A real world example

We choose a number of systems to potentially trade.

In this example we have approx $25,000 account, so will use micro contracts, and a mini Dax instead of full Dax contract.

First thing we want to do is make all systems work from 2007.1.1

The reason this date is chosen is its the earliest date that all systems can work from.

For example Gold systems do not have usable liquid intra day data before this date.

If all our other systems worked say from 1997, and gold only 20007 - then PA would have a bias to choose the other systems as the profit from gold overall is less

just because of a 10 year shorter track record.

The next problem is the mini Dax starts at 2017 - so would mean all dates should start at 2017. This is too short a period for us & PA to get an idea on who systems and draw-downs correlate.

What we will do in this case is to use the full Dax contract, and divide it by 5.

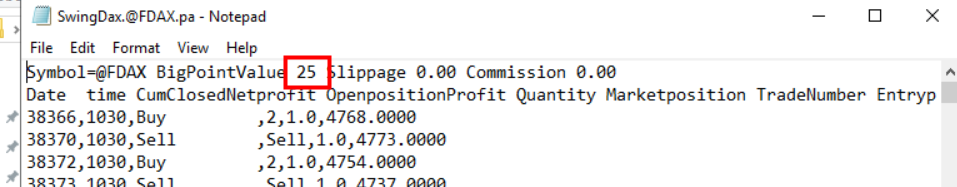

The full Dax contract is 25 Euro per point, the emini is 5 Euro

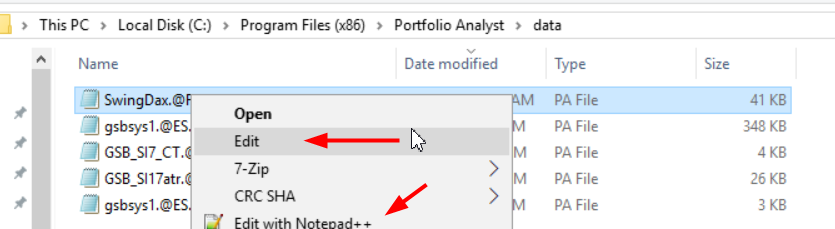

The alternative way is to edit the SwingDax.pa file edit notepad or notepad++ and change the big point value.

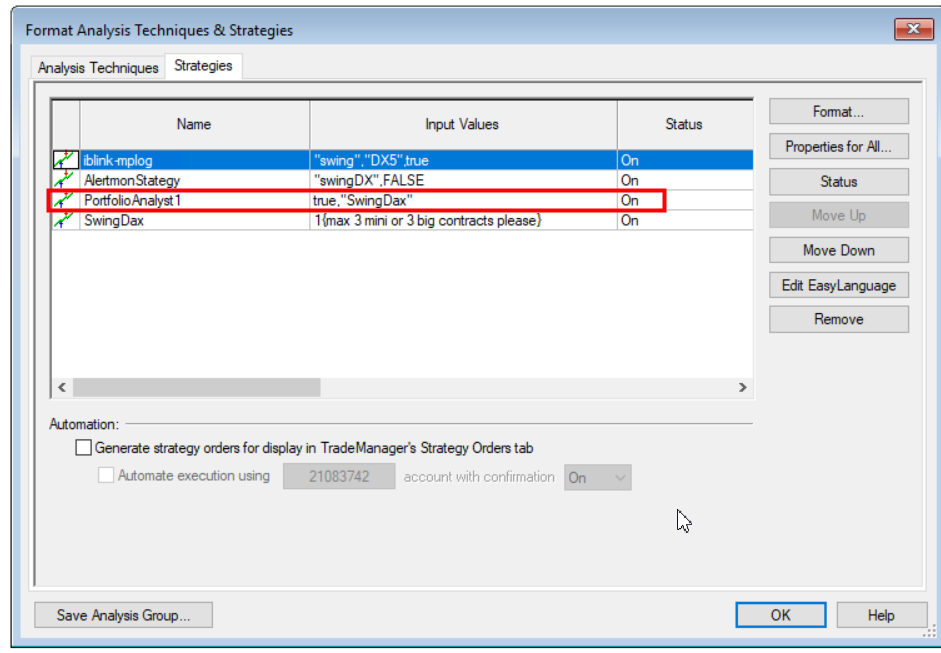

So below I have added the portfolioAnalyst file on the Dax Strategy

{Later note, we are going to use the first option and use the TS XML file, so skip to "This is the report generated" below}

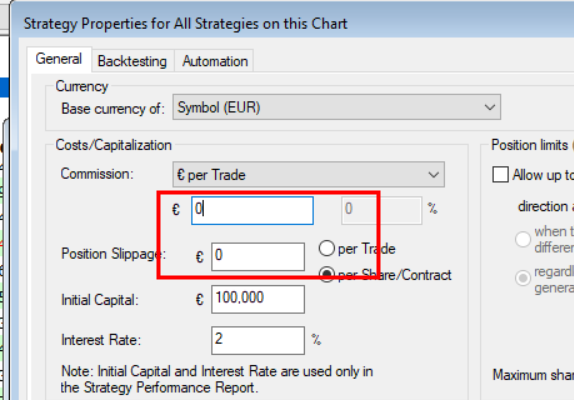

I'm also going to use 0 euro slippage and commission here, and allow PA to add slippage and commission.

