A real world example#2

DISCLAIMER

U.S. Government Required Disclaimer - Commodity Futures, Trading Commission Futures, Derivatives and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don't trade with money you can't afford to lose. This website is neither a solicitation nor an offer to Buy/Sell futures, options, or any other assets. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC rule 4.41 - Hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.

Goal. To choose best system according to the number of systems you want to trade.

In my opinion the biggest risk is trading Is that systems fail out of sample, and as humans we have a survival bias where we only include systems that are going well in our sample of systems.

On a positive note, many systems are doing much better out of sample compared to in-sample as the last year has been for many systems - the best year in my 22 years of trading.

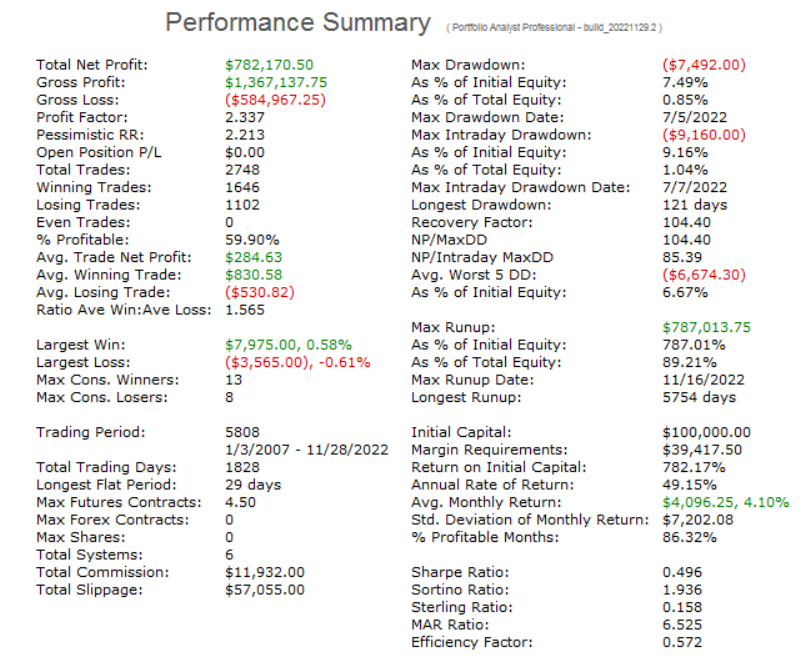

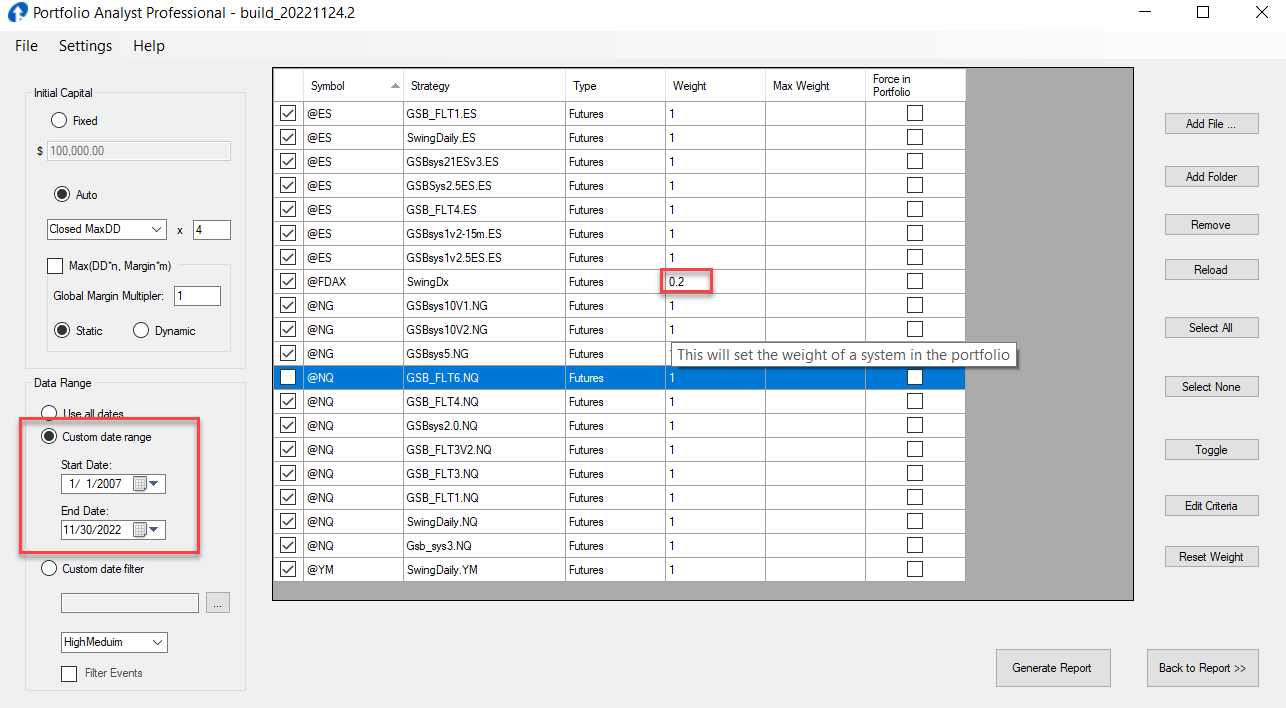

Fitness (What we try to maximize) for the portfolio was max Net profit/drawdown^2 on data since 2007.1.1 to 2022.11.30

Emini, not micros are used. Full contract for Natural Gas used. (more liquid)

Exception is the Dax is emini and Vegas ES micro as it’s a long term swing system.

No more than 1 contract per system is allowed. This is because based on historical performance, 1 system might look better with > 1 contracts. As humans we know that systems can and do fail, and PA pro doesn’t factor this in its calculations

