GSBSWING60-23NQ

GSBSWING60-23#1NQ Results updated September 30 2025

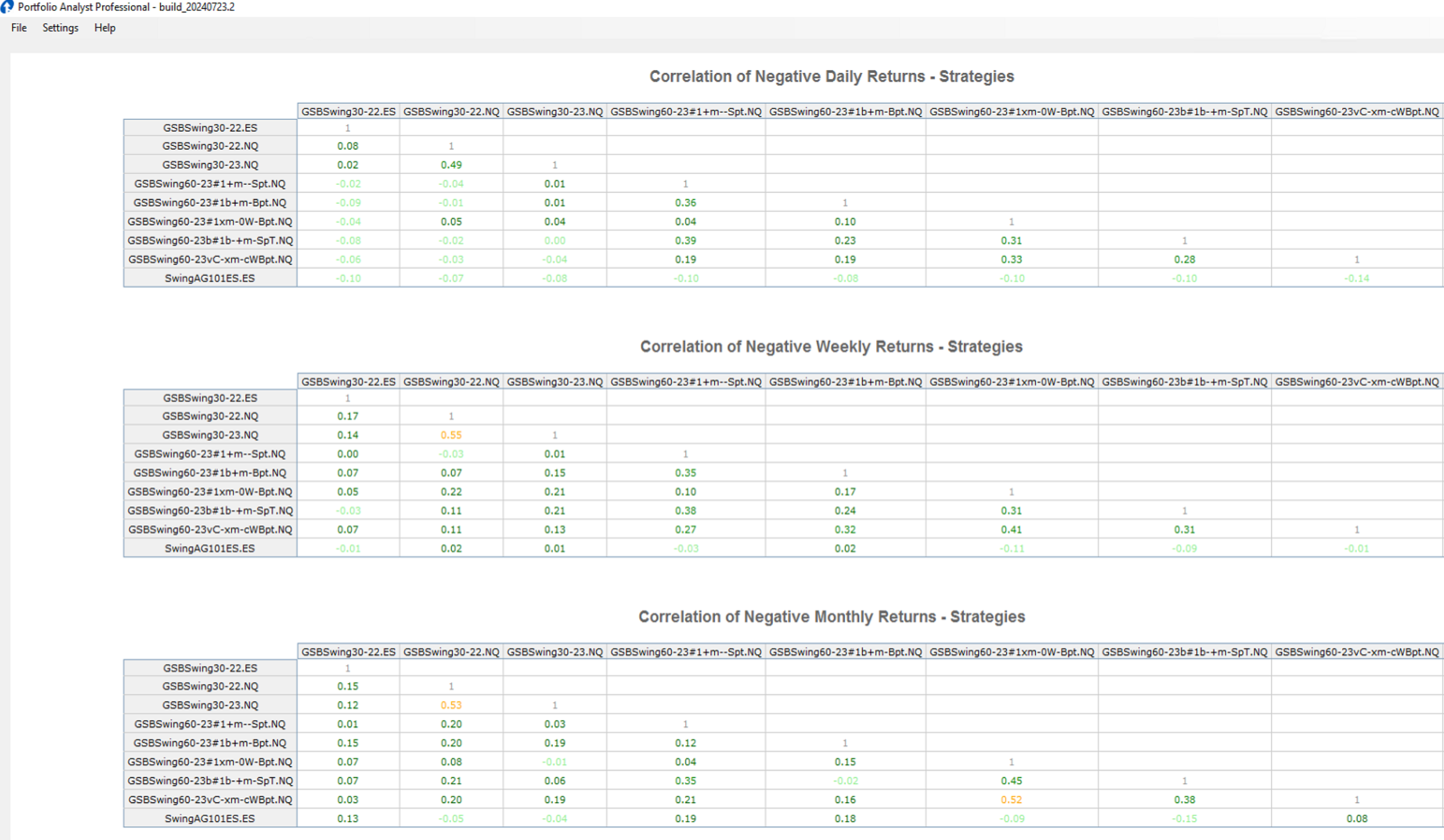

There are 5 variants of this system, which leads to greater diversity in results.