Normally PA can be set to use or over ride this value. But because we are going to edit the .PA file, we want this set to zero.

Now edit the file with notepad or notepad++

Change the 25 to 5, and save the file

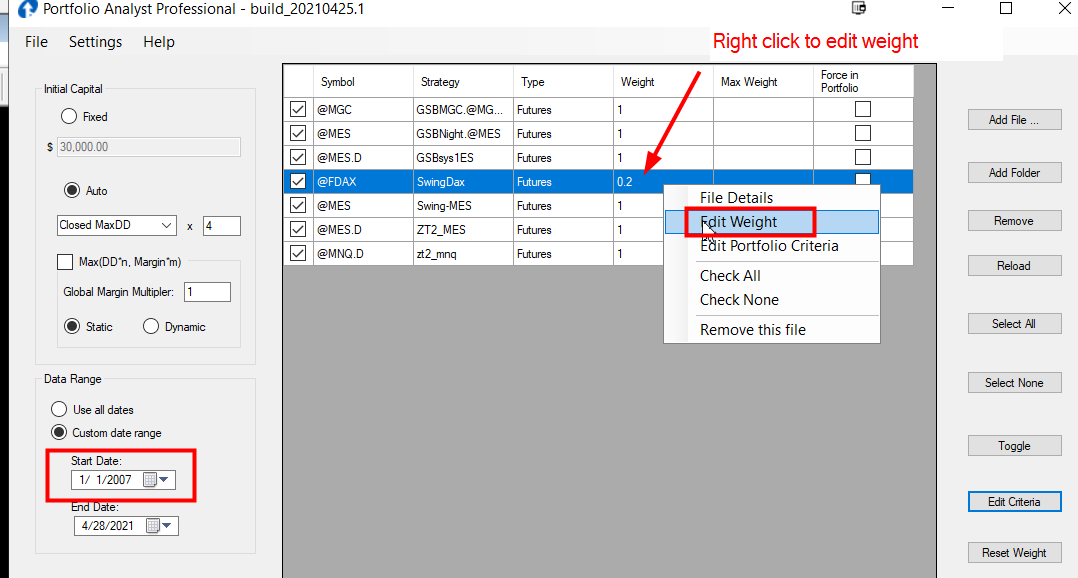

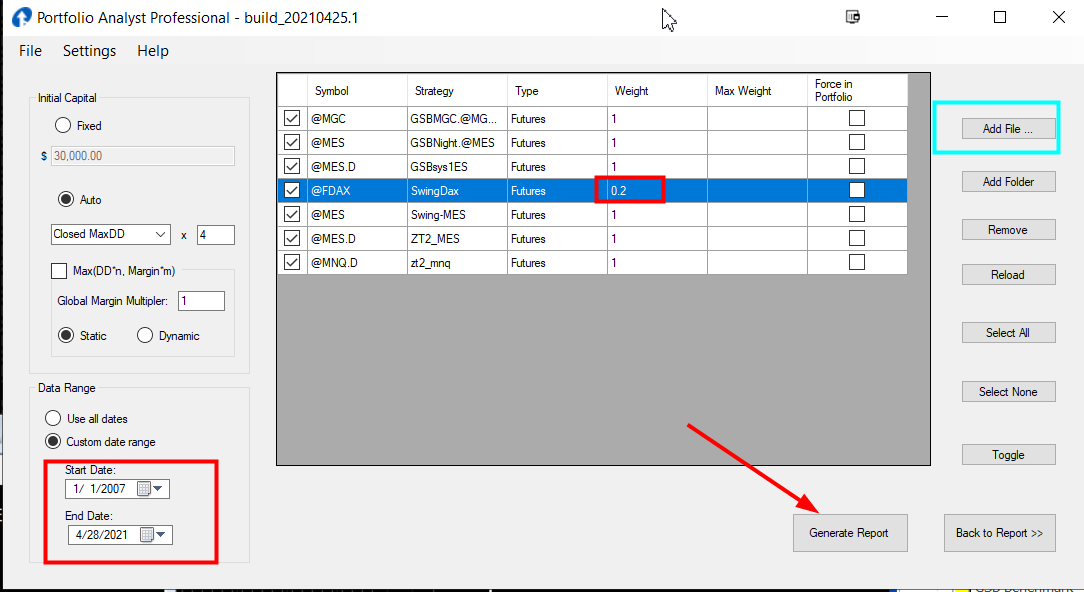

We have added all the files, changed the weight on the Dax, the dates and this hit generate report.

