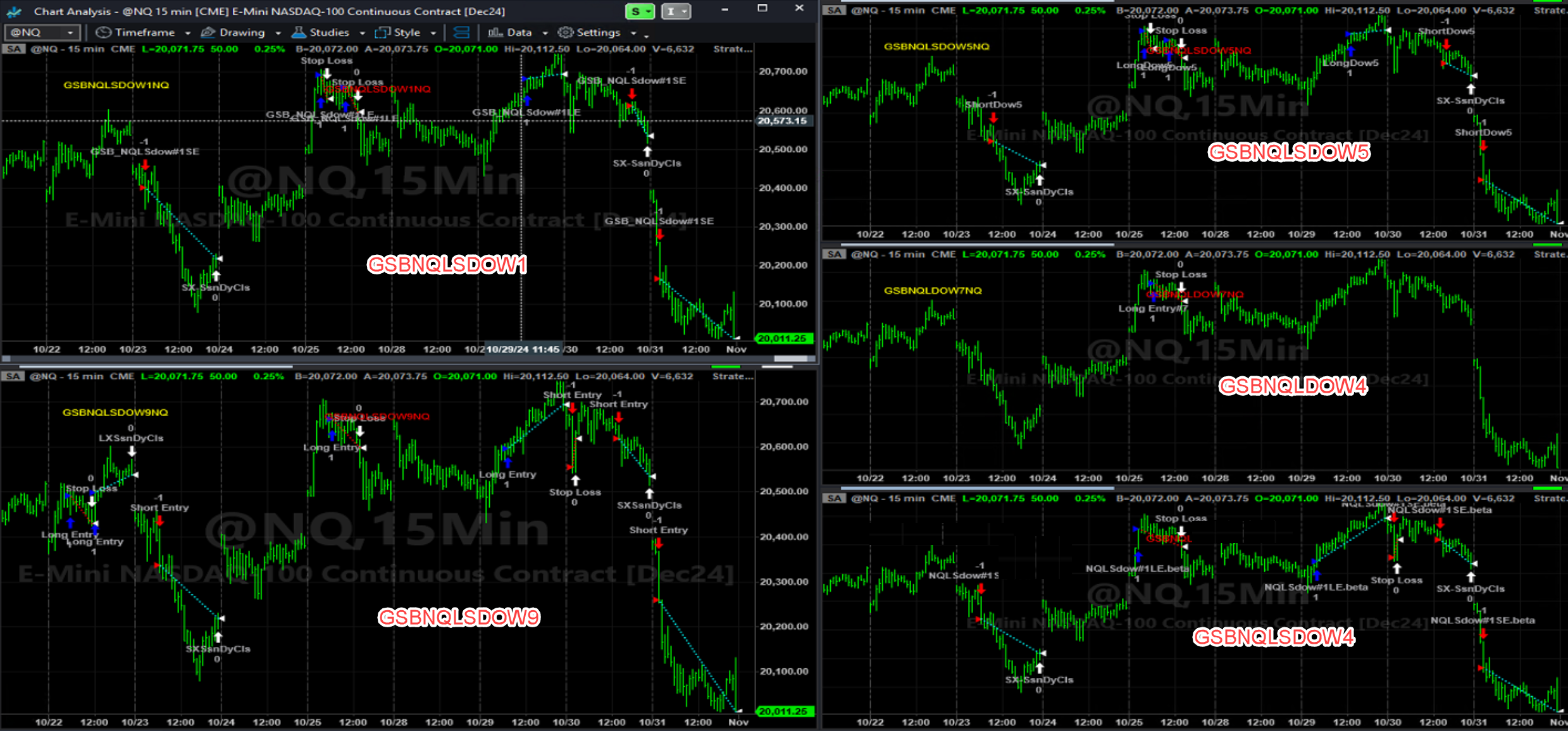

GSB long short systems were developed with day of week filters, that are the same across all systems.

The variation in the systems is primary due to different indicators and secondary filters between them.