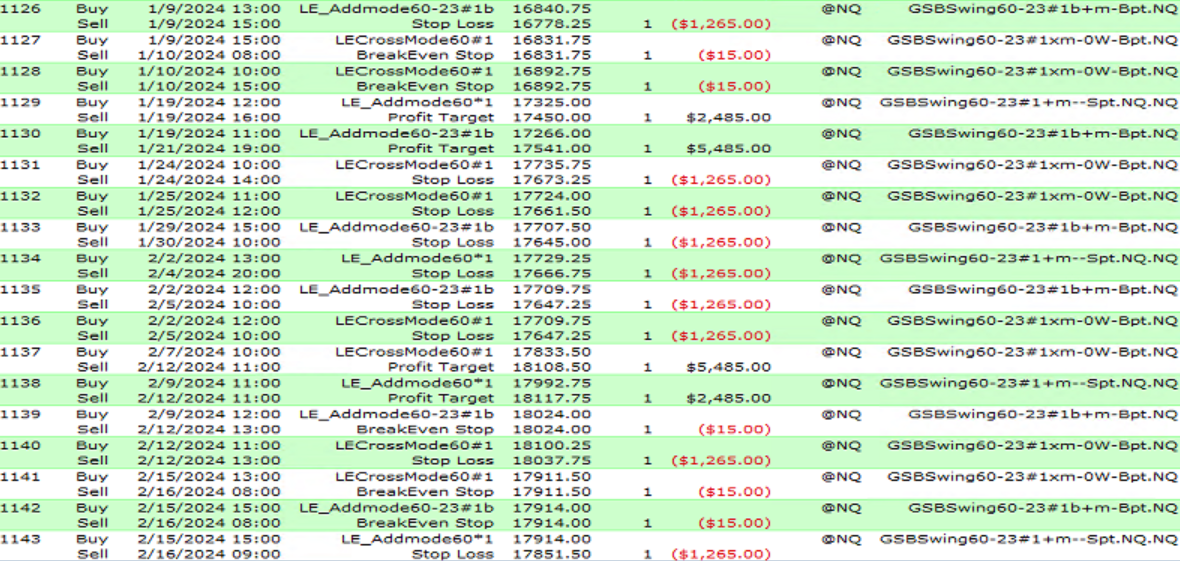

The most significant difference is a large profit target (Approx $5500 per Emini) and a break even stop

or a small $2500 profit target with out a break even stop.

These systems have a very low or even negative correlation to the GSBSwing30NQ series.

The systems trade 23 hours a day and Sunday night - giving you the opportunity to get moves when-ever the market is open, and also to exit any time the market is open.

This system has 3 indicators, and all variants use the same lengths on all indicators.

Differences between variants are just in the exits, time of day logic and logic how the 3 indicators results are used.

Systems naming convention is that systems that end in Spt have a 2500 profit target. Systems that end in BP have a larger profit target.