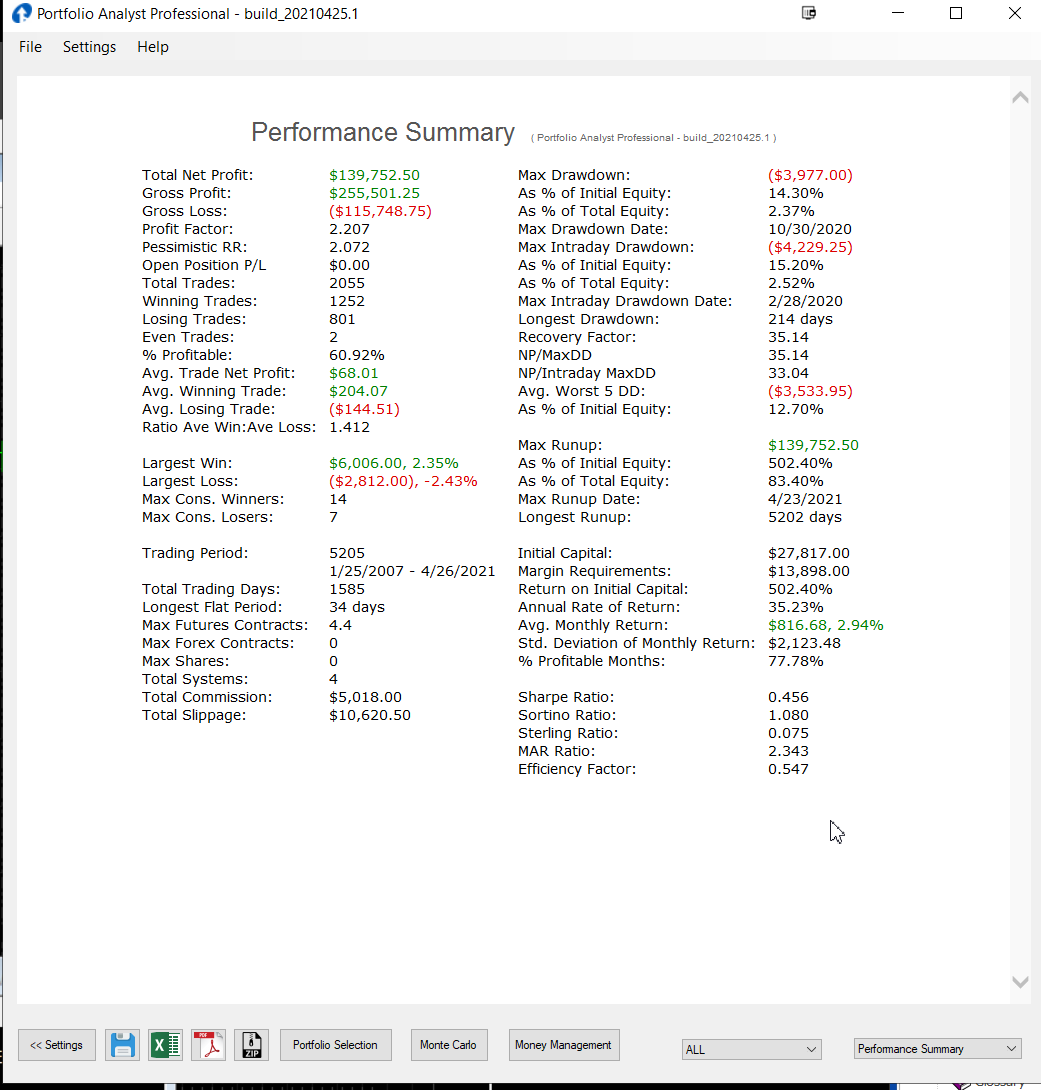

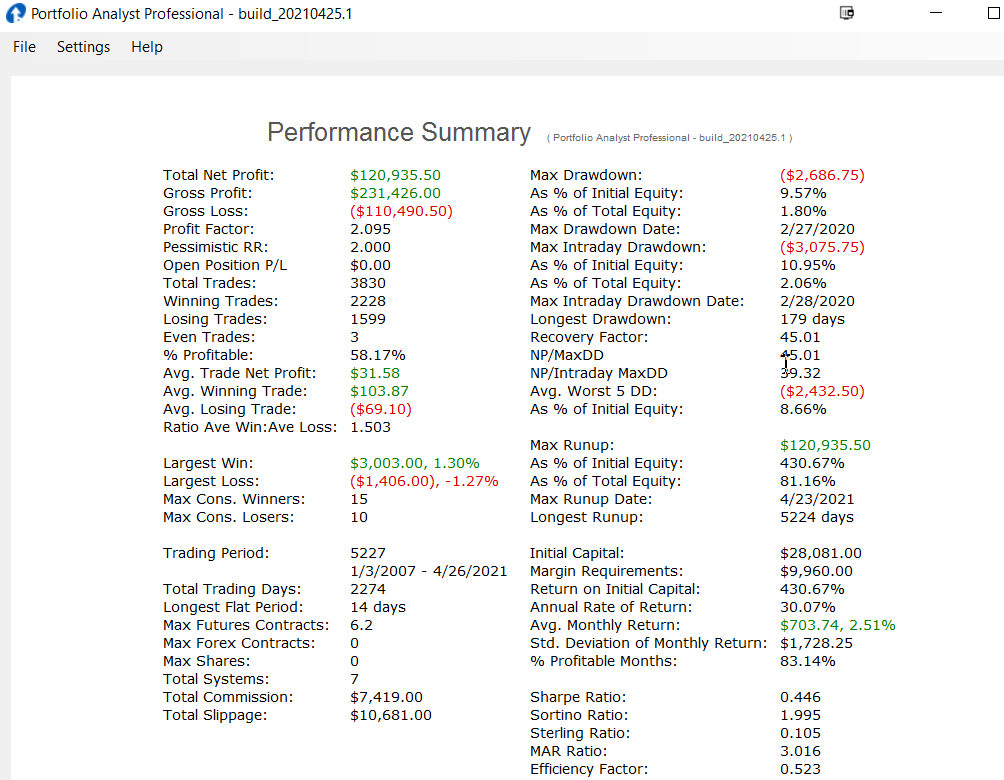

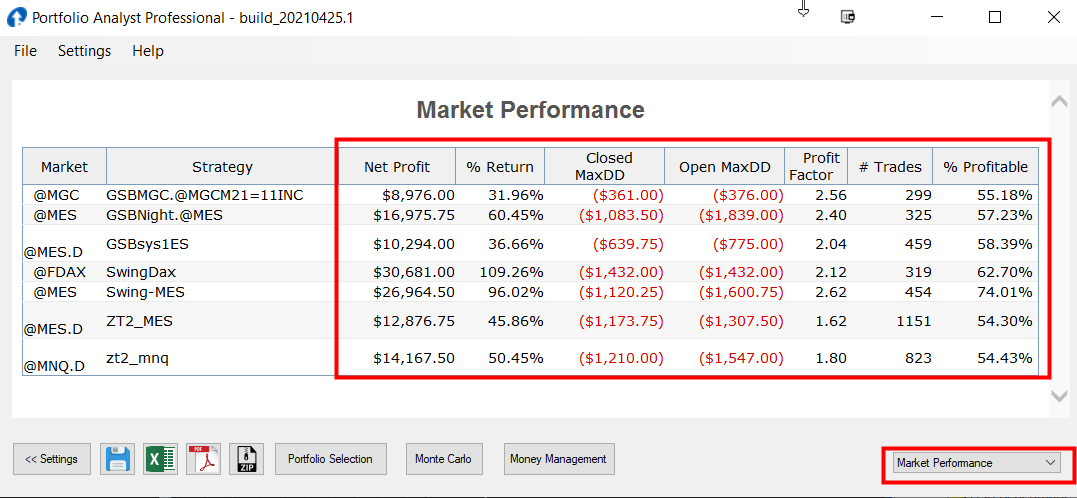

This is the report generated

First check the results are correct under market performance. For example if you had only 1 years data on a system by mistake, then the net profit would be too low.