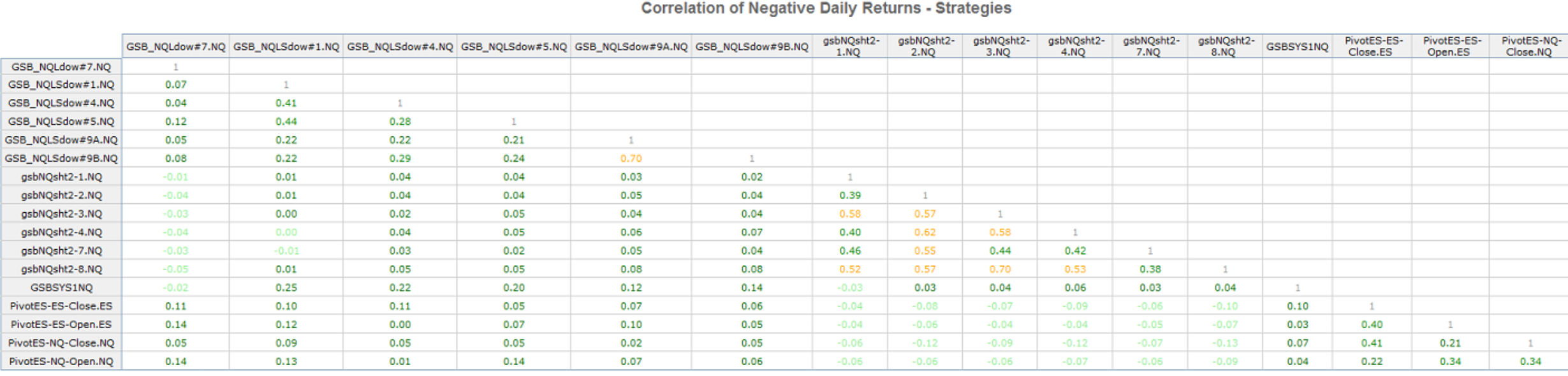

Correlation of loosing trades to earlier systems like GSBsys1NQ (the first GSB NQ system made in 2017) is near to zero.

Only GSB_NQLdow7NQ is long only. All others are long and short. All systems have a $1250 (emini) or $125 (micro) stop, and all systems exit at 3 PM exchange time unless the stop is hit.

Nasdaq futures day trading systems.

If you are only going to get a few systems - (not all of them) - then the recommend order to buy them is system 5 then, 9b, 4, 1, 7 9a. The order in which to get the systems is not a strong recommendation.

Early bird discount during November 2024 only. After this systems will be $500 each with small discount for bulk purchase.

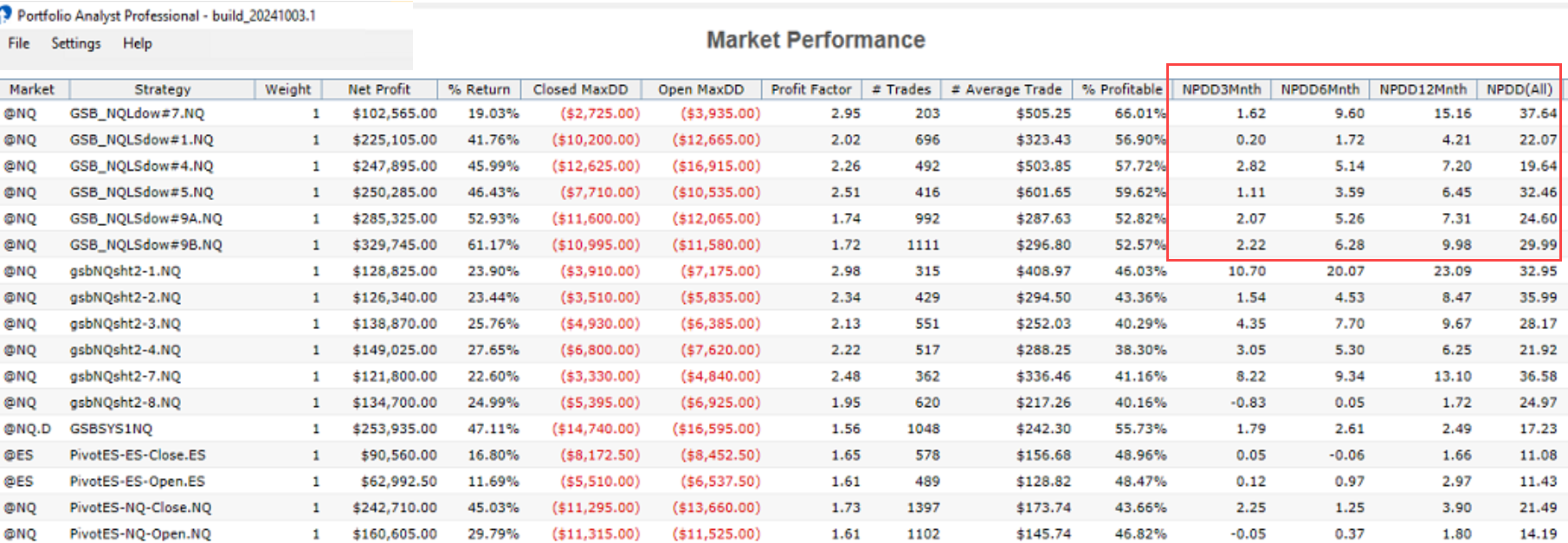

Note the variation in the Net profit / draw down figures in the red box below.