List of systems chosen not exhaustive, and there is bias. For example as a human I know that nQ followed by ES systems are the best, and that in a bear market Long only systems are range from new highs to really bad in the last year. SO Vegas ES Dax Ym was not included, though it would be very valid to do so. SwingAG101es also at new highs, but the same applies for long only systems

One of the other reasons for limiting the number of systems is the time and ram to do the maths blows out spectacularly when you get to large amount of systems.

Note also that the systems chosen may change going from say 3 to 4 contracts, but the overall historical Net-profit / Drawdown^2 figure may be only slightly different. PA pro can not show alternative combinations with similar metrics, but I would like to add this one day to PA pros features.

Commission is $20 round turn and slippage 1 tick each side.

If your commission is say $4.80 per round turn, else $2 round turn for e micros, it may be better to trade micros. Real slippage may be higher than a tick per side.

There are also many other ways to build portfolios, than the method shown here.

We have not taken into account out of sample periods. A system with long out of sample period and good results could validly be considered better than a system with short out of sample results.

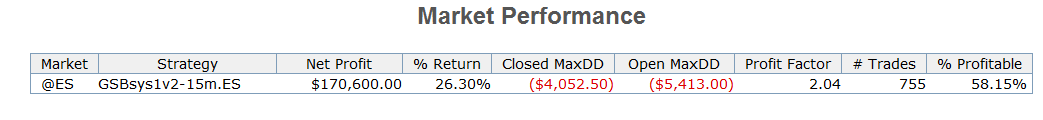

Note that GSBsys1ES doesn't even come into the top 5 systems despite 5.5 years out of sample. In my opinion however the newer variants of this system are better than the original.

There were not obvious logic imperfections in the original system that were fixed and improved in the versions after 1.5. (IE versions 2)