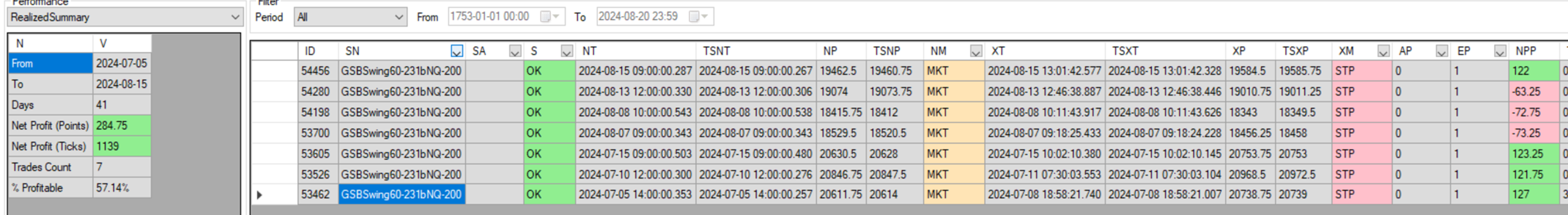

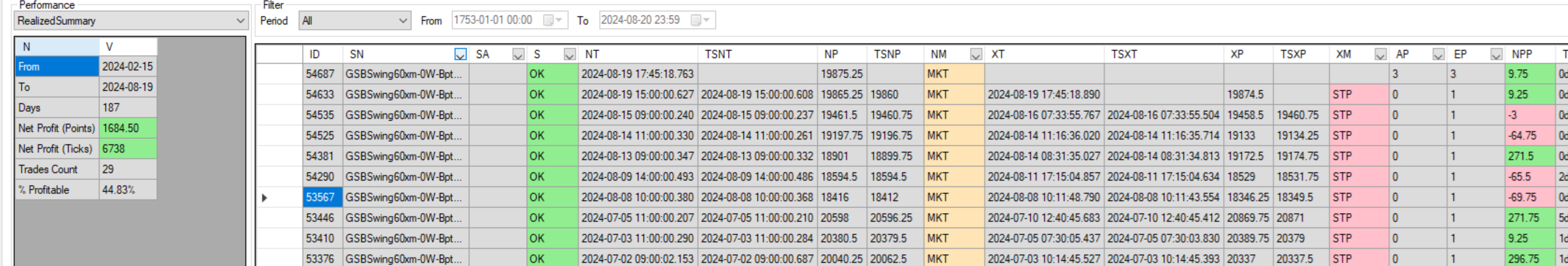

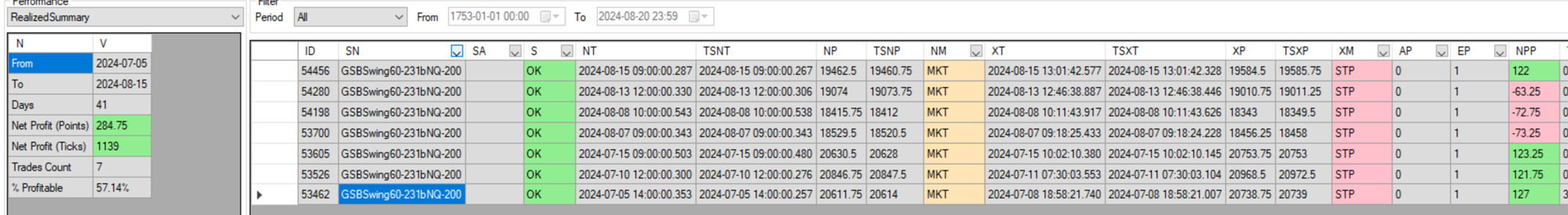

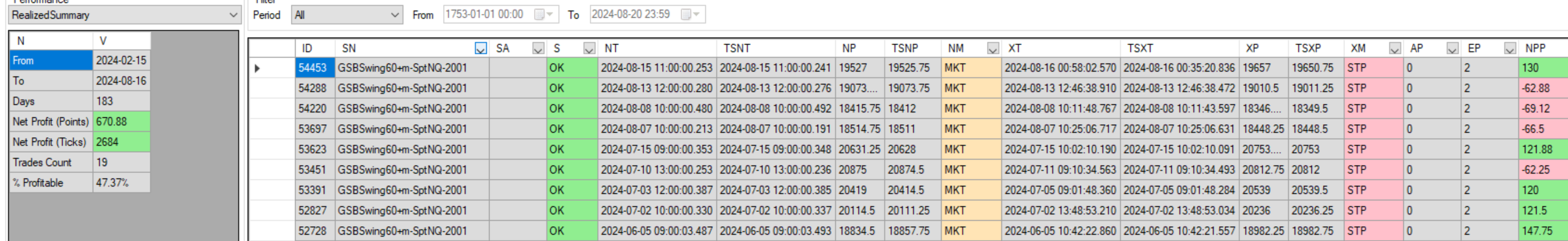

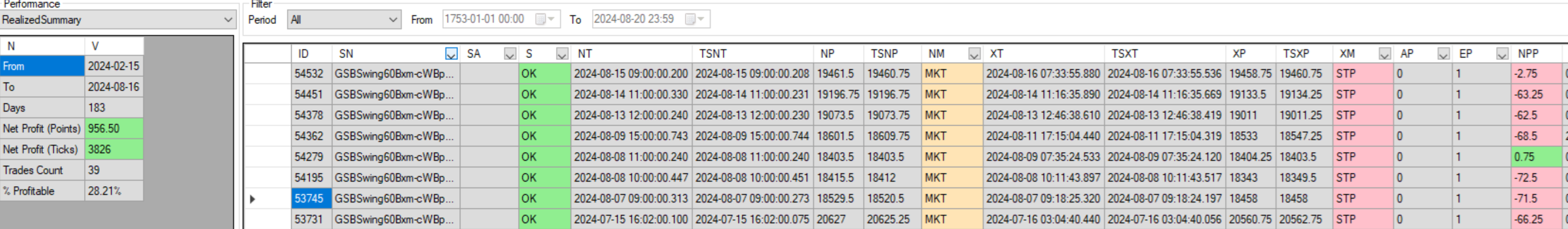

Live track record 20240215 to 20240819. Note not all systems were traded in the earlier part of this period

GSBSwing60-23#1b+m-BptNQ ($5500 Profit target)

Included in $699 bundle and $899 bundle.

GSBSwing60-23#1b+m-SptNQ ($2500 Profit target)

Included in $699 bundle and $899 bundle.

GSBSwing60-23vC-xm-cWBpt.NQ ($5250 Profit target)

Included in $899 bundle.

GSBSwing60-23-1xm-0W-Bpt.NQ ($5500 Profit target)

Included in $899 bundle.

GSBSwing60-23-1+m--Spt.NQ ($2500 Profit target)

Included in $899 bundle.

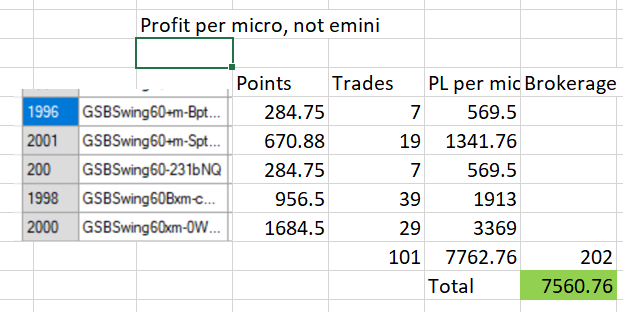

All 5 systems combined

Trade list of 3 of the 5 systems.

DISCLAIMER

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.