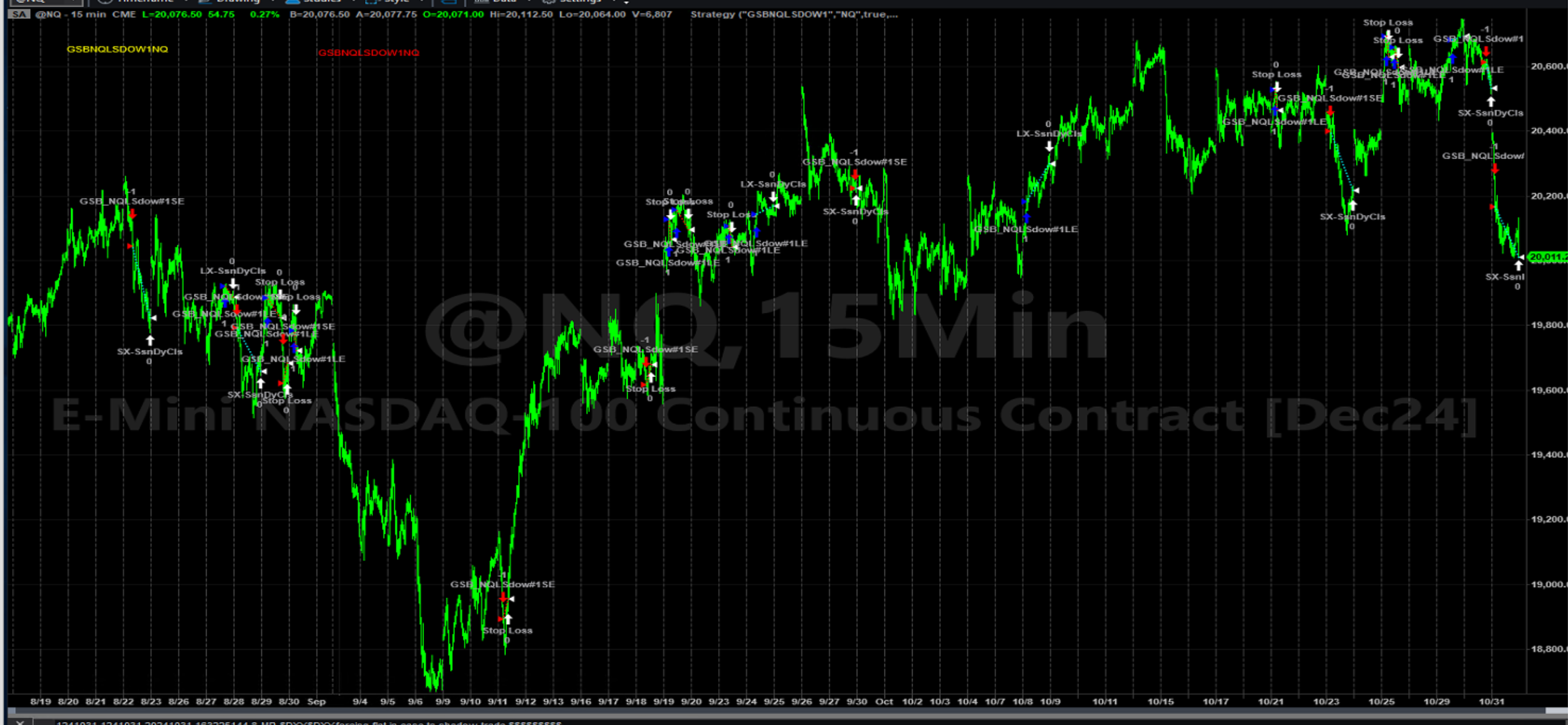

GSB_NQLSdow1NQ

GSB_NQLSdow1NQ

GSB_NQLSdow4

GSB_NQLSdow5

GSB_NQLdow7

GSB_NQLSdow9A

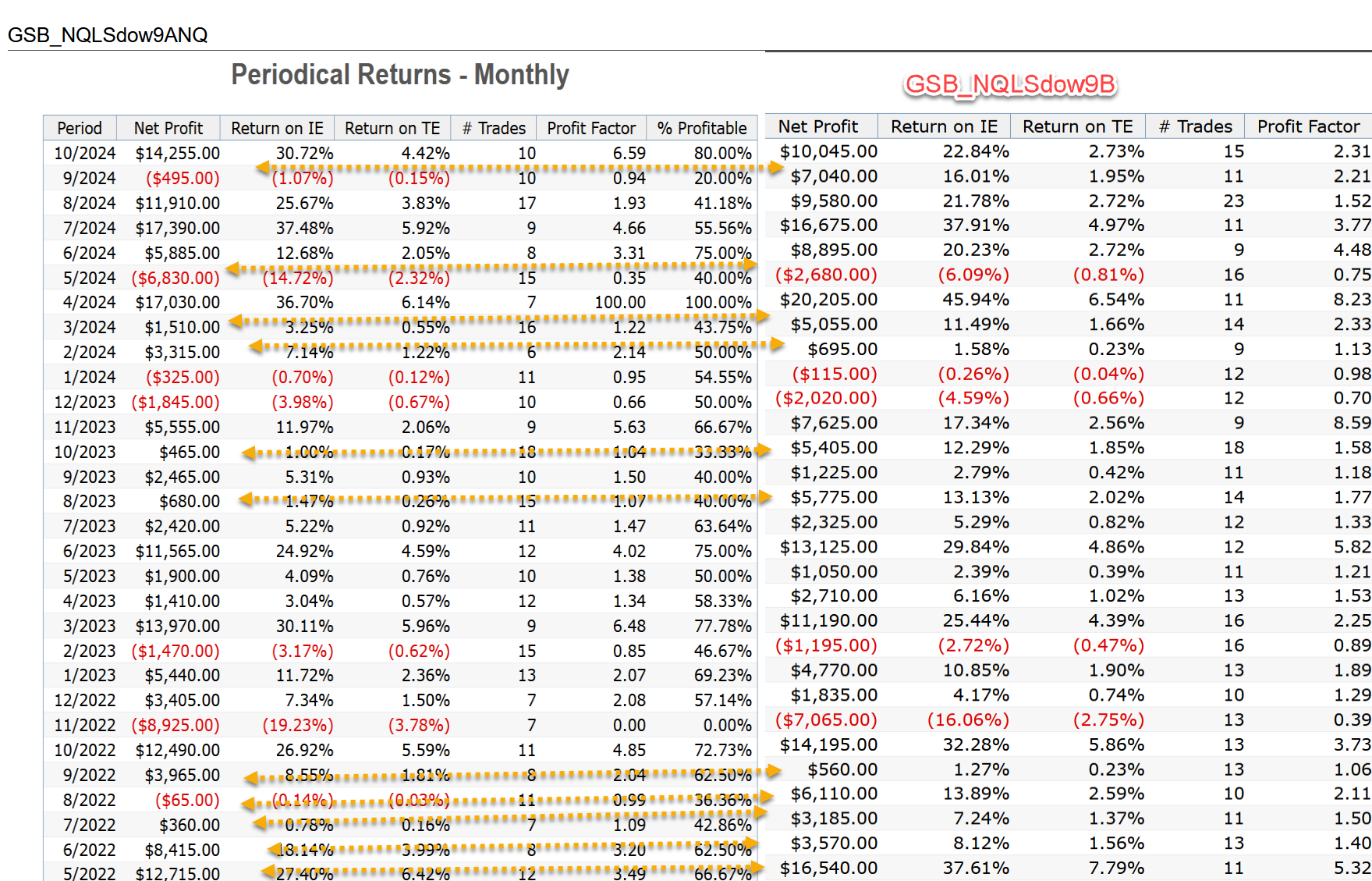

System9 A & B are variations of the same system. I recommend from a position size to treat the combination of the 2 systems as one system.

IE lets say you have 10 contracts over these 6 systems. You could do 2 contracts on all systems, but 1 contract on 9a and one contract on 9b

There is often very significant difference in monthly results, even though these systems are significantly correlated (0.70) in loosing trades.

GSB_NQLSdow9A

GSB_NQLSdow9B

GSB_NQLSdow all systems

The loosing trade correlation table shows systems have loosing trade correlation of between 0.02 to .42 (excluding the sister systems GSBLSdow9A&9B

correlation also to the pivot NQ ES series and GSB sys1NQ varies from small negative to small positive.

DISCLAIMER

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.