Articles Part1. How often do you need to re-optimize trading systems?

How often do you need to re-optimize trading systems?

Part 1. One of my oldest systems. RC2DAX

The following articles are to come at the near future..

Part 2. How did I choose the parameters?

Part 3. The evidence of GSBSY1ES, now > 3 years out of sample.

Part 4. Walk forward, should we use it? If so anchored or rolling?

How often your need to re-optimize trading systems is a controversial topic and my own opinion somewhat disagrees with some traders who have more experience and knowledge than myself.

However the correct answer might vary with the architecture of the trading system, or the market traded.

Regardless there is not one universal answer that traders agree on.

My own opinion is based on mainly GSB systems, and mainly day trading USA / German futures markets.

These assumptions of systems, architecture, markets , time frames might be very significant to my end conclusion. What I am saying is that a different system architecture, or time frame / market(s) MIGHT lead to different conclusions.

Lets look at my evidence of why I hold to this opinion.

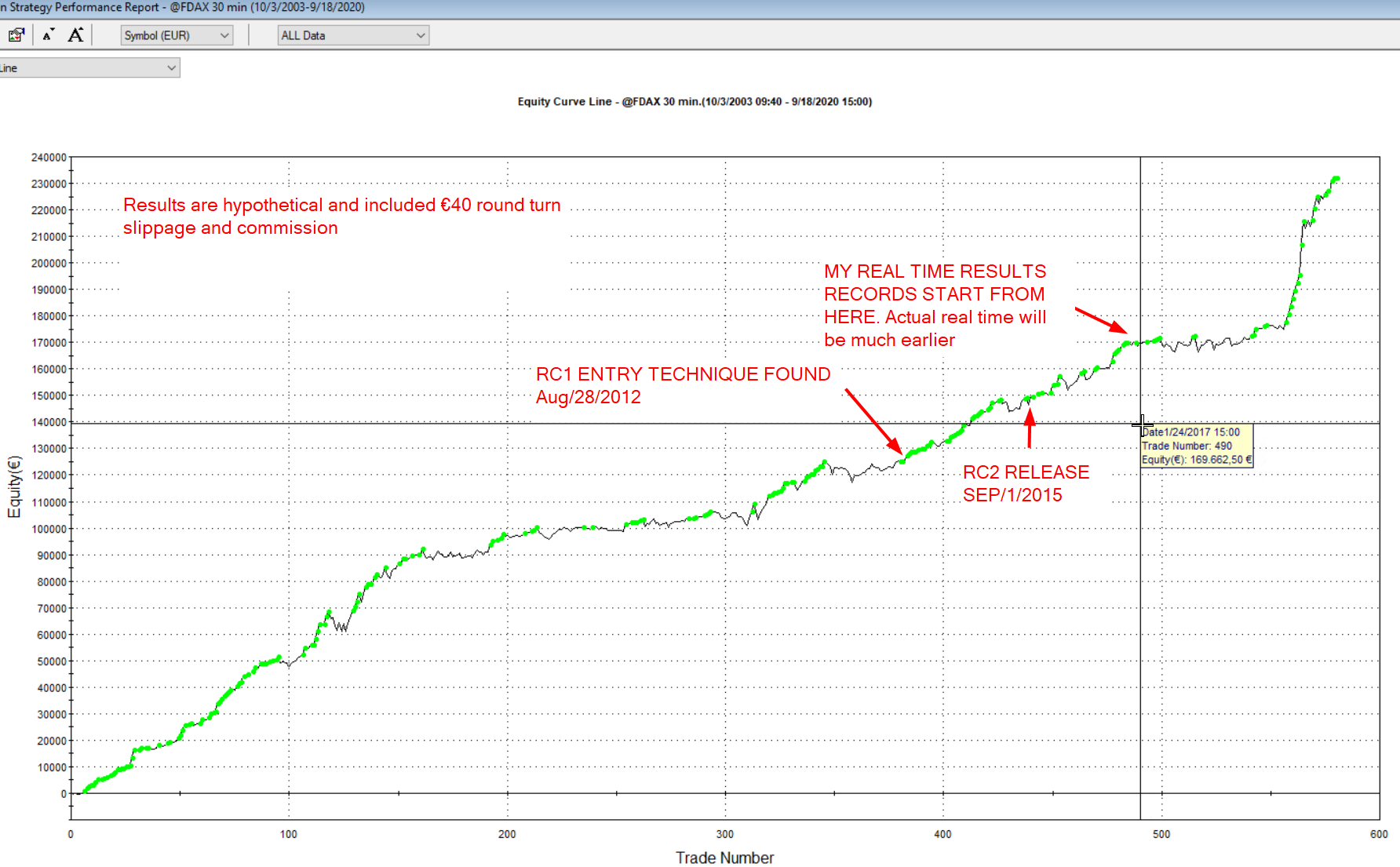

RC1 was created Aug 28 2012 by the system builder the was the predecessor to GSB. RC1 (Release candidate 1) was found to work well on S&P 500, Russell 2000, S&p mid cap 400 and the DAX. This was the first system this system builder made.

This legacy system builder was a crude command line driven app. From this RC2 was made with human designed filters to remove some trades from the original entry technique.

RC2 Dax has not been changed for many years, with the exception of the profit target changing for €3000 to €10,000 in March 2020 The hypothetical chart also has the profit target changed after this date.

The system has never been re-optimized.

Results shown included €36slippage & €4 brokerage round turn.

Note that this system has a fairly simple entry technique, then about 4 filters added by myself. I would consider this system complex with lots of inputs.

GSBSYS1ES on the other hand, I would consider simple with few inputs. We will discuss this in part 3.

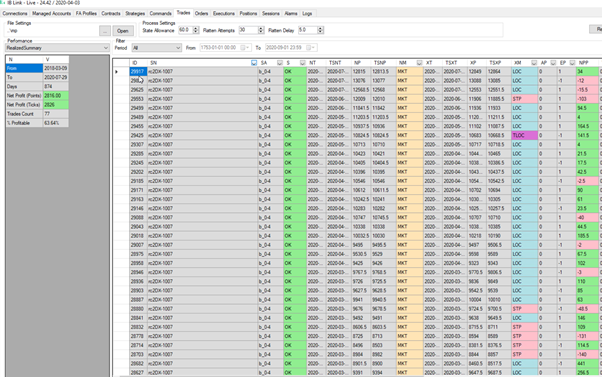

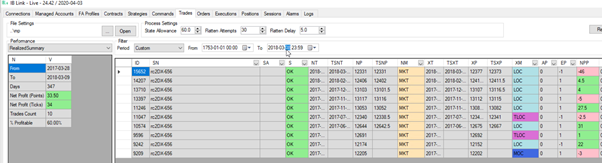

My Real time results.

Total profit 2849.5 points = €71237 less brokerage of $416 = total profit €70819

Note the following issues.

The system is not normally traded for about 2 weeks per year due to a bug in Tradestation data feed when German and USA day light savings overlap.

There were quite a number of execution issues and the system was not traded 100% of the time in this period. I'm not even sure the reasons why. It could have been chart not open or other issues.

Conclusion

So the point I make it this system has done well out of sample through extremely different market regimes, and never re-optimized. I think I have tried to improve it since, but found I could not improve it.

I also argue, regardless if you agree with my conclusion so far, if the methodology or guru you are following is making good money in live trading - be very cautious changing a methodology that works.