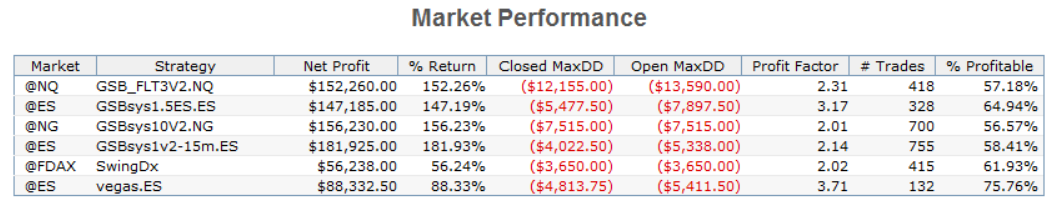

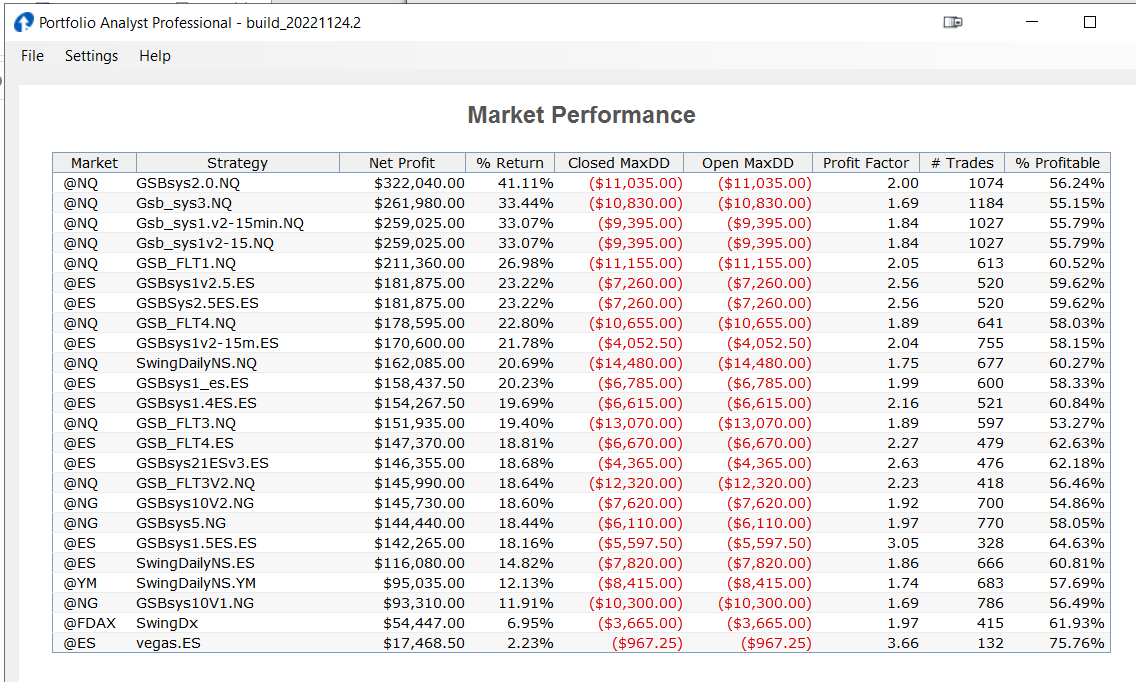

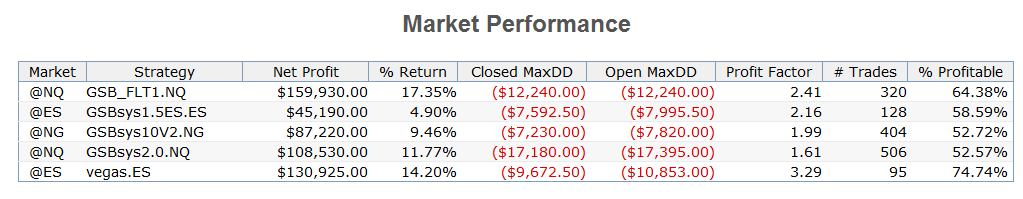

Below, systems that have been included.

Below, settings used. Swing dax we used emini, and Vegas ES a micro ES as it’s a long term swing system.

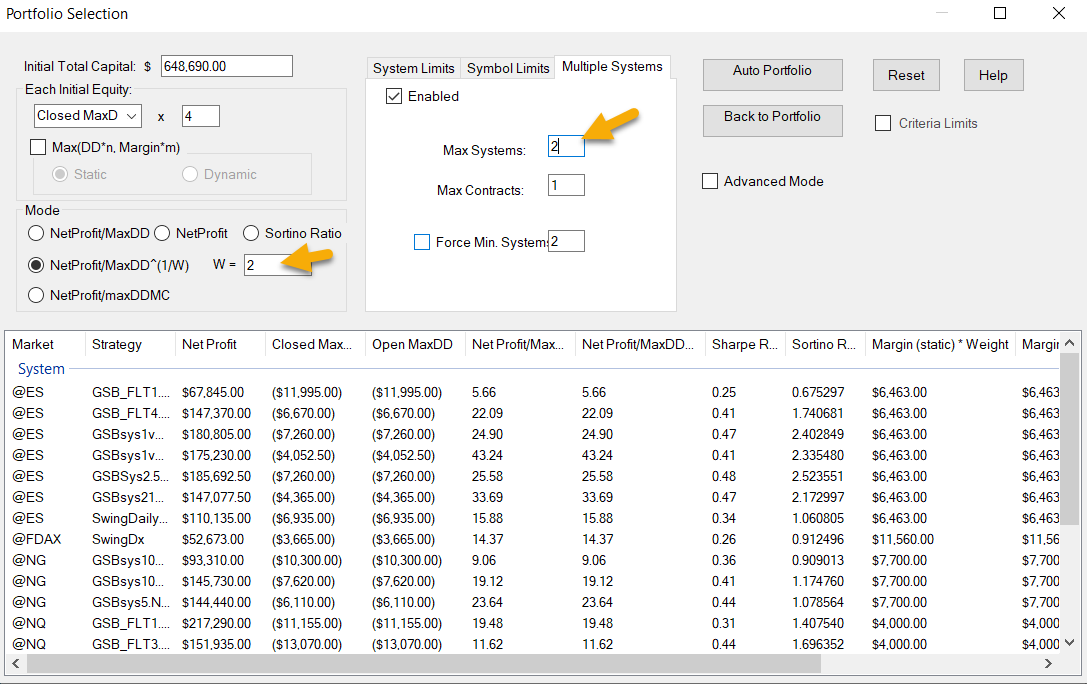

THE CONFIG IN PA PRO

In this example below, we limited trading to 2 systems, max 1 contract per system