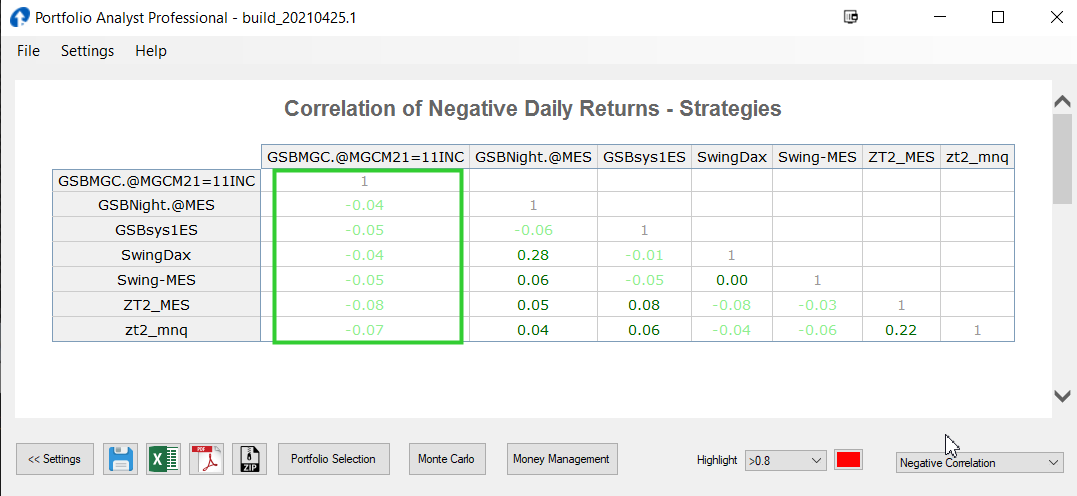

For interest sake we will check the negative (loosing trade) correlation. Note the gold systems has negative correlation to all other systems (excellent)

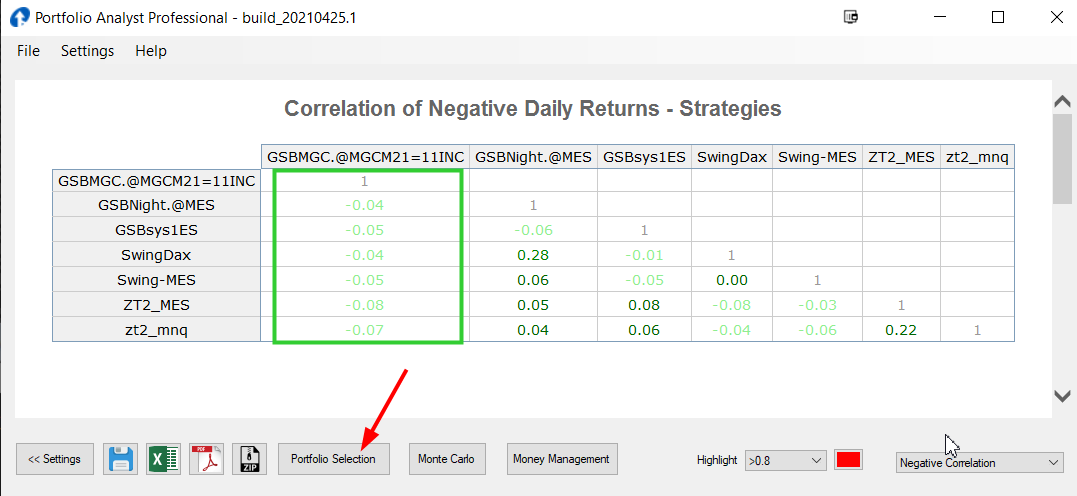

Click on portfolio selection.

