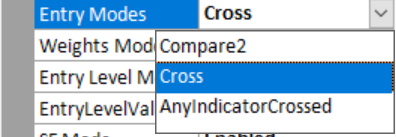

Entry modes

Entry Modes

There are 3 entry modes for trial users.

Beta testers may use CrossoversingleLevel but this is not recommend.

What entry type works best varies with each market.

Note if crossover single level is used, the entry level values should be very small. For example -2 to 2 step 0.25.

What crossover single level in effect does is change the bias a little to long or short.

The best entry modes are Compare2, Cross, AnyIndicatorsCross. It is not recommend to try other entry types.

For Nasdaq & S&P500 futures, AIC is the best entry type.

AIC description

If any indicator crosses > 0 then buy

If any indicator crosses < 0 then Sell short

NCC description (No conflict cross)

If any indicator crosses > 0 and no indicators cross below 0 then buy

If any indicator crosses < 0 and no indicators cross above 0 then Sell short

Compare1 description

If result > entrylevel then buy....

If result < entrylevel then Sell short

Compare2 description

If result > entryLevel And result[1] > entryLevel then buy

If result < entryLevel And result[1] < entryLevel then sell

crossSingleLevel description

The over simplified code looks like this for crossSingleLevel.

if result crossesover>Entrylevel then buy {Enter long}

if result crossesover<Entrylevel then Sell {Enter short}

The original crossover code (not single level) was

if result crossesover> Entrylevel then buy {Enter long}

if result crossesover<-Entrylevel then Sell {Enter short}

The over simplified code looks like this for crossDualLevel.

if result crossesover> Entrylevel1 then buy {Enter long}

if result crossesover<-Entrylevel2 then Sell {Enter short}

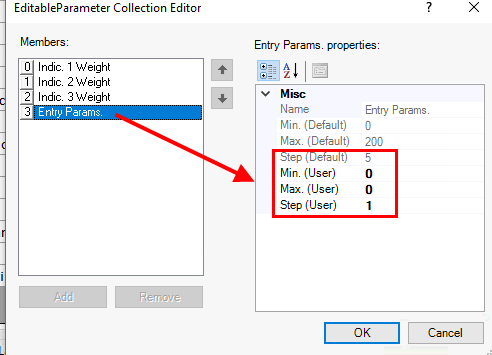

It is important to know that AnyIndicatorsCrossed, NoConlictsCross cross do not use the Entrylevel variable or weights.

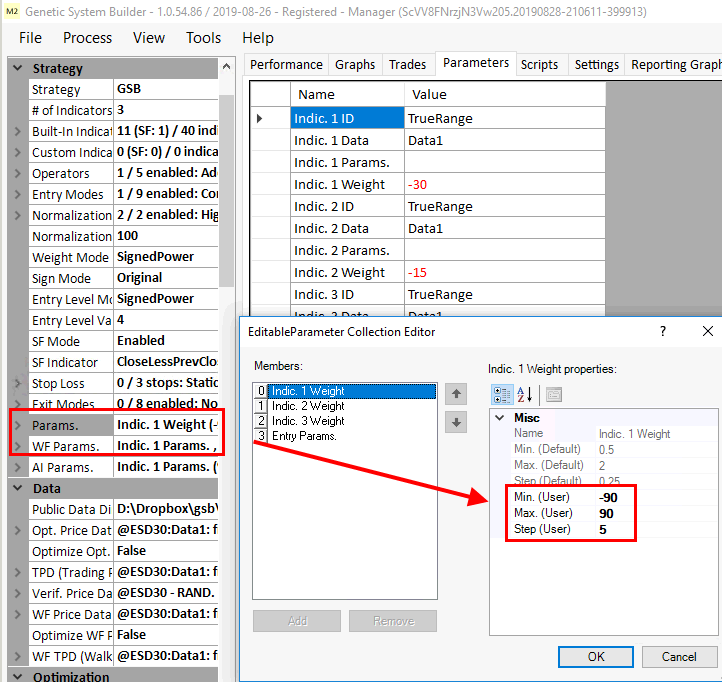

This means it should not be optimized. parameters / Weights and WF parameters should also be changed to use -90 to 90 step 5