Fitness is np/dd^2

RESULTS FOR 1 SYSTEM

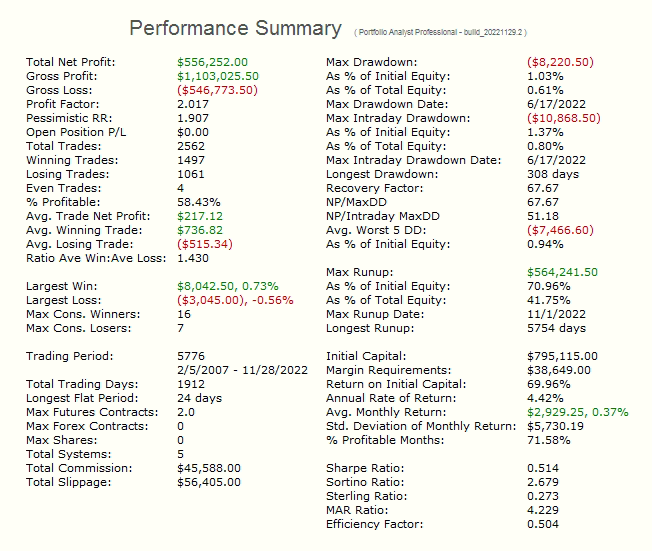

RESULTS FOR 2 SYSTEMS

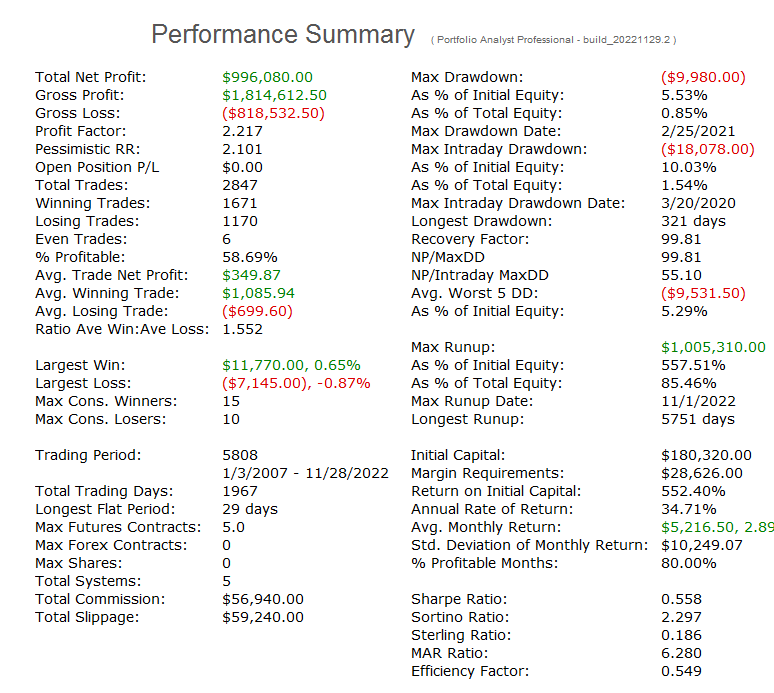

RESULTS FOR 3 SYSTEMS

What’s interesting is the portfolio is completely different to 2 system portfolio. Why? Because that’s simply what the maths shows is best.

RESULTS FOR 4 SYSTEMS

RESULTS FOR 5 SYSTEMS

After this point it is getting time consuming for my Intel I9 13900K CPU to do the maths. It will take quite a lot of minutes from here on-wards.

However if some systems are dropped from the initial systems chosen, the combinations will be significantly less.

The tests below took very roughly 15 minutes. The reason for the delay is we also ran out of ram (64GB) If you don't have a machine with more ram you would have to remove some of the systems added into PA-pro.

Results for 5 systems with Vegas ES included.

Vegas ES is a very old robust seasonal long only system, but note that the last year or so is not friendly to long only systems

Swing and Vegas are among the best long only systems and have done reasonably in the last year. Swing trades are very short, while Vegas is longer term

RESULTS FOR 6 SYSTEMS