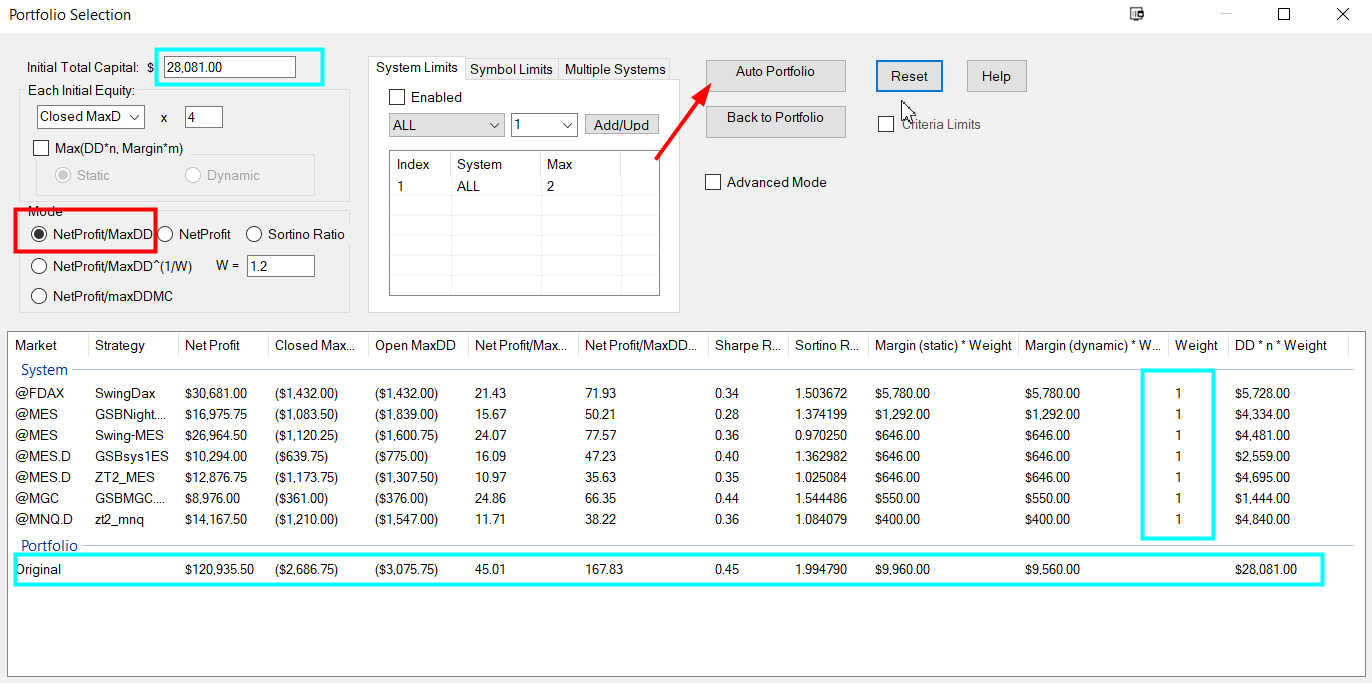

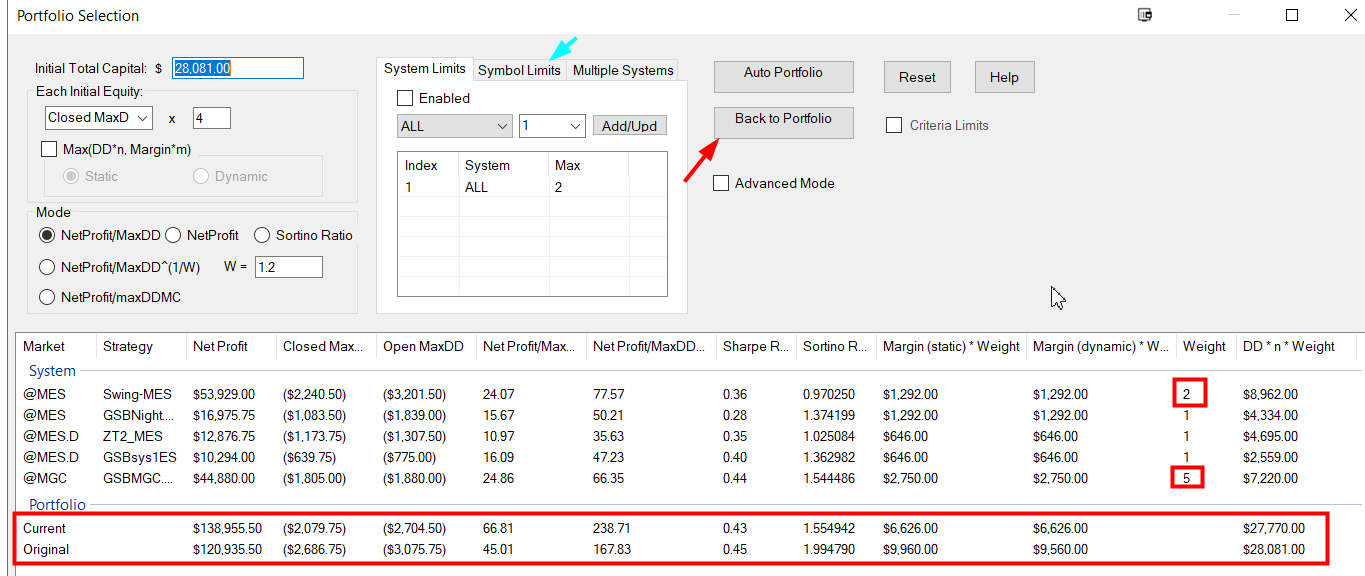

Note that if 4 time max historical draw down is used (per system) this group of systems requires $28,081 capital

Then click the auto portfolio button. You could also change the capital of $28,081 to say $25,000 if that's your account size.

You can now see PA has chosen 2 Swing MES contracts per system and 5 per gold system.

Now this is very important. PA had not understood the disclaimer that past returns are are indicative of future returns. PA does not understand the greatest risk in trading is likely that a trading system fails in future data. This is a major flaw in generating portfolios.

For this reason we force PA to not weight any system too highly. (or potentially market - see symbol limits in cyan above)

Trading too much of any one system should be considered dangerous, and ugly when it gets stopped out and or hits new maximum draw-down.

For this reason its best to increase to new markets and systems, rather than add contracts on existing systems.

Note however that pa has improved the net profit from $120,935 to $138,955 and decreased the draw-down from $3075 to $2079.

