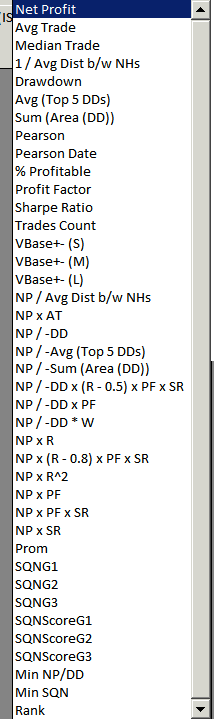

Fitness types

The following fitness types, and combinations of them with any weighting you chose can be used.

I prefer the following.

Net profit, Net profit * ave trade, NP/DD * ave trade, Net profit/max 5 draw-downs * average trade, NP/-DD*(R-0.5)*PF*SR

Most fitness are common terms in trading, with the exceptions below.

Tradestation fitness is NP / DD * W

It calculates the Net Profit * NumWinTrades / AbsValue (Max. {Intraday} Draw-down).

Note Tradestation uses Intra day draw-down, but Tradestation WFO uses closed draw-down.

EWFO can use either. Better Trader Academy users are recommend to be consistent with WFO, and used close draw-down.

Pearson's (abbreviated to / R) is Pearson's correlation to a straight line on the equity curve.

The x axis is trade number. A perfect score would be 1.00

Pearson's date, is the as above, but the x axis is date rather than trade number.

Vbase+- is volatility based fitness. Fitness is adjusted according to the range of the market.

S is short range, M is medium range, and L is large range.

NP/-sum(area(DD)) is Netprofit / - sum of the area of the draw-down graph.

NP/-DD*(R-0.5)*PF*SR is Netprofit/draw-down *(Pearson's (see above))-0.5 * profit factor * sharpe ratio.

SQN is System quality number by Van K Tharp. This is disabled by default as its extremely CPU time consuming. This will increase your walk-forward times by 3.

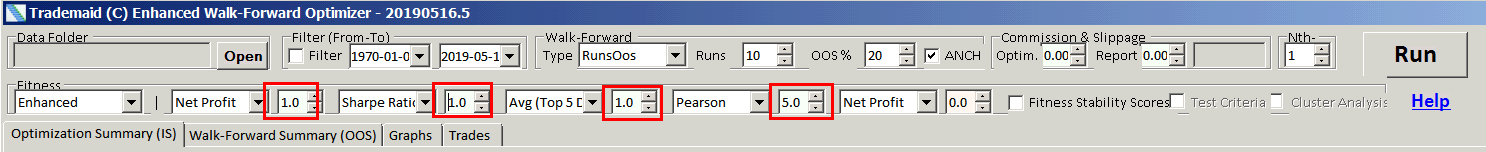

Fitness weighting

More weight can be applied to any one fitness. To have less weight, use weight <1.0

For example if you want more trades at the expense of average trade, net profit(1), AverageTrade(0.5) will give more trades with less average trade than net profit(1), AverageTrade(1)

Note also Fitness Netprofit 1 Averagetrade 1 is not always the same as Fitness NP*AT

The reason for this is when > 1 fitness is used, the fitness values are normalized.