Its also dropped Swing Dax and Zone Trader MNQ.

Click on the back to portfolio. button

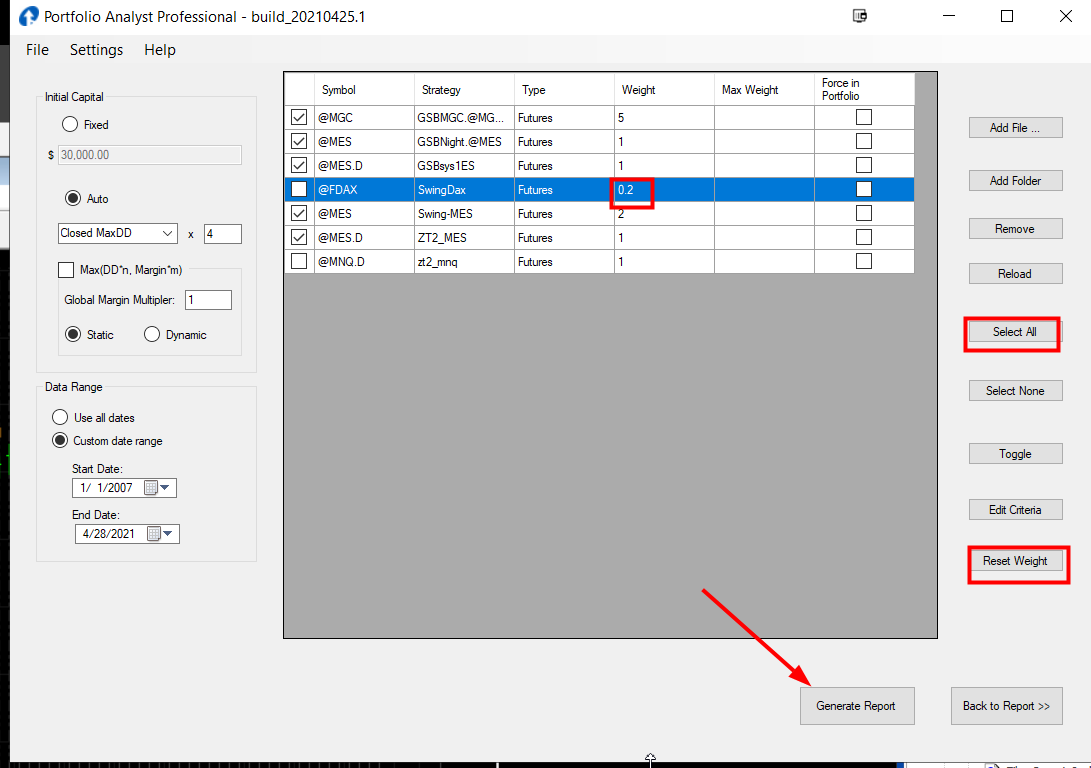

Hit reset weights, select all, make sure the Dax is at weight of 0.2, and hit generate report. We are not going to repeat this process with a small change

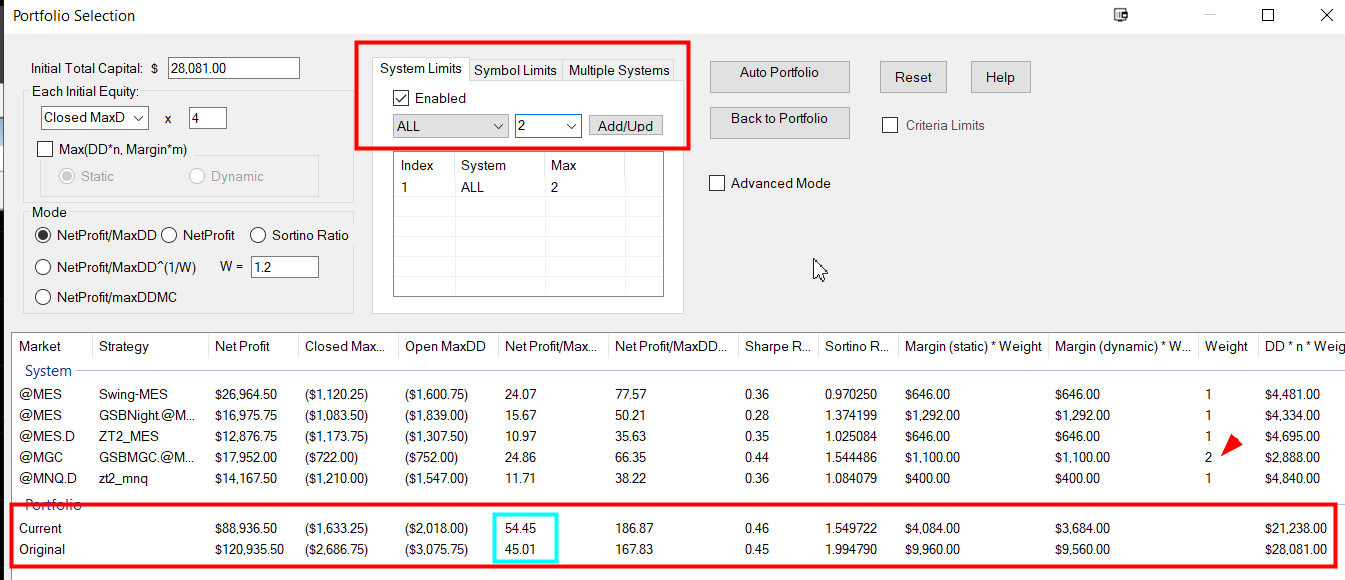

Changing system limits to 2, means we can have no more that 2 of any one system. The net profit and draw-down has decreased. to $88,036 $1633

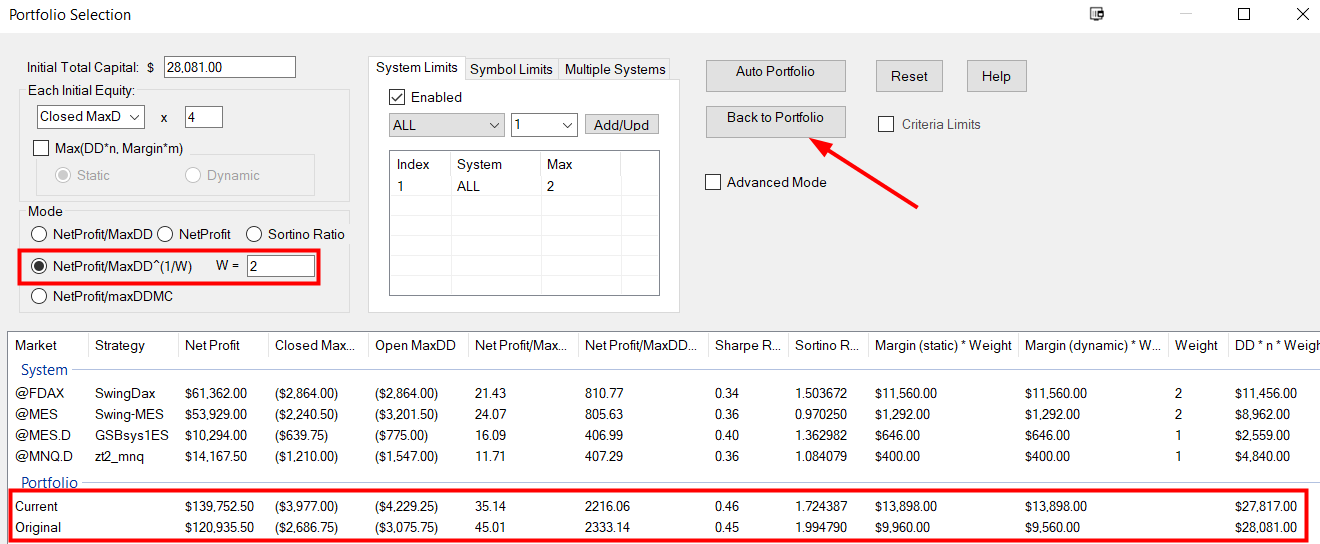

That's a very small draw-down for $28,081 capital, so we can try to be more aggressive and use Netprofit / maxDD^1/1.2

Note as much profit as earlier example, not more that 2 contracts per system, but a higher draw-down that when we had 5 gold systems

Co-incidentally, Zone trader ES has been dropped. What PA does not know is that ZT1ES (not shown here) is strongly at MAX draw down after 2++ years of great performance.

ZT2ES is also at max draw-down, but much better than ZT1ES. ZT2NQ happens to be a new highs. So I personally would have been hesitant to add a system (ZTES that's strongly in max draw down when I could choose a related system thats at new highs. (ZT2NQ) Remember PA will not put much weight on recent performance being bad, it looks at the bigger picture.

There is also great danger that you as the human, place too much danger on a recent draw down. See this document. GSBSys1ES and ZT1,2 ES/NQ all had decent draw downs in December 2020.

GSBsys1ES, ZT2NQ went on to new highs, ZT1,2 ES have not yet done so.

For system comparisons please see this url.

Then click back to portfolio, generate report and enjoy your report

Not discussed here is the ability to limit systems by groups. IE no more that 2 systems that trade metals, 2 systems that trade energies.

PA has been under constant development over the years, but the documentation is lagging.